Last week, an

article in the

Washington Post discussed a new ‘threat’ homebuyers will soon be facing: higher mortgage rates. The article revealed:

“The Mortgage Bankers Association expects that rates on 30-year loans could reach 4.8 percent by the end of next year, topping 5 percent in 2017. Rates haven’t been that high since the recession.”

How can this impact the housing market?

The article reported that recent analysis from

Realtor.com found that -

“…as many as 7% of people who applied for a mortgage during the first half of the year would have had trouble qualifying if rates rose by half a percentage point.”

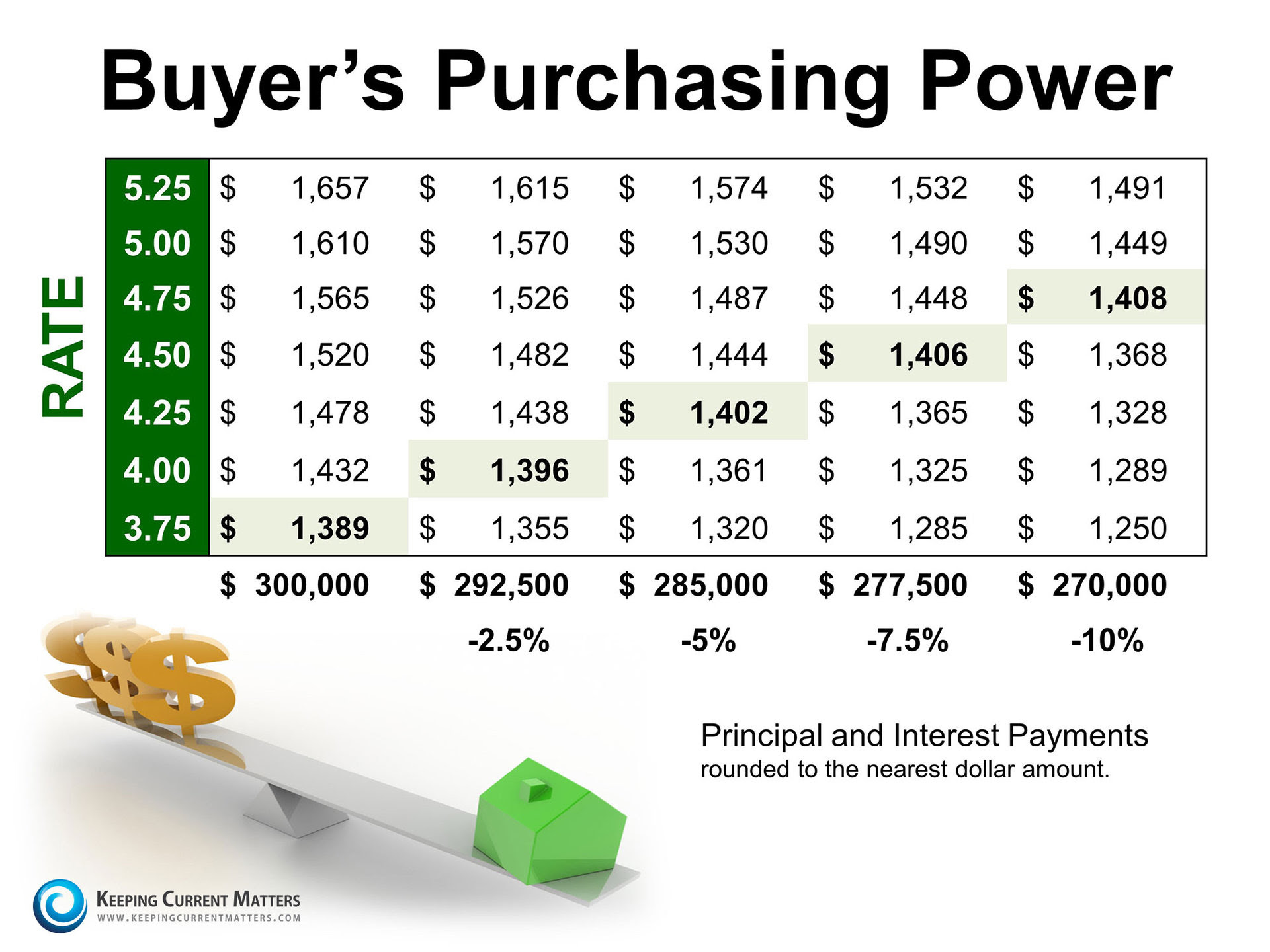

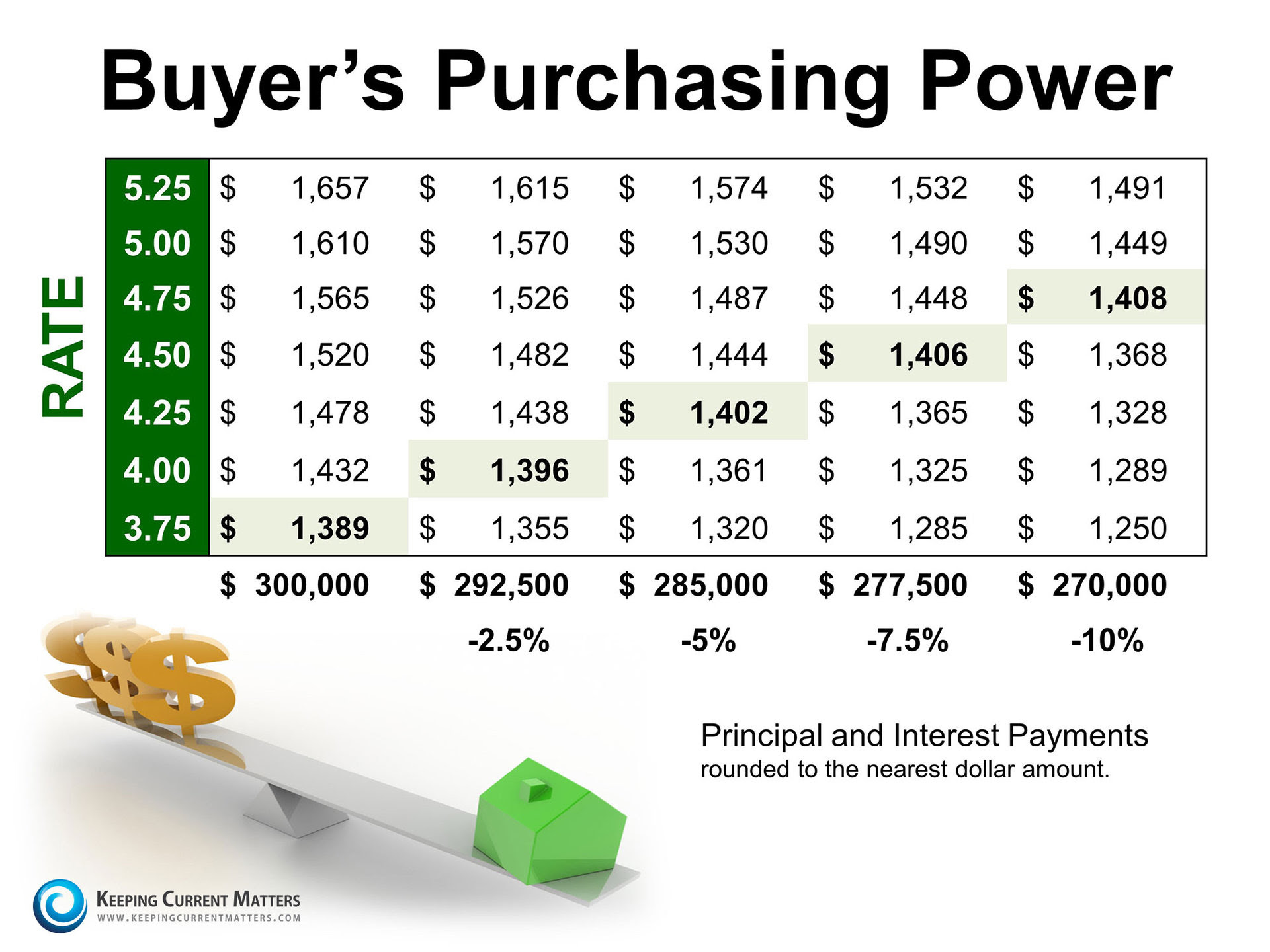

This doesn’t necessarily mean that those buyers negatively impacted by a rate increase would not purchase a home. However, it would mean that they would either need to come up with substantially more cash for a down payment or settle for a lesser priced home. Below is a table showing how a jump in mortgage interest rates would impact the purchasing power of a prospective buyer on a $300,000 home.

Last week, an article in the Washington Post discussed a new ‘threat’ homebuyers will soon be facing: higher mortgage rates. The article revealed:

Last week, an article in the Washington Post discussed a new ‘threat’ homebuyers will soon be facing: higher mortgage rates. The article revealed:

No comments:

Post a Comment