Friday, January 31, 2014

Wednesday, January 29, 2014

Friday, January 24, 2014

Wednesday, January 15, 2014

Monday, January 13, 2014

Predictions for 2014: Interest Rates Will Increase Significantly

|

Posted: 08 Jan 2014 04:00 AM PST

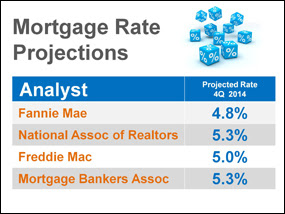

Most experts are calling for an increase in mortgage interest rates in 2014. However, we believe the increase will be more dramatic than is being projected. We believe rates will be closer to 6% than 5% by year’s end.

The Fed announced last month that they would be pulling back some of their stimulus package which has helped the housing market by keeping long term mortgage rates at historic lows for the last few years. This should come as no surprise as the KCM Blog has been warning of this likelihood over the last several months.  Above are the most recent projections of where rates will be at the end of 2014 by the four major agencies. However, we believe that the government is not afraid to shoot right past these levels. Doug Duncan, chief economist for Fannie Mae, this past summerannounced: “I don’t think the Fed ultimately would be troubled with a 6.5% mortgage rate.” And Frank Nothaft, Freddie Mac VP and chief economist, at virtually the same time explained: "As the economy continues to improve, we expect to see continued upward movement in long-term interest rates… At today’s house prices and income levels, mortgage rates would have to be nearly 7 percent before the U.S. median priced home would be unaffordable to a family making the median income in most parts of the country.” Only time will tell. However, we feel that rates will be in the 5.75-6% range by year’s end. |

Friday, January 3, 2014

Thursday, January 2, 2014

Tapering Signals Year-End Economic Strength Indicators Point to Greater Recovery for 2014

Tapering Signals Year-End Economic Strength

Indicators Point to Greater Recovery for 2014

Tapering Signals Year-End Economic Strength - Indicators Point to Greater Recovery for 2014

The big "will-they or won't they" ended last month with the Fed's mid-December announcement that it would begin tapering its economic stimulus efforts. Federal Reserve Chairman Ben Bernanke's decision to scale back on Bond and Treasury purchases by $10 billion signaled that the economy has showed sufficient ability to play on its own, albeit, on a kid leash.

The Fed's ambivalence towards tapering dominated central banking discussions and created market volatility for most of 2013. Janet Yellen, the Fed's current vice chairman and President Barack Obama's nominee to succeed Bernanke, voted in favor of the policy action, which was bolstered by promising figures in the labor and housing markets.

The Year in Housing

Housing gained traction in 2013 amid job gains and rising stock values. Residential construction starts soared in November to a five-year high, explaining why builder optimism last month matched its highest level since 2005.

Despite robust new construction, sales of previously-owned homes declined for the third consecutive month in November to the lowest level this year, as rising home loan rates and a limited supply of existing properties discouraged homebuyers. Rates could rise even further with Fed tapering.

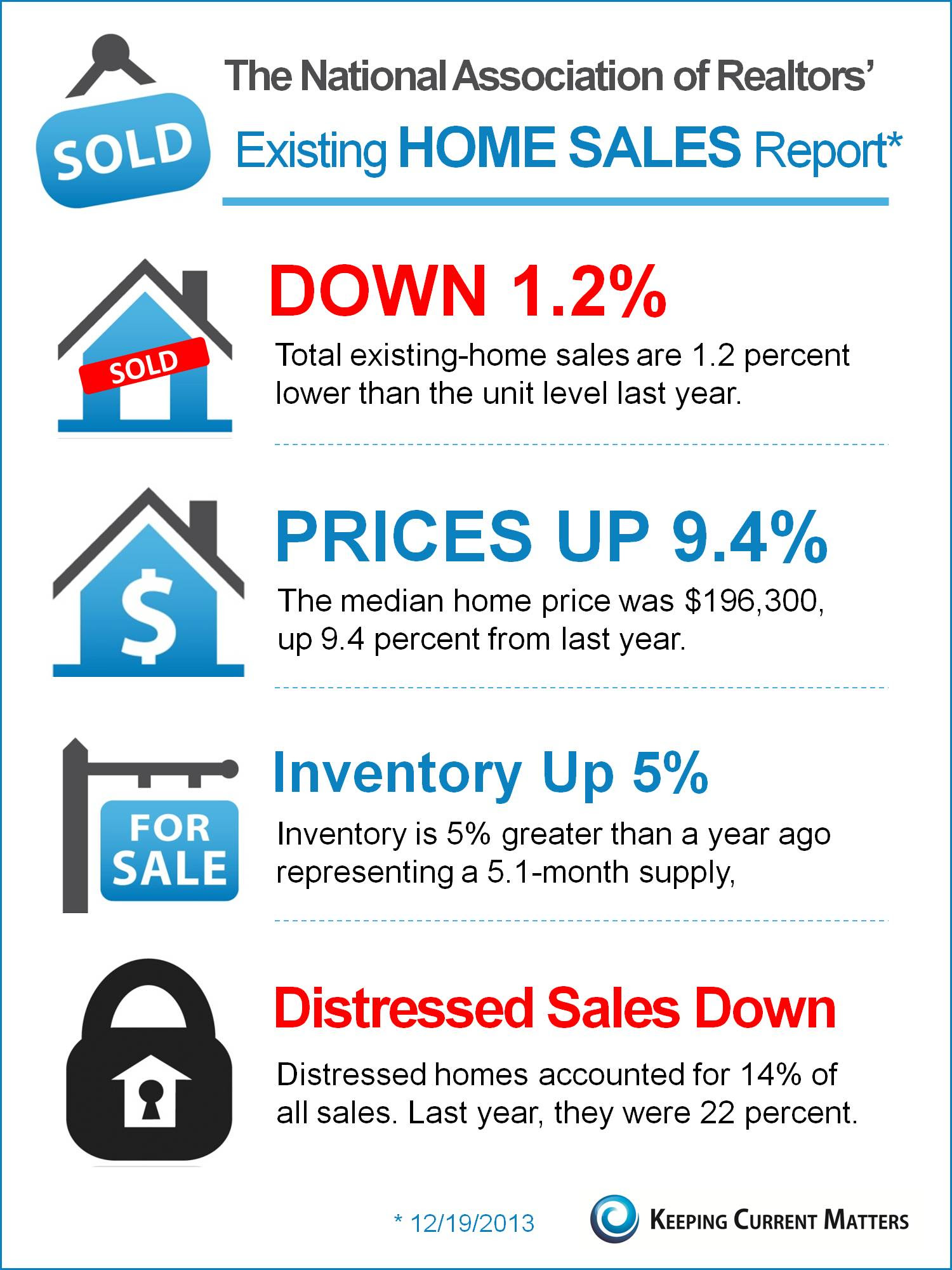

Purchases overall dropped 4.3 percent to a 4.9 million annual rate, in a mid-December report from the National Association of Realtors. The report also showed that the median price of an existing home rose 9.4 percent to $196,300 from $179,400 one year ago. The group still projects 2013 will be the best year for the industry in seven years, with an estimated 5.1 million properties sold. Rising prices and borrowing costs may have put homes out of reach for many first-time buyers and the partial federal government shutdown in October may have delayed some purchase decisions.

The Year in Jobs

A five-year low in unemployment and a boost in job hirings helped prompt Fed tapering. In what was largely typical year-end activity, applications for U.S. unemployment benefits rose in early December to an almost nine-month high, according to the Labor Department. Gains in payrolls on the other hand lifted consumer confidence and prospects for retailers during the holidays. The U.S. Automotive industry is also hiring, with sales at their best pace since 2007, according to data from Ward Automotive Group.

Indicators Point to Greater Recovery for 2014

Tapering Signals Year-End Economic Strength - Indicators Point to Greater Recovery for 2014

The big "will-they or won't they" ended last month with the Fed's mid-December announcement that it would begin tapering its economic stimulus efforts. Federal Reserve Chairman Ben Bernanke's decision to scale back on Bond and Treasury purchases by $10 billion signaled that the economy has showed sufficient ability to play on its own, albeit, on a kid leash.

The Fed's ambivalence towards tapering dominated central banking discussions and created market volatility for most of 2013. Janet Yellen, the Fed's current vice chairman and President Barack Obama's nominee to succeed Bernanke, voted in favor of the policy action, which was bolstered by promising figures in the labor and housing markets.

The Year in Housing

Housing gained traction in 2013 amid job gains and rising stock values. Residential construction starts soared in November to a five-year high, explaining why builder optimism last month matched its highest level since 2005.

Despite robust new construction, sales of previously-owned homes declined for the third consecutive month in November to the lowest level this year, as rising home loan rates and a limited supply of existing properties discouraged homebuyers. Rates could rise even further with Fed tapering.

Purchases overall dropped 4.3 percent to a 4.9 million annual rate, in a mid-December report from the National Association of Realtors. The report also showed that the median price of an existing home rose 9.4 percent to $196,300 from $179,400 one year ago. The group still projects 2013 will be the best year for the industry in seven years, with an estimated 5.1 million properties sold. Rising prices and borrowing costs may have put homes out of reach for many first-time buyers and the partial federal government shutdown in October may have delayed some purchase decisions.

The Year in Jobs

A five-year low in unemployment and a boost in job hirings helped prompt Fed tapering. In what was largely typical year-end activity, applications for U.S. unemployment benefits rose in early December to an almost nine-month high, according to the Labor Department. Gains in payrolls on the other hand lifted consumer confidence and prospects for retailers during the holidays. The U.S. Automotive industry is also hiring, with sales at their best pace since 2007, according to data from Ward Automotive Group.

Subscribe to:

Posts (Atom)