Posted: 28 Sep 2015 04:00 AM PDT

In today's market, with homes selling quickly and prices rising some homeowners might consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons this might not be a good idea for the vast majority of sellers. Here are five reasons:

In today's market, with homes selling quickly and prices rising some homeowners might consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons this might not be a good idea for the vast majority of sellers. Here are five reasons:1. There Are Too Many People to Negotiate With

Here is a list of some of the people with whom you must be prepared to negotiate if you decide to For Sale By Owner:- The buyer who wants the best deal possible

- The buyer’s agent who solely represents the best interest of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies, which work for the buyer and will almost always find some problems with the house.

- The appraiser if there is a question of value

2. Exposure to Prospective Purchasers

Recent studies have shown that 88% of buyers search online for a home. That is in comparison to only 21% looking at print newspaper ads. Most real estate agents have an internet strategy to promote the sale of your home. Do you?3. Results Come from the Internet

Where do buyers find the home they actually purchased?- 43% on the internet

- 9% from a yard sign

- 1% from newspaper

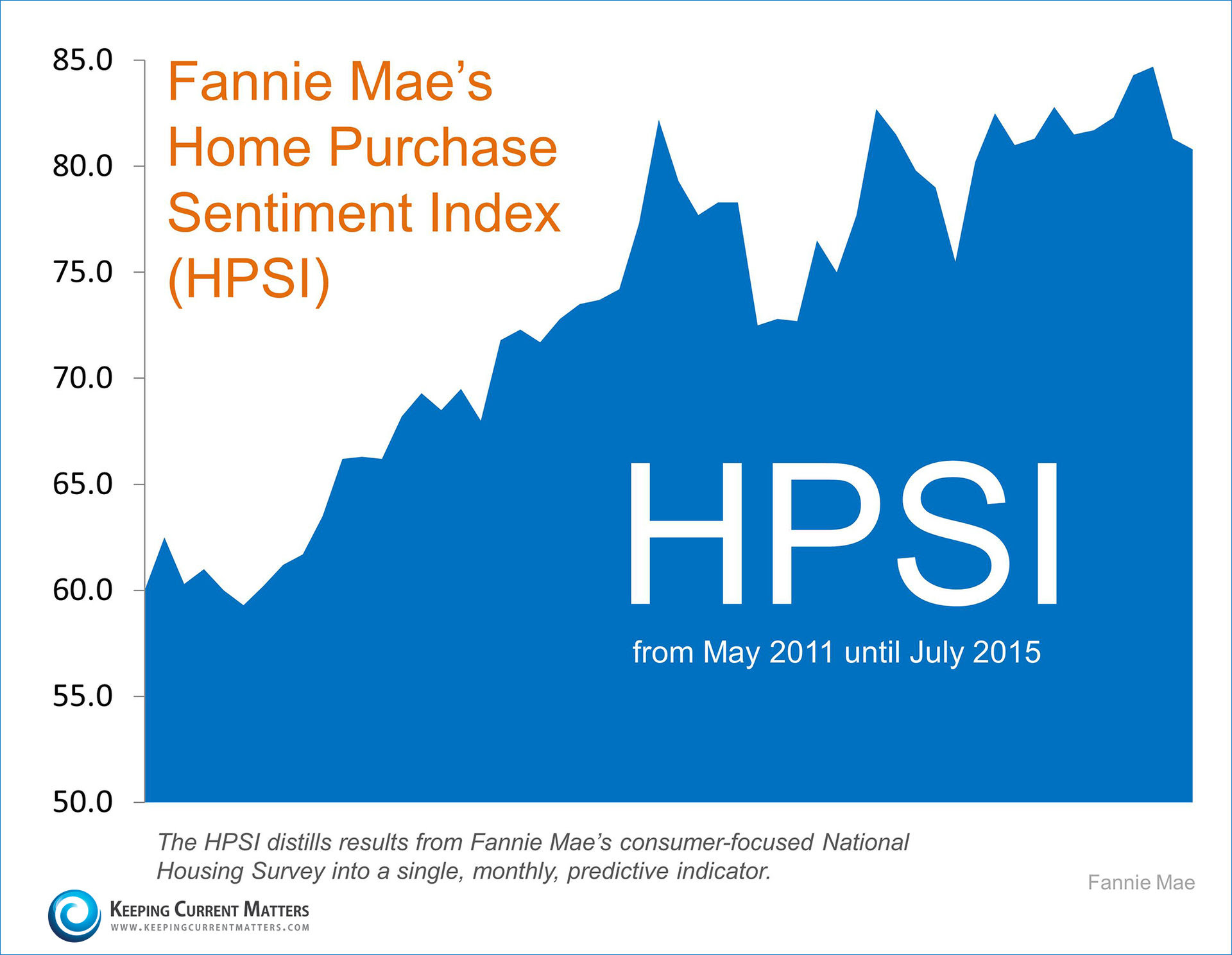

Earlier this month, Fannie Mae’s Economic & Strategic Research Group announced the launch of their

Earlier this month, Fannie Mae’s Economic & Strategic Research Group announced the launch of their  According to consumer sentiment, the housing market has made great strides over the last four years.

According to consumer sentiment, the housing market has made great strides over the last four years.