Monday, May 30, 2016

Tuesday, May 24, 2016

If you're like most of us, you need to take care of a number of small home repairs. The problem is that you just can’t find the time to do it. But while it’s easy to de-prioritize minor repairs, it's also important to understand that they could lead to bigger problems — and bigger bills — if left unaddressed. The good news is that there’s a quick and easy solution: hiring a handyman.

Surprisingly, it doesn't occur to a lot of homeowners to hire a handyman. In fact, many falsely believe that they either need to tackle the job themselves or hire a specialist to tackle each project. The truth is, handymen are perfectly suited to take care of most minor projects, as well as some larger ones.

Hiring a handyman to perform multiple small home repairs will typically cost less than hiring multiple specialized contractors. But if you have a specific problem that is manifesting itself in multiple areas, a specialist is generally the way to go. If you have a squeaky stair, a leaky faucet and a shorting outlet, for example, hiring a handyman is probably the best way to get everything fixed quickly and affordably. If you have an entire set of stairs that needs to be replaced, low water pressure in all of your faucets or a house full of two-pronged outlets that need to be upgraded, on the other hand, you're better off hiring a carpenter, plumber or electrician.

It's simple when you think about it. Having one pro handle several small home repairsunder a single trip charge is going to be cheaper and easier than hiring three or four separate pros. But when dealing with a single severe or widespread problem, a specialized contractor will have the equipment and expertise to more efficiently make the repairs. Whichever way you go, keep this in mind: If any "small" home repair is valued at over $500, your state might require that you hire a properly licensed contractor.

Have a list of repairs ready before you contact a handyman. Taking a close inventory of every small repair will help your handyman understand the breadth of your projects and eliminate the need for multiple repair visits. While many minor repairs appear simple, some need a considerable amount of prep work and require multiple steps to complete (e.g., drywall repair).

The beauty of hiring a handyman is that most are pretty flexible when it comes to defining what constitutes a "small" home repair. Of course, faulty faucets and sticking doors are handyman-friendly projects, but if you have something a little more substantial or obscure, a handyman is likely to be able to handle that too. Going over your list before your handyman is at your doorstep is essential. While handymen might be able to mend everything from a plugged shower drain to a rickety antique bed frame, there's a good chance that they won't have every tool for every project in the van (i.e., they'll make more trips to the hardware store on the clock). Make sure you describe your home repairs in detail and try to provide your pro with a good idea of what materials will likely be needed to complete the project.

Saturday, May 21, 2016

Thursday, May 19, 2016

In s Seller's Market: Is it Time to Downsize?

In a Seller's Market: Is it Time to Downsize?

A study by Edelman Berland reveals that 33% of homeowners who are contemplating selling their house in the near future are planning to scale down. Let's look at a few reasons why this might make sense for many homeowners, as the majority of the country is currently experiencing a seller's market. In a recent blog, Dave Ramsey, the financial guru, highlighted the advantages of selling your current house and downsizing into a smaller home that better serves your current needs. Ramsey explains three potential financial advantages to downsizing: A study by Edelman Berland reveals that 33% of homeowners who are contemplating selling their house in the near future are planning to scale down. Let's look at a few reasons why this might make sense for many homeowners, as the majority of the country is currently experiencing a seller's market. In a recent blog, Dave Ramsey, the financial guru, highlighted the advantages of selling your current house and downsizing into a smaller home that better serves your current needs. Ramsey explains three potential financial advantages to downsizing:

Q: What kind of lifestyle do I want after I downsize?A: "For some folks, it's a matter of living a simpler life focused on family. Some might want to cross off travel destinations on their bucket lists. Some might want a low-maintenance community with high-end upgrades and social events. Decide what you want to achieve from your move first, and you'll be able to better narrow down your housing options."Comments: Many homeowners are taking the profit from the sale of their current home and splitting it in order to put down payments on a smaller home in their current location, as well as a vacation/retirement home where they plan to live when they retire. This allows them to lock in the home price and mortgage interest rate at today's values. This makes sense financially as both home prices and interest rates are projected to rise. Q: Have I built up enough equity in my current home to make a profit?A: "For most homeowners, the answer is yes. This is if they've held on to their properties long enough to have positive equity that will be sizable enough to put a large down payment on their next home."Comments: A study by Fannie Mae revealed that only 37% of Americans believe that they have significant equity (> 20%) in their current home. In actuality, CoreLogic's latest Equity Report revealed that 72.6% have greater than 20% equity. That equity could enable you to build the life you've always dreamt about. Bottom LineIf you are debating downsizing your home and want to evaluate the options you currently have, meet with a real estate professional in your area who can help guide you through the process. |

Tuesday, May 17, 2016

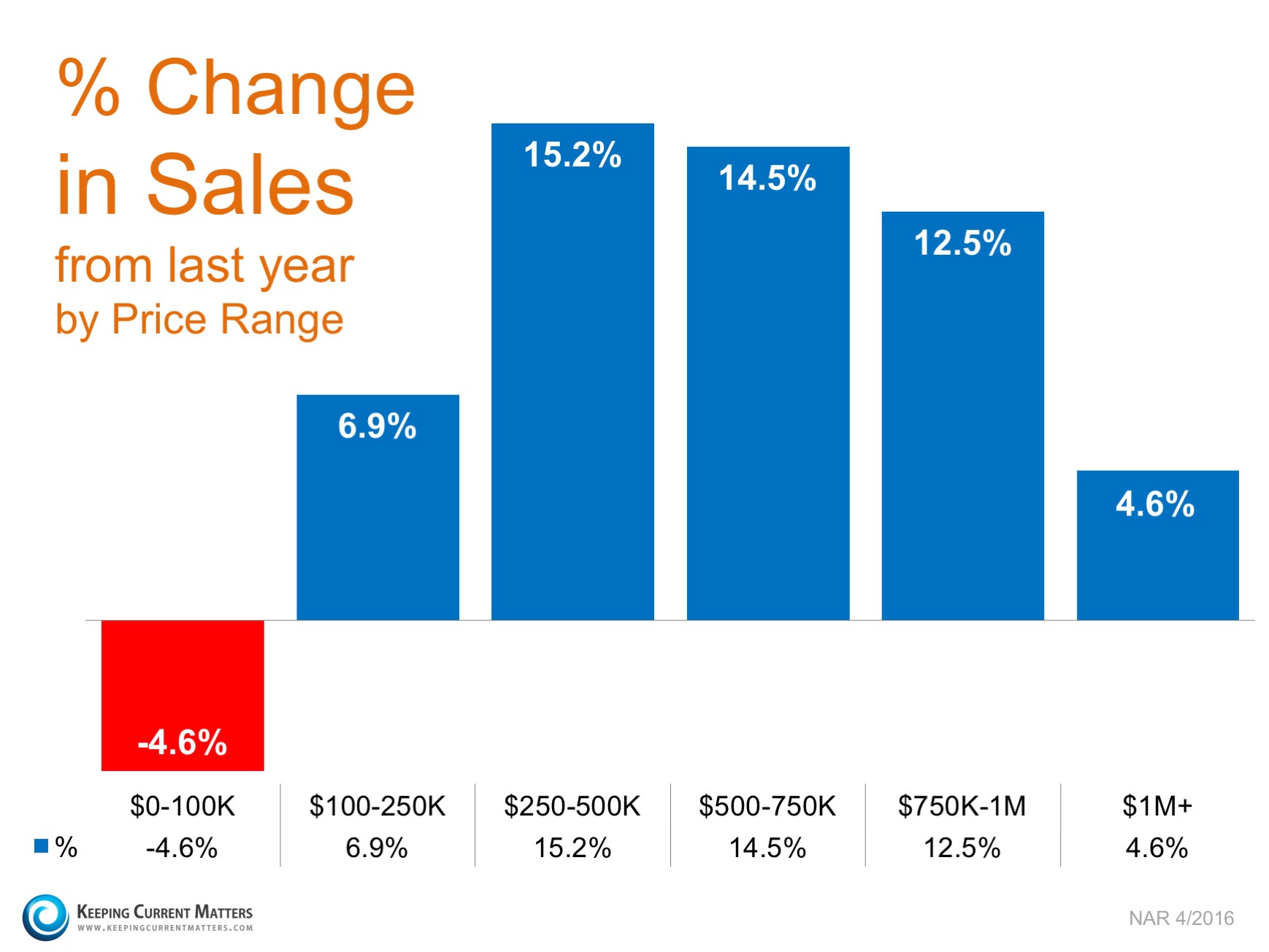

Sales Up In Nearly Every Price Range

The National Association of Realtors' most recent Existing Home Sales Report revealed that home sales were up rather dramatically over last year in five of the six price ranges they measure. Only those homes priced under $100,000 showed a decline (-4.6%). The decline in this price range points to the lower inventory of distressed properties available for sale and speaks to the strength of the market. Every other category showed a minimum increase of at least 4.6%, with sales in the $250,000- $500,000 range up 15.2%!

The National Association of Realtors' most recent Existing Home Sales Report revealed that home sales were up rather dramatically over last year in five of the six price ranges they measure. Only those homes priced under $100,000 showed a decline (-4.6%). The decline in this price range points to the lower inventory of distressed properties available for sale and speaks to the strength of the market. Every other category showed a minimum increase of at least 4.6%, with sales in the $250,000- $500,000 range up 15.2%!Here is the breakdown:

What does that mean to you if you are selling?

Houses are definitely selling. If your house has been on the market for any length of time and has not yet sold, perhaps it is time to sit with your agent and see if it is priced appropriately to compete in today's market.Tuesday, May 10, 2016

4 Reasons to Move Up to Your Dream Home This Spring

Spring is in full force; the summer months are right around the corner. If you are debating moving up to your dream home, here are four great reasons to consider listing your current home and moving up to your dream home now, instead of waiting. Spring is in full force; the summer months are right around the corner. If you are debating moving up to your dream home, here are four great reasons to consider listing your current home and moving up to your dream home now, instead of waiting.1. Buyer Demand is High & Inventory is LowRecent numbers show that buyer demand is at the highest peak experienced in years, and inventory for sale is at a 4.5-month supply, which is still markedly lower than the 6 months needed for a historically normal market. Demand in many markets is far exceeding the supply, and more properties in March sold in less than 30 days (42%) than in any month since last July. Listing your home today can greatly increase exposure to buyers who are out in force and ready to act.2. Prices Will Continue to RiseCoreLogic recently released their latest Home Price Index in which they predict that national home values will appreciate by 5.3% by this time next year. The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting for your current home's value to increase before selling could price you out of your new home if you aren't careful.3. Mortgage Interest Rates Are Still Near Record LowsInterest rates have remained below 4% for some time now and are substantially lower than the rate previous generations paid when getting a mortgage. The Mortgage Bankers Association, Fannie Mae, Freddie Mac & the National Association of Realtors are in unison projecting that rates will rise over the next 12 months. An increase in rates will impact YOUR monthly mortgage payment. Even an increase of half a percentage point can put a dent in your family's net worth. Whether you are moving up or buying your first home, your housing expense will be more a year from now if a mortgage is necessary to purchase your home.4. It's Time to Move On with Your LifeThe 'cost' of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise. But, what if they weren't? Would you wait? Look at the actual reason you are buying and decide whether it is worth waiting. Have you always wanted to live in a certain neighborhood? Would a climate change be just what the doctor ordered? Would you like to be closer to your family?Bottom LineIf the right thing for you and your family is to move up to the home of your dreams this year, buying sooner rather than later could lead to substantial savings. |

Monday, May 9, 2016

Find Your Dream Cabinets in 5 Easy Steps

The growing number of designs, price points and materials makes finding good-looking (decently priced) cabinets a difficult task. Thankfully, outfitting your kitchen with attractive, budget-friendly cabinets is as easy as 1-2-3 — 4-5. Just follow these five painless steps to find exactly the cabinets you’re looking for.

There are two kinds of cabinets: framed and frameless. Framed cabinets are best for traditional décor. If you like a full-flavored, classic aesthetic, consider the warm design of framed cabinets. Frameless, also known as shaker, cabinets work best with modern and transitional designs. The sleek profile of frameless cabinets will give your kitchen an attractive splash of modern.

Plan your cabinets’ construction around your budget. Generally, stock cabinets are the most affordable option. Before purchasing stock cabinets, you should know about the quality and measurement issues that sometimes arise with prefab cabinets. (Measure your installation area twice to make sure your cabinets will fit.) If you have a larger budget and need custom sizing and finishes, semi-custom cabinets offer a variety of options at a reasonable price. Custom cabinets will come with a substantial price tag, but they’ll also meet your exact specifications. Custom construction is perfect for oddly shaped kitchens or specific design and functionality needs.

Exotic cabinet materials are available, but must homeowners choose maple, cherry, oak or pine. If you’re looking for a strong, versatile material, maple and cherry mix well with other woods and work for both contemporary and traditional cabinet designs. Oak cabinets are perfect if you’re looking for a durable material that can take both dark and light stains. Pine, while a softer wood, offers a continuous grain, giving your kitchen a rugged (yet refined) look.

Your cabinet’s hardware is also important. The hardware you choose for your cabinets will vary depending on the design of your kitchen. If your kitchen is a traditional design, rounded kitchen knobs are perfect for a welcoming, home-style aesthetic. If your kitchen is more contemporary, understated handles and pulls work best.

The finish of your hardware is also critical to completing the look of your cabinets. Nickel, stainless steel and polished aluminum are best suited for modern designs. Choose polished brass and bronze for rustic or traditional décor.

Your cabinet’s hardware is also important. The hardware you choose for your cabinets will vary depending on the design of your kitchen. If your kitchen is a traditional design, rounded kitchen knobs are perfect for a welcoming, home-style aesthetic. If your kitchen is more contemporary, understated handles and pulls work best.

The finish of your hardware is also critical to completing the look of your cabinets. Nickel, stainless steel and polished aluminum are best suited for modern designs. Choose polished brass and bronze for rustic or traditional décor.

It’s a good idea to plan your expenses around the material, construction and installation costs of your cabinets. Here’s a quick guide to help you pick and choose the perfect combo for your home and budget:

How much should you plan to spend? According to HomeAdvisor’s True Cost Guide, most homeowners spend between $2,000 and $7,000 on their cabinet install.

Cabinet installation boils down to two options: DIY or hire a pro. Consider your skill level, kitchen layout, budget and schedule before making a decision.

For most homeowners, it’s a good idea to hire a professional. Your pro will install your cabinets correctly and work according to an agreed-upon timeline — avoiding any headache-inducing delays. Also, most professionals will have additional help, meaning a quicker install time than a DIY project.

If you have the time, tools and know-how to hang your own cabinets, a DIY job can save you money. But, unless you’re a professional or have past experience with cabinet installs, tackling this project yourself isn’t recommended. Aside from the potential for mistakes, a DIY cabinet install can take much longer than a professional job.

For most homeowners, it’s a good idea to hire a professional. Your pro will install your cabinets correctly and work according to an agreed-upon timeline — avoiding any headache-inducing delays. Also, most professionals will have additional help, meaning a quicker install time than a DIY project.

If you have the time, tools and know-how to hang your own cabinets, a DIY job can save you money. But, unless you’re a professional or have past experience with cabinet installs, tackling this project yourself isn’t recommended. Aside from the potential for mistakes, a DIY cabinet install can take much longer than a professional job.

Wednesday, May 4, 2016

Subscribe to:

Posts (Atom)