renovationFavorable economic conditions have long triggered investment in home improvements—more money, more upgrades—and progress on the housing front is set to spur the next wave of homeowner spending on both necessary and discretionary projects.

How should homeowners invest their remodeling dollars this year? By and large, homeowners can expect to reap the highest returns on projects that cost relatively less, according to REMODELING magazine’s 2016 Cost vs. Value Report.

On a national scale, the top five projects with the greatest return on investment (ROI) in the report’s “midrange” cost category are:

Attic Insulation (Fiberglass) (116.9% ROI)

Average Cost: $1,268

Average Resale Value: $1,482

Manufactured Stone Veneer (92.9% ROI)

Average Cost: $7,519

Average Resale Value: $6,988

Garage Door Replacement (91.5% ROI)

Average Cost: $1,652

Average Resale Value: $1,512

Entry Door Replacement (Steel) (91.1% ROI)

Average Cost: $1,335

Average Resale Value: $1,217

Minor Kitchen Remodel (83.1% ROI)

Average Cost: $20,122

Average Resale Value: $16,716

On a national scale, the top five projects with the greatest ROI in the report’s “upscale” cost category are:

Garage Door Replacement (90.1% ROI)

Average Cost: $3,140

Average Resale Value: $2,830

Siding Replacement (Fiber-Cement) (78.1% ROI)

Average Cost: $14,520

Average Resale Value: $11,342

Window Replacement (Vinyl) (73.3% ROI)

Average Cost: $14,725

Average Resale Value: $10,794

Window Replacement (Wood) (72.1% ROI)

Average Cost: $18,087

Average Resale Value: $13,050

Grand Entrance (Fiberglass) (69.6% ROI)

Average Cost: $7,971

Average Resale Value: $5,545

On the whole, regional data mirror these national findings, but variations exist in markets abuzz with real estate activity. Homeowners in the Pacific region (California, Hawaii, Oregon and Washington), for instance, can expect to see six of the 30 projects analyzed in the report recoup over 100 percent of their cost.

At the other end of the spectrum are projects with the lowest returns on investment—improvements generally not in demand by the market.

On a national scale, the five projects with the lowest ROI in the “midrange” cost category are:

Bathroom Addition (56.2% ROI)

Average Cost: $42,233

Average Resale Value: $23,727

Backup Power Generator (59.4% ROI)

Average Cost: $12,712

Average Resale Value: $7,556

Master Suite Addition (64.1% ROI)

Average Cost: $115,810

Average Resale Value: $74,224

Deck Addition (Composite) (64.4% ROI)

Average Cost: $16,798

Average Resale Value: $10,819

Major Kitchen Remodel (64.9% ROI)

Average Cost: $59,999

Average Resale Value: $38,938

On a national scale, the five projects with the lowest ROI in the “upscale” cost category are:

Bathroom Addition (56.7% ROI)

Average Cost: $79,380

Average Resale Value: $45,006

Master Suite Addition (57.2% ROI)

Average Cost: $245,474

Average Resale Value: $140,448

Bathroom Remodel (57.5% ROI)

Average Cost: $57,411

Average Resale Value: $32,998

Deck Addition (Composite) (57.7% ROI)

Average Cost: $37,943

Average Resale Value: $21,877

Major Kitchen Remodel (61.5% ROI)

Average Cost: $119,909

Average Resale Value: $73,707

The 2016 Cost vs. Value Report compares, across 100 markets, the average cost of 30 popular remodeling projects with their average value at resale one year later. Average resale value is calculated based on estimates provided by real estate professionals. View the full report, including project descriptions and city-level data, here.

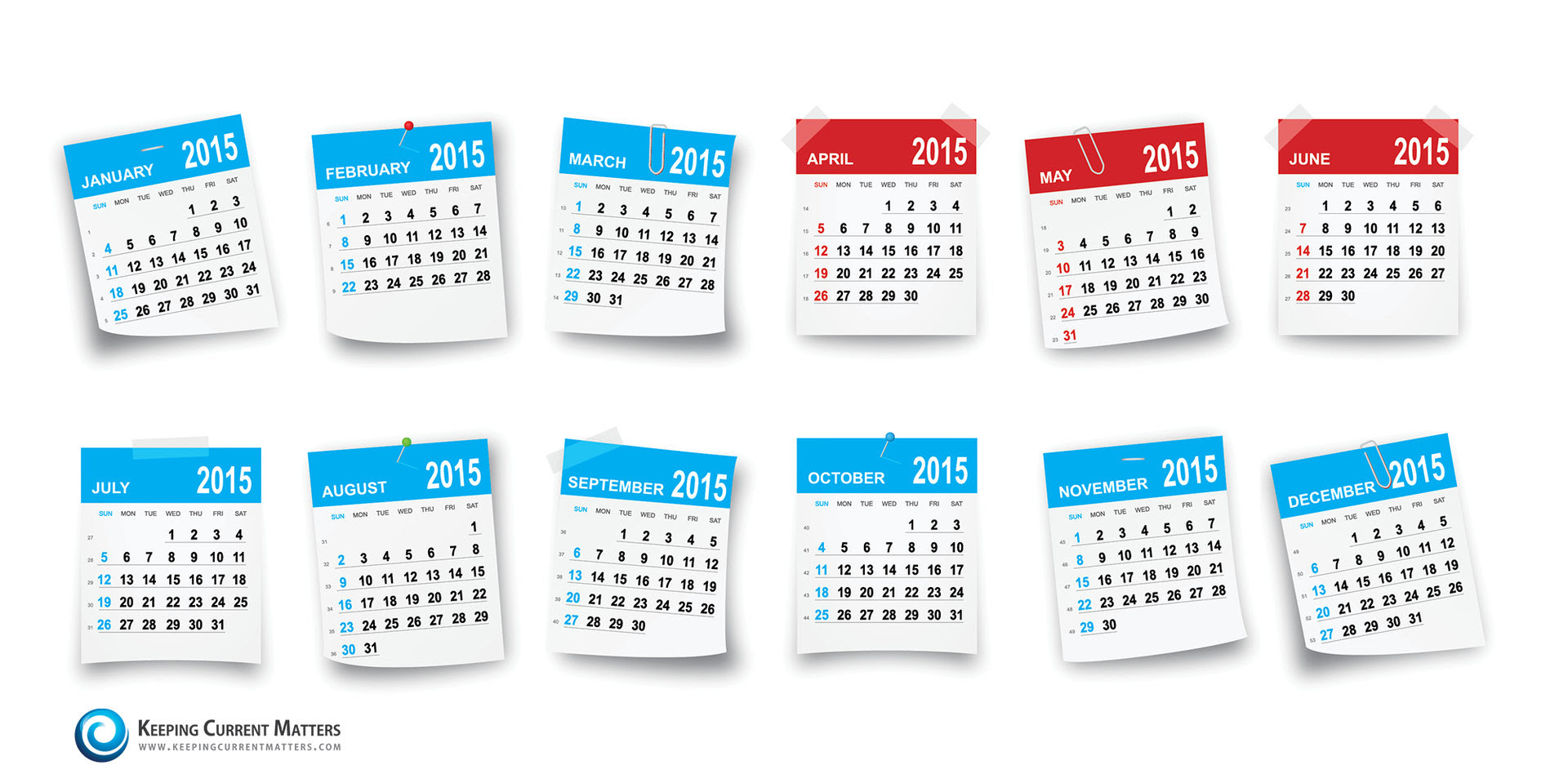

It is common knowledge that a large number of homes sell during the spring-buying season. For that reason, many homeowners hold off on putting their home on the market until then. The question is whether or not that will be a good strategy this year. The other listings that do come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the market in the spring, as compared to the rest of the year? The National Association of Realtors (NAR) recently revealed which months most people listed their home in for 2015. Here is a graphic showing the results:

It is common knowledge that a large number of homes sell during the spring-buying season. For that reason, many homeowners hold off on putting their home on the market until then. The question is whether or not that will be a good strategy this year. The other listings that do come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the market in the spring, as compared to the rest of the year? The National Association of Realtors (NAR) recently revealed which months most people listed their home in for 2015. Here is a graphic showing the results:  The three months in the second quarter of the year (represented in red) are consistently the most popular months for sellers to list their homes on the market. Last year, the number of homes available for sale in January was 1,860,000.

The three months in the second quarter of the year (represented in red) are consistently the most popular months for sellers to list their homes on the market. Last year, the number of homes available for sale in January was 1,860,000.

![Home Equity Increasing as Home Prices Rise [INFOGRAPHIC] | Keeping Current Matters](https://blogger.googleusercontent.com/img/proxy/AVvXsEjsbEwvnR-OvFrFaVac-OBgGQ8tfADmNDvRsw0D_gZOH0hyphenhyphenjIsUP34zWeDQac4nsuyrk9SBc8MG9VA8eMT9CnqMsTySBpdUtCphmWFcxyctBHCmvhYXfhIXOL-6KJG0pNRh41LzvMi84p5K90I6Rcm_hlbjT9o4lip2-QJwVc9jjEoDm50iLDnLj0SPRqDtfoU_FIR9MXvgi710=s0-d-e1-ft)

![Do You Know The Difference Your Interest Rate Makes? [INFOGRAPHIC] | Keeping Current Matters](https://blogger.googleusercontent.com/img/proxy/AVvXsEhAJ1T4McVYyhT43O23hSoCoCMCjIy26zYeGVqdxXE4lUBPa_7rYyAxK3YHLkNAVASsEzGwDg_2E48m3UC0sLTsNUgP4p2p2f8Ny1i3995g5h9MQwKnH9UohqrspnbPv9ZlnUTAGyUhCNiOOthSQ7L_VYmeK7YVauj3whW_hjbq5HkWvM0LZZ6uzkCsA_WGGOZ2afHVnY_IkA=s0-d-e1-ft)