So you want to buy a house! But first you need a car. And you want to get married in a big wedding, and then have some babies. Don’t forget their college education, and your master’s degree, and the looming specter of retirement.

Life often feels like a series of savings goals. Once you’ve paid off your student loans, there are a half-dozen other major costs lying ahead. The most ominous? Buying a house—a dream that might seem unachievable when you want other things, too.

But having it all doesn’t have to be stressful. Here are some financial adviser-approved techniques for saving for multiple goals—all at the same time.

1. Review your spending

There’s a reason this is the first bullet point in any financial advice story: You can’t make any serious savings inroads without first taking a good, hard look at your spending.

Before diving into hard-core budgeting, financial adviser

Cheryl Vesely of

Balance Financial Planning always forces her clients to analyze their current spending.

Don’t try to whittle down your spending without tracking it first—otherwise, you’ll set unrealistic goals and be disappointed when you don’t achieve them. Vesely recommends starting by evaluating fixed expenses, such as streaming TV services or your gym membership.

Here’s another tip: Search for purchases where the amount you spend exceeds your joy.

“Your fourth pair of shoes is not as fun as your third pair,” Vesely says. “Try to step back a little on things you don’t appreciate as much.”

2. Prioritize (and visualize) your goals

Chances are good your down payment will be the biggest priority, but paying for your kid’s college might be up there, too.

Or perhaps you want a wedding in two years, and ideally you’d like a home in five—how do you choose which goal to focus on?

For many home buyers, it’ll come down to which timeline has the most flexibility, says

Jason Hull, a financial planner in

Fort Worth, TX.

If you’ve already set a date for your wedding, for instance, maybe you need to consider renting for another year or two.

And when saving gets tricky, think about the future. Actually, don’t just think. Visualize.

“Mentally imagine you are watching a movie where future you is starring, doing whatever it is you’re trying to do,” Hull says. This helps combat the part of your brain that wants instant gratification.

3. Try the ‘snowball method’

If you’ve ever tuned in to financial guru

Dave Ramsey’s radio show, you’ve probably heard him advocate for the

debt snowball method: Knock out your debts one at a time, from smallest to largest.

That means you shouldn’t feel bad about putting most of your savings toward something smaller first—again, assuming your home purchase isn’t on a tight deadline. Accomplishing one financial goal might be the push you need to keep saving.

4. Separate your money

If you do decide to save for multiple goals at once, make sure to keep your savings in different accounts.

Many banks easily allow you to create as many accounts as you’d like, but Vesely also recommends online options such as

SmartyPig. Keeping the money separate helps mentally separate “house savings” from “car savings.”

You can also choose different types of savings accounts that are better suited to each goal: For a short-term goal such as a wedding or new car, keep your money in a risk-averse account, like a traditional savings or a money market account. For the longer term, Hull says, you might want to buy a low-cost index fund.

“You can’t guarantee you’re gonna get a return,” he says. “But chances are historically pretty decent you’ll beat inflation by doing that.”

While we’re at it: If your workplace allows it, set up a rule that automatically deposits a portion of your paycheck into a separate account. Decide what percentage of your income you want to dedicate to each savings goal and allocate it directly. As they say: Out of sight, out of mind.

5. Decide if you need to sacrifice

We know, we know—all of your goals are very important. But if you’re struggling to create a financial map that gets you everything you’re looking for in a reasonable timeline, maybe it’s time to evaluate what needs to go.

“You might have to look for a smaller house or decide to spend less on a wedding,” Vesely says. “You might have to step back a little bit and look for another way to do it.”

Maybe your home budget should be the cost of your dream home—minus the cost of your dream wedding. Think realistically about what you can afford. When you’re looking for a lot out of life, you’ve got to be willing to make sacrifices.

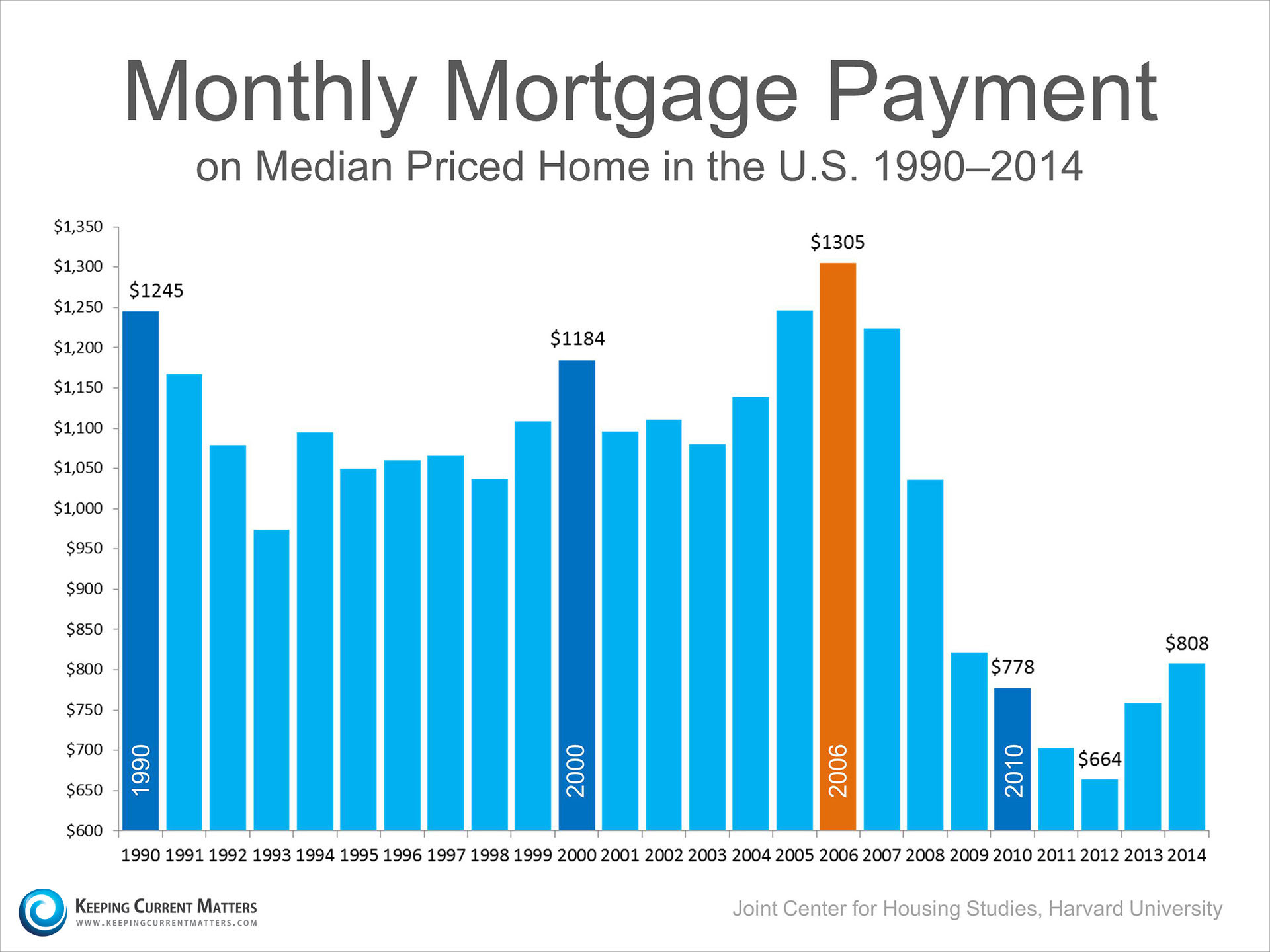

Last week, the National Association of Realtors (NAR) released their Existing Home Sales Report. The report announced that the median existing-home price in June was $236,400. That value surpasses the peak median sales price set in July 2006 ($230,400). This revelation created many headlines exclaiming that home prices had hit a “new record”:

Last week, the National Association of Realtors (NAR) released their Existing Home Sales Report. The report announced that the median existing-home price in June was $236,400. That value surpasses the peak median sales price set in July 2006 ($230,400). This revelation created many headlines exclaiming that home prices had hit a “new record”:

![Cost Across Time [INFOGRAPHIC] | Keeping Current Matters](https://blogger.googleusercontent.com/img/proxy/AVvXsEhF3zgOgRpoMRkkuQmQyGZWLfR8V6bF0kM3usDnzEqlpuMeYxgPQumb72yT6d5SKZk4z0hfxgUbAbcpuuQajdO5-RSnV2gJwXvU4YxagPMdV3ljt9muHsUx0nZJ68H8u917sshD_b0Ot3Ia74Aw3EHcu4Vd9GzstREcHygVJZCjexZ2N1S1DMA09XkLUHf9ShXYd56dvwhaVpy8AM7PADD35A=s0-d-e1-ft)