There are many benefits to homeownership. One of the top benefits is protecting yourself from rising rents, by locking in your housing cost for the life of your mortgage.

Don’t Become Trapped

A recent article by Apartment List addressed rising rents by stating:

“Rents are up 2.7% year-over-year at the national level. Year-over-year growth continues to fall between the 2.1% rate from this time last year and the 3.4% growth rate from October 2015.”

The article continues explaining that:

“Despite the seasonal slowdown, rents are still up year-over-year in 89 of the 100 Largest cities.”

Additionally, the Urban Institute revealed that,

“Over a quarter of renters, or 11.1 million households, are severely cost burdened, spending at least half their income on rental housing.”

These households struggle to save for a rainy day and pay other bills, including groceries and healthcare.

It’s Cheaper to Buy Than Rent

As we have previously mentioned, the results of the latest Rent vs. Buy Report from Trulia shows that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.

The updated numbers show that the range is an average of 6.5% less expensive in San Jose (CA), all the way up to 57% less expensive in Detroit (MI) and 37.4% nationwide!

Know Your Options

Perhaps you have already saved enough to buy your first home. A nationwide survey of about 24,000 renters found that 80% of millennial renters plan to eventually buy a house, but 72% cite affordability as their primary obstacle. Aside from affordability, one in three millennial renters have concerns about their credit scores, and another 53% said that a down payment is an obstacle.

Many first-time homebuyers who believe that they need a large down payment may be holding themselves back from their dream homes. As we have reported before, in many areas of the country, a first-time home buyer can save for a 3% down payment in less than two years. You may have already saved enough!

Bottom Line

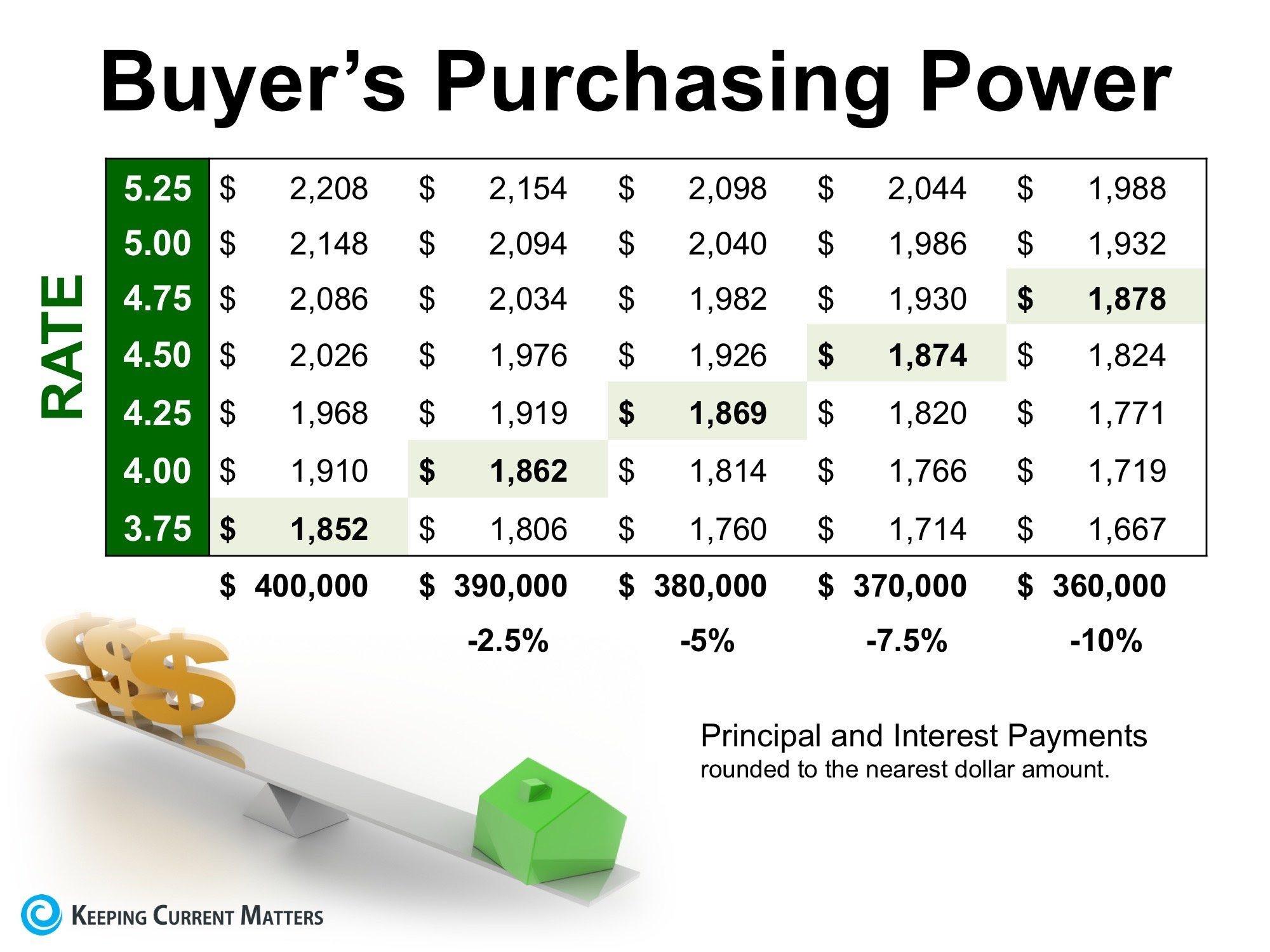

Don’t get caught in the trap that so many renters are currently in. If you are ready and willing to buy a home, find out if you are able. Have a professional help you determine if you are eligible for a mortgage.