Friday, May 26, 2017

Wednesday, May 24, 2017

#1 Answer to the Housing Shortage: New Construction

The biggest challenge to today’s housing market is the shortage of housing inventory for sale. A normal market would see a six-month supply of homes for sale. Currently, that number is below four months. This is the major reason home prices have continued to appreciate at higher levels than historic averages. The good news is that builders are now starting to build more homes in lower price ranges.

The biggest challenge to today’s housing market is the shortage of housing inventory for sale. A normal market would see a six-month supply of homes for sale. Currently, that number is below four months. This is the major reason home prices have continued to appreciate at higher levels than historic averages. The good news is that builders are now starting to build more homes in lower price ranges.Builder Confidence is Up

The Housing Market Index from the National Association of Home Builders (NAHB) reveals that builder confidence increased last month. HousingWire quoted NAHB Chief Economist Robert Dietz about the reason for the increase in confidence amongst builders.“The HMI measure of future sales conditions reached its highest level since June 2005, a sign of growing consumer confidence in the new home market. Especially as existing home inventory remains tight, we can expect increased demand for new construction moving forward.”

Builders are Meeting the Needs of Today’s Purchaser

Builders are not only jumping into the market – they are doing a better job of matching current demand. The Wall Street Journal recently reported:“In a shift, new households are overwhelmingly choosing to buy rather than rent. Some 854,000 new-owner households were formed during the first three months of the year, more than double the 365,000 new-renter households formed during the period, according to Census Bureau data.”The WSJ article went on to say:

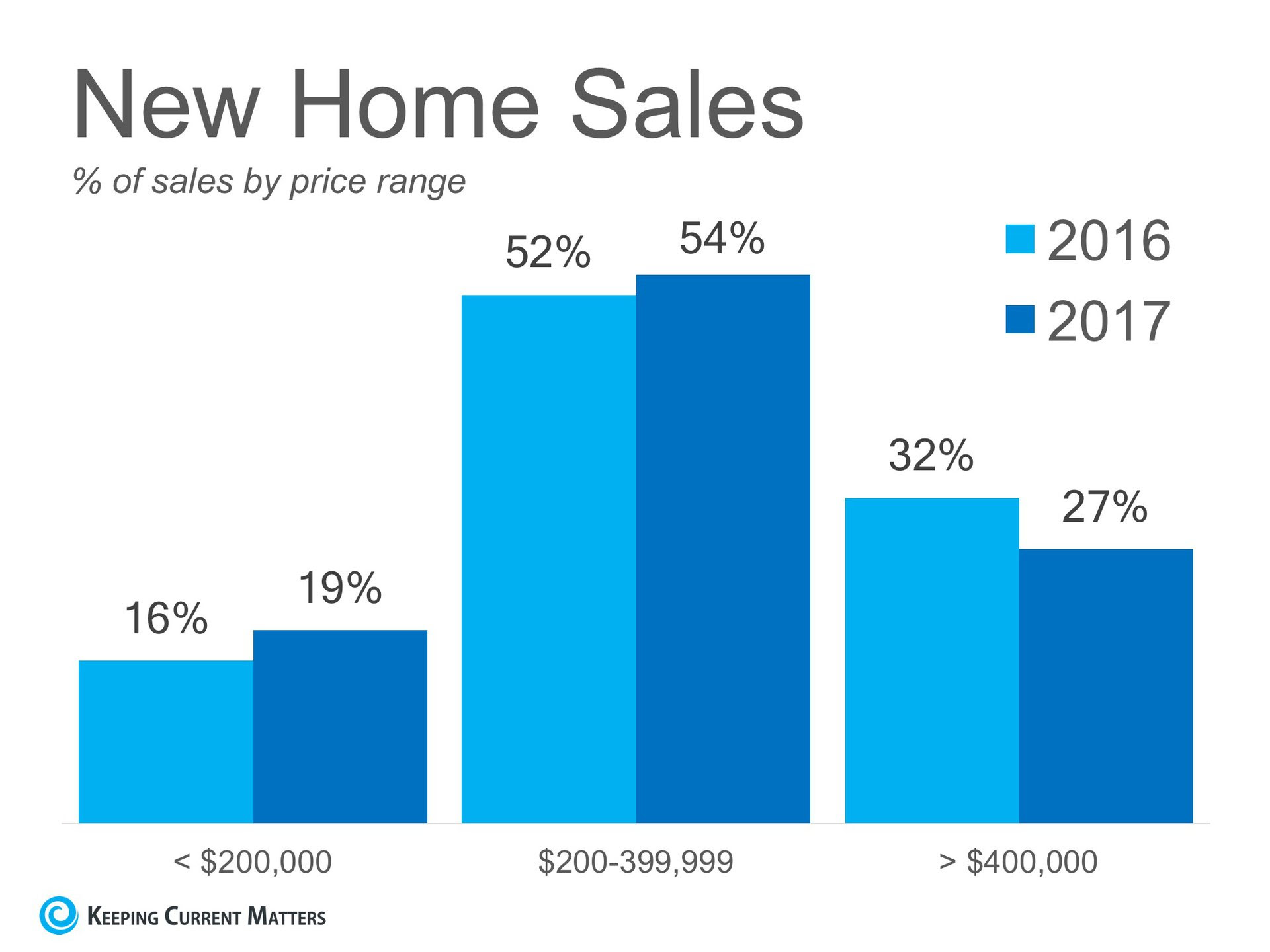

“Home builders are beginning to shift their focus away from luxury homes and toward homes at lower price points to cater to this burgeoning millennial clientele.”The graph below compares 2016 to 2017 new construction sales by price point. As we can see, builders are slowly beginning to shift to prices more favorable to the first-time and non-luxury buyer.

Bottom Line

There is a drastic need for a larger supply of home inventory to meet the skyrocketing demand. Builders are finally doing their part to help rectify this situation.Monday, May 22, 2017

Do You Know the Cost of NOT Owning Your Home?

Owning a home has great financial benefits, yet many continue renting! Today, let’s look at the financial reasons why owning a home of your own has been a part of the American Dream for as long as America has existed. Zillow recently reported that:

Owning a home has great financial benefits, yet many continue renting! Today, let’s look at the financial reasons why owning a home of your own has been a part of the American Dream for as long as America has existed. Zillow recently reported that:“With Rents continuing to climb and interest rates staying low, many renters find themselves gazing over the homeownership fence and wondering if the grass really is greener. Leaving aside, for the moment, the difficulties of saving for a down payment, let’s focus on the monthly expenses of owning a home: it turns out that renters currently paying the median rent in many markets could afford to buy a higher-quality property than the typical (read: median-valued) home without increasing their monthly expenses.”

What proof exists that owning is financially better than renting?

1. The latest Rent Vs. Buy Report from Trulia pointed out the top 5 financial benefits of homeownership:- Mortgage payments can be fixed while rents go up.

- Equity in your home can be a financial resource later.

- You can build wealth without paying capital gain.

- A mortgage can act as a forced savings account

- Overall, homeowners can enjoy greater wealth growth than renters.

Bottom Line

Owning a home has always been, and will always be, better from a financial standpoint than renting.Saturday, May 20, 2017

Thursday, May 18, 2017

4 Ways to Create a Stunning Outdoor Living Space

1. Pump up your patio. Upgrade the look of your patio with stylish outdoor furniture. Lounge chairs, love seats and sofas are comfy additions to any exterior space. Accent your furniture with throw pillows, potted plants and fashionable side tables. Finish off your patio décor with quirky details like string lighting, vintage candelabras and fun arrangements of succulents.

Include a chimenea or patio-safe fire pit in your plans. A cozy fire will offer mood lighting, warmth and even a place to roast marshmallows.

Design must-haves: Outdoor furniture, chimenea, potted plants, string lighting, throw pillows, succulents.

2. Perfect your pergola. Pergolas are the picture-perfect outdoor living space. Fill your pergola with comfy seating for an outdoor lounging area. Or, open up the space with a beautiful outdoor dining set. Include an antique bar cart or coffee table for a boost in looks and functionality. Wrap up your design with string lighting or a candle chandelier.

Gardens are a wonderful pergola accent. Tall, flowering plants like hibiscus or lilies will give your pergola extra privacy and a stunning aesthetic. Creeping vines are also perfect for an added dash of style and privacy.

Design must-haves: Outdoor dining set, privacy garden, candle chandelier.

3. Kick off your outdoor kitchen. Outdoor kitchens bring the quality and convenience of indoor cooking to summertime grilling. If you have a large backyard, consider adding a full kitchen layout. A grill-smoker combo, refrigerator, prep station and washing area will boost the ease and enjoyment of your summertime cooking.

Introduce an outdoor dining room to complement your kitchen. Keep it basic with an outdoor table, chairs and a stylish cantilever umbrella. Or, go with a full dining set for larger gatherings.

Design must-haves: Grill or smoker, outdoor dining set, food prep areas, refrigerator.

4. Outfit your outdoor fireplace. An outdoor fireplace is the ultimate gathering spot during nice weather. Situate your fireplace near your patio or devote a separate part of your yard to fireside get-togethers. Accentuate your fireplace with comfortable outdoor furniture — wrap around sofas are great for larger spaces —and several small coffee or side tables. If your fireplace is near your home, hang lighting or small lanterns over your seating area.

Design must-haves: Wrap-around outdoor sofa, hanging lanterns.

Tuesday, May 16, 2017

3 Reasons the Housing Market is NOT in a Bubble

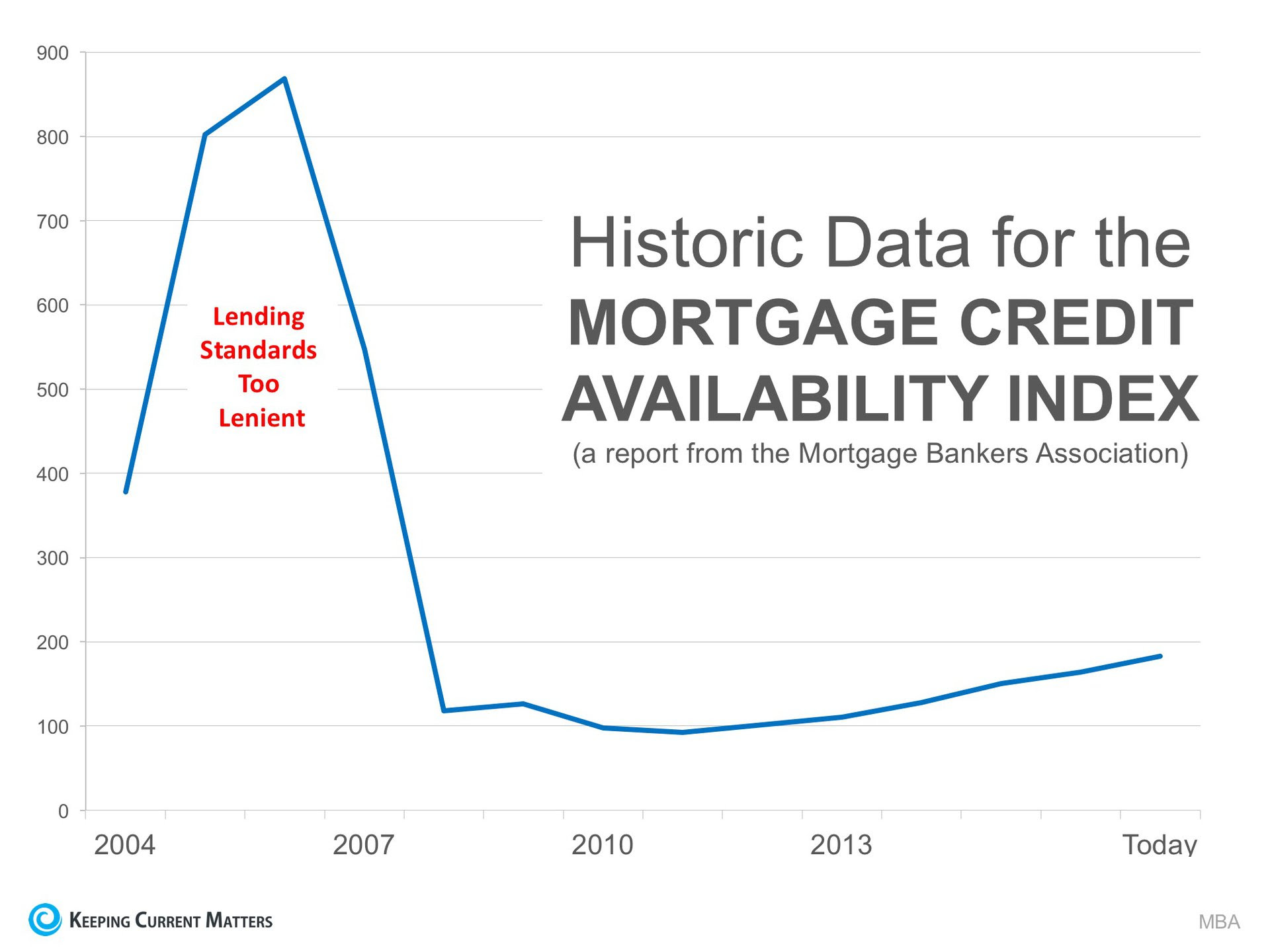

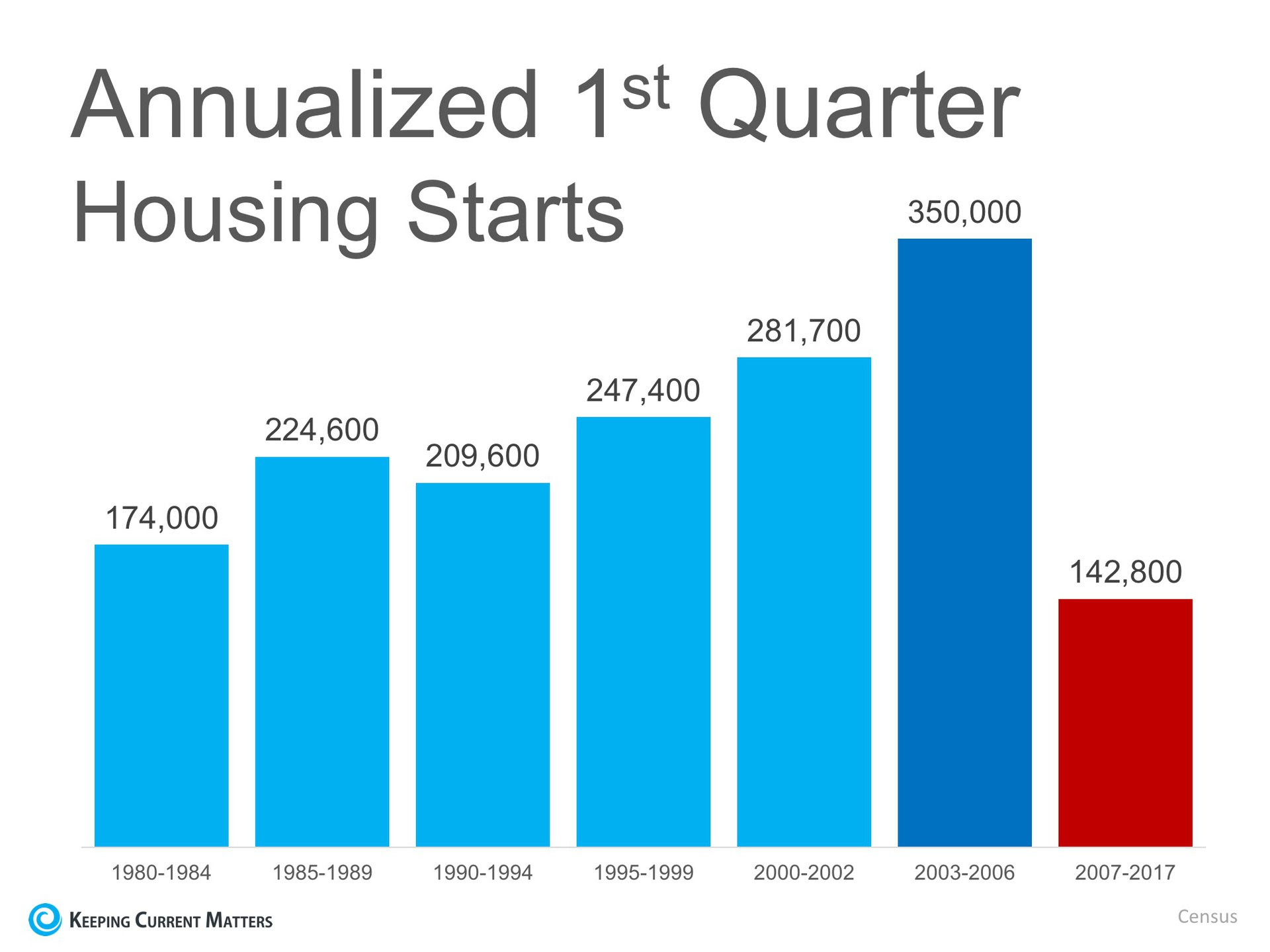

With housing prices appreciating at levels that far exceed historical norms, some are fearful that the market is heading for another bubble. To alleviate that fear, we just need to look back at the reasons that caused the bubble ten years ago. Last decade, demand for housing was artificially propped up because mortgage lending standards were way too lenient. People that were not qualified to purchase were able to attain a mortgage anyway. Prices began to skyrocket. This increase in demand caused homebuilders in many markets to overbuild. Eventually, the excess in new construction and the flooding of the market with distressed properties (foreclosures & short sales), caused by the lack of appropriate lending standards, led to the housing crash. With housing prices appreciating at levels that far exceed historical norms, some are fearful that the market is heading for another bubble. To alleviate that fear, we just need to look back at the reasons that caused the bubble ten years ago. Last decade, demand for housing was artificially propped up because mortgage lending standards were way too lenient. People that were not qualified to purchase were able to attain a mortgage anyway. Prices began to skyrocket. This increase in demand caused homebuilders in many markets to overbuild. Eventually, the excess in new construction and the flooding of the market with distressed properties (foreclosures & short sales), caused by the lack of appropriate lending standards, led to the housing crash.Where we are today…1. If we look at lending standards based on the Mortgage Credit Availability Index released monthly by the Mortgage Bankers Association, we can see that, though standards have become more reasonable over the last few years, they are nowhere near where they were in the early 2000s. 2. If we look at new construction, we can see that builders are not “over building.” Average annual housing starts in the first quarter of this year were not just below numbers recorded in 2002-2006, they are below starts going all the way back to 1980. 2. If we look at new construction, we can see that builders are not “over building.” Average annual housing starts in the first quarter of this year were not just below numbers recorded in 2002-2006, they are below starts going all the way back to 1980.  3. If we look at home prices, most homes haven’t even returned to prices seen a decade ago. Trulia just released a report that explained: 3. If we look at home prices, most homes haven’t even returned to prices seen a decade ago. Trulia just released a report that explained:“When it comes to the value of individual homes, the U.S. housing market has yet to recover. In fact, just 34.2% of homes nationally have seen their value surpass their pre-recession peak.” Bottom LineMortgage lending standards are appropriate, new construction is below what is necessary and home prices haven’t even recovered. It appears fears of a housing bubble are over-exaggerated. |

Sunday, May 14, 2017

Tuesday, May 9, 2017

Inventory Shortages Are Slowing Down the Market

The real estate market is moving more and more into a complete recovery. Home values are up. Home sales are up. Distressed sales (foreclosures and short sales) have fallen dramatically. It seems that 2017 will be the year that the housing market races forward again. However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory. While buyer demand looks like it will remain strong throughout the summer, supply is not keeping up. Here are the thoughts of a few industry experts on the subject:

The real estate market is moving more and more into a complete recovery. Home values are up. Home sales are up. Distressed sales (foreclosures and short sales) have fallen dramatically. It seems that 2017 will be the year that the housing market races forward again. However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory. While buyer demand looks like it will remain strong throughout the summer, supply is not keeping up. Here are the thoughts of a few industry experts on the subject:Lawrence Yun, Chief Economist at NAR:

"Sellers are in the driver's seat this spring as the intense competition for the few homes for sale is forcing many buyers to be aggressive in their offers. Buyers are showing resiliency given the challenging conditions. However, at some point — and the sooner the better — price growth must ease to a healthier rate. Otherwise sales could slow if affordability conditions worsen."

Tom O’Grady, Pro Teck CEO

“The lack of inventory is very real and could have a severe impact on home sales in the months to come. Traditionally, a balanced market would have an MRI (Months Remaining Inventory) between six and 10 months. This month, only eight metros we track have MRIs over 10, compared to 27 last year and 48 two years ago—illustrating that this lack of inventory is not being driven by traditionally ‘hot’ markets, but is rather a broad-based, national phenomenon.”

Ralph McLaughlin, Chief Economist at Trulia

“Nationally, housing inventory dropped to its lowest level on record in 2017 Q1. The number of homes on the market dropped for the eighth consecutive quarter, falling 5.1% over the past year.”

Freddie Mac

“Tight housing inventory has been an important feature of the housing market at least since 2016. For-sale housing inventory, especially of starter homes, is currently at its lowest level in over ten years. If inventory continues to remain tight, home sales will likely decline from their 2016 levels. …all eyes are on housing inventory and whether or not it will meet the high demand.”

Bottom Line

If you are thinking of selling, now may be the time. Demand for your house will be strongest at a time when there is very little competition. That could lead to a quick sale for a really good price.Friday, May 5, 2017

When a homeowner decides to sell their house, they obviously want the best possible price for it with the least amount of hassles along the way. However, for the vast majority of sellers, the most important result is actually getting their homes sold. In order to accomplish all three goals, a seller should realize the importance of using a real estate professional. We realize that technology has changed the purchaser’s behavior during the home buying process. According to the National Association of Realtors’ 2016 Profile of Home Buyers & Sellers, the percentage of buyers who used the internet in their home search increased to 94%. However, the report also revealed that 96% of buyers who used the internet when searching for homes purchased their homes through either a real estate agent/broker or from a builder or builder’s agent. Only 2% purchased their homes directly from a seller whom the buyer didn’t know. Buyers search for a home online but then depend on an agent to find the home they will buy (50%), to negotiate the terms of the sale (47%) & price (36%), or to help understand the process (61%). The plethora of information now available has resulted in an increase in the percentage of buyers that reach out to real estate professionals to “connect the dots.” This is obvious, as the percentage of overall buyers who have used agents to buy their homes has steadily increased from 69% in 2001.

Bottom Line

If you are thinking of selling your home, don’t underestimate the role a real estate professional can play in the process.Wednesday, May 3, 2017

Buying a Home? Do You Know the Lingo?

Buying a home can be intimidating if you are not familiar with the terms used during the process. To start you on your path with confidence, we have compiled a list of some of the most common terms used when buying a home. Freddie Mac has compiled a more exhaustive glossary of terms in their “My Home” section of their website. Annual Percentage Rate (APR) – This is a broader measure of your cost for borrowing money. The APR includes the interest rate, points, broker fees and certain other credit charges a borrower is required to pay. Because these costs are rolled in, the APR is usually higher than your interest rate. Appraisal – A professional analysis used to estimate the value of the property. This includes examples of sales of similar properties. This is a necessary step in getting your financing secured as it validates the home’s worth to you and your lender. Closing Costs – The costs to complete the real estate transaction. These costs are in addition to the price of the home and are paid at closing. They include points, taxes, title insurance, financing costs, items that must be prepaid or escrowed and other costs. Ask your lender for a complete list of closing cost items. Credit Score – A number ranging from 350-800, that is based on an analysis of your credit history. Your credit score plays a significant role when securing a mortgage as it helps lenders determine the likelihood that you’ll repay future debts. The higher your score, the better, but many buyers believe they need at least a 780 score to qualify when, in actuality, over 55% of approved loans had a score below 750. Discount Points – A point equals 1% of your loan (1 point on a $200,000 loan = $2,000). You can pay points to buy down your mortgage interest rate. It’s essentially an upfront interest payment to lock in a lower rate for your mortgage. Down Payment – This is a portion of the cost of your home that you pay upfront to secure the purchase of the property. Down payments are typically 3 to 20% of the purchase price of the home. There are zero-down programs available through VA loans for Veterans, as well as USDA loans for rural areas of the country. Eighty percent of first-time buyers put less than 20% down last month. Escrow – The holding of money or documents by a neutral third party before closing. It can also be an account held by the lender (or servicer) into which a homeowner pays money for taxes and insurance. Fixed-Rate Mortgages – A mortgage with an interest rate that does not change for the entire term of the loan. Fixed-rate mortgages are typically 15 or 30 years. Home Inspection – A professional inspection of a home to determine the condition of the property. The inspection should include an evaluation of the plumbing, heating and cooling systems, roof, wiring, foundation and pest infestation. Mortgage Rate – The interest rate you pay to borrow money to buy your house. The lower the rate, the better. Interest rates for a 30-year fixed rate mortgage have hovered between 4 and 4.25% for most of 2017. Pre-Approval Letter – A letter from a mortgage lender indicating that you qualify for a mortgage of a specific amount. It also shows a home seller that you're a serious buyer. Having a pre-approval letter in hand while shopping for homes can help you move faster, and with greater confidence, in competitive markets. Primary Mortgage Insurance (PMI) – If you make a down payment lower than 20% on your conventional loan, your lender will require PMI, typically at a rate of .51%. PMI serves as an added insurance policy that protects the lender if you are unable to pay your mortgage and can be cancelled from your payment once you reach 20% equity in your home. For more information on how PMI can impact your monthly housing cost, click here. Real Estate Professional – An individual who provides services in buying and selling homes. Real estate professionals are there to help you through the confusing paperwork, to help you find your dream home, to negotiate any of the details that come up, and to help make sure that you know exactly what’s going on in the housing market. Real estate professionals can refer you to local lenders or mortgage brokers along with other specialists that you will need throughout the home-buying process.

Buying a home can be intimidating if you are not familiar with the terms used during the process. To start you on your path with confidence, we have compiled a list of some of the most common terms used when buying a home. Freddie Mac has compiled a more exhaustive glossary of terms in their “My Home” section of their website. Annual Percentage Rate (APR) – This is a broader measure of your cost for borrowing money. The APR includes the interest rate, points, broker fees and certain other credit charges a borrower is required to pay. Because these costs are rolled in, the APR is usually higher than your interest rate. Appraisal – A professional analysis used to estimate the value of the property. This includes examples of sales of similar properties. This is a necessary step in getting your financing secured as it validates the home’s worth to you and your lender. Closing Costs – The costs to complete the real estate transaction. These costs are in addition to the price of the home and are paid at closing. They include points, taxes, title insurance, financing costs, items that must be prepaid or escrowed and other costs. Ask your lender for a complete list of closing cost items. Credit Score – A number ranging from 350-800, that is based on an analysis of your credit history. Your credit score plays a significant role when securing a mortgage as it helps lenders determine the likelihood that you’ll repay future debts. The higher your score, the better, but many buyers believe they need at least a 780 score to qualify when, in actuality, over 55% of approved loans had a score below 750. Discount Points – A point equals 1% of your loan (1 point on a $200,000 loan = $2,000). You can pay points to buy down your mortgage interest rate. It’s essentially an upfront interest payment to lock in a lower rate for your mortgage. Down Payment – This is a portion of the cost of your home that you pay upfront to secure the purchase of the property. Down payments are typically 3 to 20% of the purchase price of the home. There are zero-down programs available through VA loans for Veterans, as well as USDA loans for rural areas of the country. Eighty percent of first-time buyers put less than 20% down last month. Escrow – The holding of money or documents by a neutral third party before closing. It can also be an account held by the lender (or servicer) into which a homeowner pays money for taxes and insurance. Fixed-Rate Mortgages – A mortgage with an interest rate that does not change for the entire term of the loan. Fixed-rate mortgages are typically 15 or 30 years. Home Inspection – A professional inspection of a home to determine the condition of the property. The inspection should include an evaluation of the plumbing, heating and cooling systems, roof, wiring, foundation and pest infestation. Mortgage Rate – The interest rate you pay to borrow money to buy your house. The lower the rate, the better. Interest rates for a 30-year fixed rate mortgage have hovered between 4 and 4.25% for most of 2017. Pre-Approval Letter – A letter from a mortgage lender indicating that you qualify for a mortgage of a specific amount. It also shows a home seller that you're a serious buyer. Having a pre-approval letter in hand while shopping for homes can help you move faster, and with greater confidence, in competitive markets. Primary Mortgage Insurance (PMI) – If you make a down payment lower than 20% on your conventional loan, your lender will require PMI, typically at a rate of .51%. PMI serves as an added insurance policy that protects the lender if you are unable to pay your mortgage and can be cancelled from your payment once you reach 20% equity in your home. For more information on how PMI can impact your monthly housing cost, click here. Real Estate Professional – An individual who provides services in buying and selling homes. Real estate professionals are there to help you through the confusing paperwork, to help you find your dream home, to negotiate any of the details that come up, and to help make sure that you know exactly what’s going on in the housing market. Real estate professionals can refer you to local lenders or mortgage brokers along with other specialists that you will need throughout the home-buying process.The best way to ensure that your home-buying process is a confident one is to find a real estate professional who will guide you through every aspect of the transaction with ‘the heart of a teacher,’ and who puts your family’s needs first.

Subscribe to:

Posts (Atom)

![What You Need to Know About Qualifying for a Mortgage [INFOGRAPHIC] | Keeping Current Matters](https://blogger.googleusercontent.com/img/proxy/AVvXsEhGlZ23r3uTGQmcb_yxy8UoGZnw5gR4jaF3gb1v2U2LMXSiAaLlgRq0qSlCDN3yiC1nvgHvV1Q-sAEmYKqplu6alQc05OK1FH2XHcU8iNb5glQpo9xRk5rkNB0YFEh64PseKER-3_7jI8XLYPYzSvexbN_jhyphenhyphenhRY6tgeB7cn28ty93vRbYWjLKu-VymqOF5otBvo9BikdAEWmP0ghbl9j8X=s0-d-e1-ft)