Tuesday, March 31, 2015

Monday, March 30, 2015

Three Estate Planning Items Everyone Needs

We all own assets in one form or another. When we die, we want to make sure that the assets are properly going to those we love. We also want to minimize any confusion, unnecessary legal fees and stress for our loved ones. There are three essential items that everyone needs to have in place to ensure their wishes are carried out after their death.

1) Will or a Trust:

The simplest estate planning document is a Will. You can create your own Will by simply writing out the Will in your own handwriting, signing and dating it. This type of Will is called a holographic Will. California Probate Code 6110 sets forth the basic requirements of a valid Will. If you type your Will then, it must have the signatures of two disinterested witnesses. However, the problem with a Will is that if the gross value of the estate is more than $150,000 then a probate will be required. In California, if someone owns a home, the gross value of that home is certain to be over $150,000, therefore, if someone has a Will and owns a home, then a probate is required upon his or her death.

The other commonly used estate planning document is a living trust. A living trust allows one to put all of his or her assets into the trust, administer the trust for his or her benefit during the lifetime and transferring the assets to their beneficiaries upon death -- no probate is needed. The other great benefit of a trust is that if one becomes incapacitated, the trust would name a conservator to care for one's needs. This conservator could be your spouse, your children or whomever you choose but the main benefit is that it avoids having the court appoint a conservator. California Probate Code 15400 provides that unless otherwise stated, a living trust is revocable; meaning, once the living trust is set up, one can change their mind at anytime and terminate the trust. A living trust is a popular estate planning tool that is a convenient and efficient means to distribute one's assets at death.

2) Durable Power of Attorney:

A "power of attorney" is a legal document that names another person to step into your shoes and make decisions on your behalf. It gives that person the right and authority to act on your behalf. However, the power of attorney is ineffective if you become incapacitated -- unless you have a durable power of attorney. If one were to become incapacitated, hospitalized, or disabled and unable to handle one's own affairs then the durable power of attorney will remain in effect and the one whom you named as your attorney-in-fact can carry out your affairs for you. Not all power of attorneys are created equal. A regular power of attorney will terminate at your incapacity or at a fixed date. It is important to have a durable power of attorney because when you need it most your durable power of attorney will endure your incapacity and allow your loved one to take care of you. The laws governing power of attorney are set forth in California Probate Code 4000 to 4545.

3) Updated Beneficiary Designation Forms:

In most cases, the designated beneficiaries named in 401(k) plan, IRA or life insurance will override one's will, so it is imperative to take the time to update these forms when one has major changes in one's life such as a birth, death, marriage or divorce. It is important to check and update these forms on a regular basis.

Friday, March 27, 2015

How to Avoid Paying Capital Gains Tax When Selling Income Property

When selling income property you always need to think about the tax consequences involved. The most common way to avoid paying capital gains tax on the sale of income property is to do a 1031 tax exchange. from the day you close escrow on the property you are selling you have 180 days to close escrow on the property you are purchasing, however, you only have 45 days to name the property you are going to purchase. When escrow closes on the property you are selling the money must go directly to a third party called an Accommodator who holds the money until escrow closes on the property you are buying. It is important that you never have control over any of the money. the property you purchase must be of equal or greater value than the one you sell. You may sell one property and buy several or sell several properties and buy one. Either way the total value of the properties your are purchasing must be equal or greater than the total value of the property or properties you are selling. This is a complicated subject and I cannot address all the details here so if you have any questions please don't hesitate to call me. If I don't have the answers I will refer you to someone of does.

Thursday, March 26, 2015

Most Millennials Unaware of Closing Costs

| Most Millennials Unaware of Closing Costs A new survey by ClosingCorp reveals that approximately two-thirds of millennials who plan to buy a home are unaware of closing costs. The survey also found that across all adult age brackets, more than one-third of potential homeowners are "Not Very" or "Not At All" aware of closing costs. The survey of more than 1,000 adults also found that most people learn about closing costs from their real estate agent, or by doing their own research. In fact, millennial homeowners are more likely to learn about closing costs from their agent as opposed to a lender by a ratio of nearly two-to-one. "This study is very interesting in that it shows millennials are more dependent on REALTORS® than previously presumed," said Brian Benson, CEO of ClosingCorp. "We know they are more tech-savvy than their predecessors, so we believe this really highlights the complexity of a residential real estate transaction. Whether they are researching a home on their own or getting help from an interested third party, the bottom line is that people need access to the correct information, and it needs to be simple for them to understand. With the upcoming changes to the disclosure process being made by the Consumer Financial Protection Bureau this August, we as an industry should be stepping up our proactive education efforts to ensure homebuyers are fully prepared to make the most significant financial transaction of their lives." |

Wednesday, March 25, 2015

Baby Boomers: Home Is Where The Heart Is

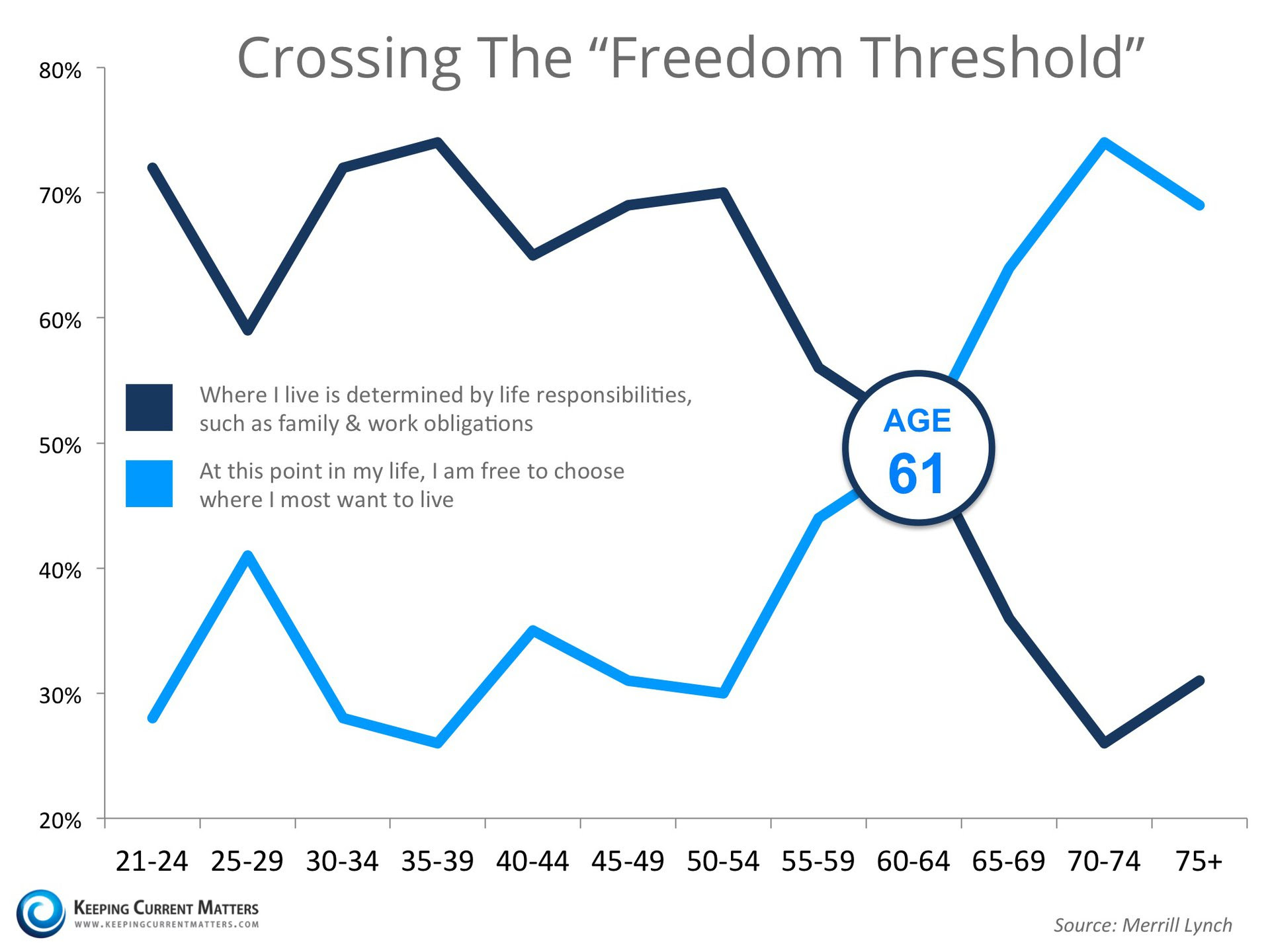

Crossing the “Freedom Threshold”

Throughout our lives, there are often responsibilities that dictate where we live. Whether being in the best school district for our children, being close to our jobs, or some other factor is preventing a move, the study found that there is a substantial shift that takes place at age 61. The study refers to this change as “Crossing the Freedom Threshold”. When where you live is no longer determined by responsibilities, but rather a freedom to live wherever you like. (see the chart below) As one participant in the study stated:

As one participant in the study stated:“In retirement, you have the chance to live anywhere you want. Or you can just stay where you are. There hasn’t been another time in life when we’ve had that kind of freedom.”

On the Move

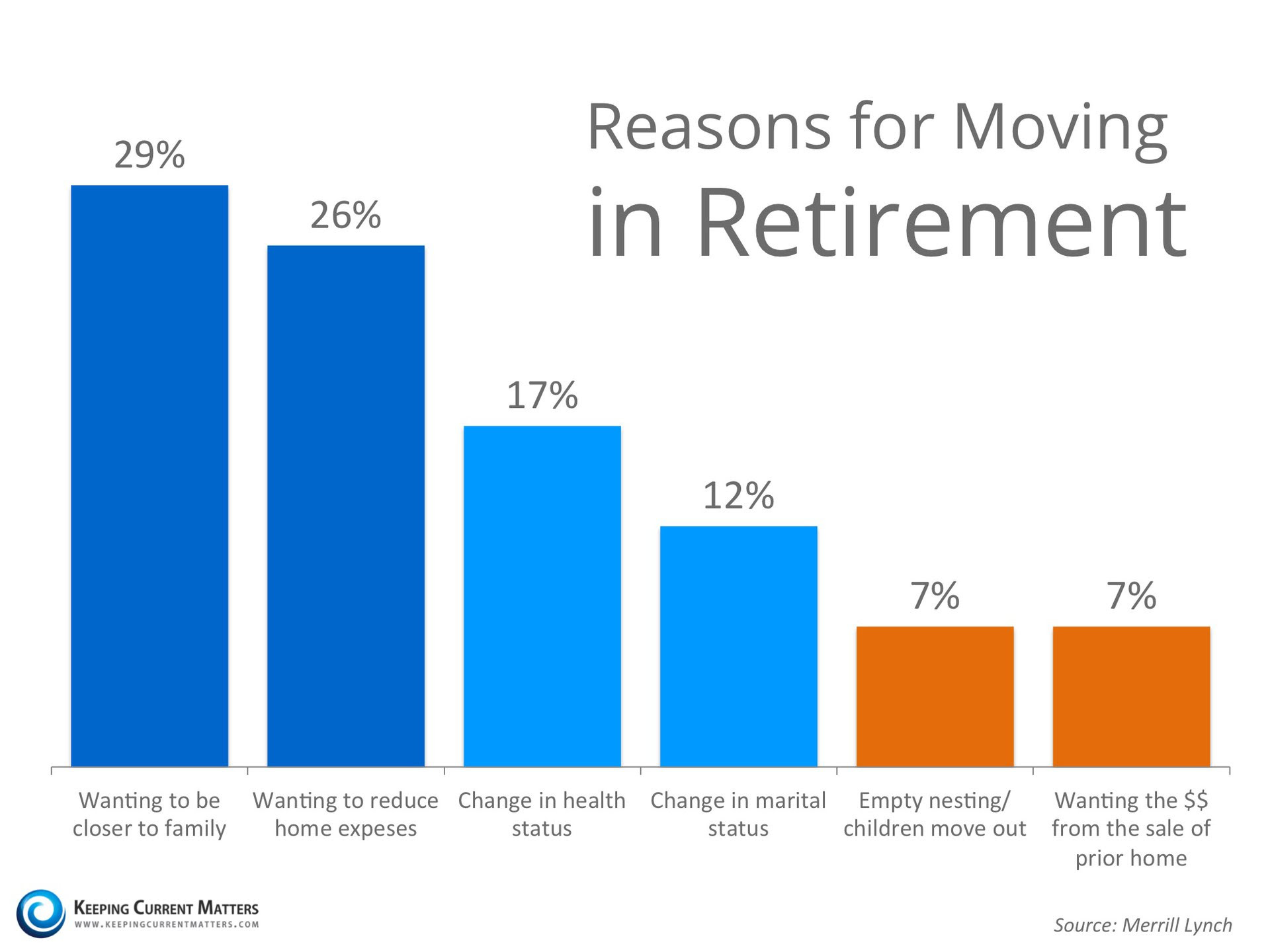

According to the study, “an estimated 4.2 million retirees moved into a new home last year alone.” Two-thirds of retirees say that they are likely to move at least once during retirement. The top reason to relocate cited was “wanting to be closer to family” at 29%, a close second was “wanting to reduce home expenses”. See the chart below for the top 6 reasons broken down.

Not Every Baby Boomer Downsizes

There is a common misconception that as retirees find themselves with less children at home that they will instantly desire a smaller home to maintain. While that may be the case for half of those surveyed, the study found that three in ten decide to actually upsize to a larger home. Some choose to buy a home in a desirable destination with extra space for large family vacations, reunions, extended visits, or to allow other family members to move in with them."Retirees often find their homes become places for family to come together and reconnect, particularly during holidays or summer vacations."

Bottom Line

If your housing needs have changed or are about to change, meet with a local real estate professional in your area who can help with deciding your next step.Friday, March 20, 2015

Projects to Boost Your Home's Curb Appeal

Given the amount of time we spend inside the home, it’s no surprise that’s where we spend most of our remodeling dollars. But neglecting your home’s exterior can leave it looking tired and rundown. Here are four projects that will boost your home’s curb appeal and ensure the outside of your home looks as good as the inside.

Liven Up Your Landscaping

Brown spots in your lawn, overgrown shrubs, and worn out mulch do wonders for making your house look more worn down that it actually is. If you’re ready to spruce up your landscaping, you’ll want to do so in the spring or fall when the temps are relatively cool, especially if you’re planning on laying sod or planting new trees or shrubs. While you’re planning your project, be sure to take a look at the grade surrounding your home. Over time it can become compacted and slope towards your house. If that happens, water will no longer flow away from your foundation; instead, it will flow towards it, putting your home’s foundation at risk.

Touch It Up

While your home’s exterior paint should last about 15 years, over time it will begin to chip and peel. Left untouched, your siding could start to rot, mold, or warp. Thankfully, a little preventative maintenance can help prevent any costly siding repairs. If you notice chipping or peeling paint, it’s time to breakout the sandpaper, primer, paint and paintbrushes. Most of the time, it’s a project that you can knock out in an afternoon. However, it could be that your project involves more work than you have time to put in. If that’s the case, now is a good time to start talking to pros. Pro Tip:pressure washing your home each spring removes dirt and can help prevent mold and mildew infestations.

Repair Your Roofing and Gutters

Missing shingles and sagging gutters do more than make your home look shoddy; they can cause seriously spendy problems. Water takes the path of least resistance and exploits any crack, gap or hole it can find. Left unrepaired, the damage can quickly make its way down to your sub roofing, or, in the case of damaged gutters, down to your foundation. If you notice that your gutters are having trouble moving water away from your foundation, or if it’s been a while since you’ve had your roof inspected, it’s a good idea to have a roofing pro stop by for an inspection.

Fantastic Fencing

Has your fence seen better days? If so, taking the time to fix it now could prevent you from having to replace the whole thing down the road. In many cases, all you’ll need to do is pressure wash it, replace missing or damaged boards, and throw a fresh coat of stain or paint on it. Unless it’s really worse for wear, you should be able to tackle the project in a weekend. Don’t have a fence? Now’s the perfect time to start gathering estimates from at least three pros.

Wednesday, March 11, 2015

Budget Bathroom Makeovers

If a major bathroom remodel isn't in your budget, simply updating a smaller aspect of your bathroom can still have significant impact. New tile, cabinets, lighting or plumbing fixtures can give the room a whole new style. Update the walls with a fresh coat of paint or use drywall to provide texture for a faux look. To keep up with recent trends, some people are even updating their electrical systems to accommodate in-bathroom TVs, stereos, and towel warmers.

To get the most out of your makeover, keep in mind how the bathroom is used and choose projects that will have the greatest impact as well as will positively affect your daily routine. The key to a small bathroom makeover is to pick one or two projects and focus all of your creativity and budget on those.

1. Add colorful tile for personality

2. Revilatize your cabinetry

2. Revilatize your cabinetry

To get the most out of your makeover, keep in mind how the bathroom is used and choose projects that will have the greatest impact as well as will positively affect your daily routine. The key to a small bathroom makeover is to pick one or two projects and focus all of your creativity and budget on those.

1. Add colorful tile for personality

Brighten up a neutral bathroom with brightly colored tile. If tiling your entire bathroom is out of the question, mix and match tile colors above the sink or bathtub to create your own wall mosaic. Consider choosing a colorful grout to further customize your creation.

Give life to old cabinets by restaining, painting or refacing them. Or replace them altogether with new cabinets. While bathroom cabinets can help set the tone of the room, they also need to be functional. Choose cabinets that provide adequate storage or add additional shelving to your current cabinets.

3. Change your light fixtures

Swap out your old light fixtures for newer ones that allow the option of having softer light for those relaxing evenings in the tub as well as brighter light for getting ready in the morning.

Nothing dates a bathroom like a dingy, basic 1970s chrome faucet. Today's faucets have become the inspiration for an entire bathroom. From elegant waterfall to traditional fixtures, chrome to brass, there are more options than ever to choose from.

Tuesday, March 3, 2015

Do You Know How to Take Title to Real Property?

When a husband and wife hunt for a home, they consider factors such as the neighborhood, the quality of the school district, curb appeal, or the condition of the house. However, they frequently overlook something else that is perhaps just as important: how they take title to their new home. It's a fact that most married couples choose joint tenancy. However, joint tenancy will create future tax liabilities if one of the spouse dies and the property is sold. A married couple can escape this tax liability by simply taking title as community property (CP) or community property with right of survivorship (CPWROS). The only time the IRS will forgive you for the capital gains on your home is if you vested title as CP or CPWROS. So you should take advantage of it!

In California, most married couples will hold title to their homes in joint tenancy because they don't seek legal counsel, they are not well informed, or because someone told them that holding title in joint tenancy escapes probate. However, holding title in joint tenancy escapes probate only after the first spouse's death and creates tax liabilities if the property is sold by the surviving spouse.

How is it that joint tenancy creates future unnecessary tax liability? Look at an example. John and Jane, a married couple, bought a home in California for $100,000 in 1980 and in 2015 it is worth $ 1 million dollars. John dies in 2015. Jane sells the property for $1 million dollars following his death. What is Jane's cost basis in computing how much income tax she will owe? The couple originally bought their home for $100,000 and Jane is still alive; therefore, her cost basis is $50,000 or half of the original price. When John dies, Jane receives John's 50% share of the house AND John's stepped up cost basis as well. Because Jane is receiving John's 50% after his death, she is receiving John's stepped up cost basis, which includes half of all the appreciation in the value of the house. When John died, the house was worth $1 million dollars; therefore, John's 50% cost basis would be stepped up to $500,000. When Jane sells the property for $1 million dollars minus her cost basis of $50,000 and John's stepped up basis of $500,000, her taxable proceeds would now be $450,000 ($1,000,000 minus $50,000 minus $500,000 = $450,000). The bottom line here is that in joint tenancy, there is ONLY a 50% or half stepped up in cost basis, whereas if John and Jane held title of their home as CP or CPWROS, then the stepped up tax basis would be 100% and Jane will have to pay ZERO in taxes!

Holding title as CP or CPWROS is a good method for paying NO income tax for your surviving spouse in the future. Lets look at the same example. Instead of taking title in joint tenancy to their home, they took title as CP or CPWROS. When John dies the house is worth $1 million dollars. Jane sells the house for $1 million. How much tax does Jane now need to pay? The answer is ZERO tax liability! Why? Because, when Jane sells the house for $1 million dollars, her cost basis is also $1 million dollars. This is because Jane received a 100% or full stepped up cost basis since the home was vested as CP or CPWROS and not held in joint tenancy.

Therefore, a husband and wife should strongly consider holding title to their home as CP or CPWROS because after the death of the first spouse, the surviving spouse can sell the house and not pay any taxes on the appreciated value of the home. However, the best method in vesting title is a living trust.

In California, most married couples will hold title to their homes in joint tenancy because they don't seek legal counsel, they are not well informed, or because someone told them that holding title in joint tenancy escapes probate. However, holding title in joint tenancy escapes probate only after the first spouse's death and creates tax liabilities if the property is sold by the surviving spouse.

How is it that joint tenancy creates future unnecessary tax liability? Look at an example. John and Jane, a married couple, bought a home in California for $100,000 in 1980 and in 2015 it is worth $ 1 million dollars. John dies in 2015. Jane sells the property for $1 million dollars following his death. What is Jane's cost basis in computing how much income tax she will owe? The couple originally bought their home for $100,000 and Jane is still alive; therefore, her cost basis is $50,000 or half of the original price. When John dies, Jane receives John's 50% share of the house AND John's stepped up cost basis as well. Because Jane is receiving John's 50% after his death, she is receiving John's stepped up cost basis, which includes half of all the appreciation in the value of the house. When John died, the house was worth $1 million dollars; therefore, John's 50% cost basis would be stepped up to $500,000. When Jane sells the property for $1 million dollars minus her cost basis of $50,000 and John's stepped up basis of $500,000, her taxable proceeds would now be $450,000 ($1,000,000 minus $50,000 minus $500,000 = $450,000). The bottom line here is that in joint tenancy, there is ONLY a 50% or half stepped up in cost basis, whereas if John and Jane held title of their home as CP or CPWROS, then the stepped up tax basis would be 100% and Jane will have to pay ZERO in taxes!

Holding title as CP or CPWROS is a good method for paying NO income tax for your surviving spouse in the future. Lets look at the same example. Instead of taking title in joint tenancy to their home, they took title as CP or CPWROS. When John dies the house is worth $1 million dollars. Jane sells the house for $1 million. How much tax does Jane now need to pay? The answer is ZERO tax liability! Why? Because, when Jane sells the house for $1 million dollars, her cost basis is also $1 million dollars. This is because Jane received a 100% or full stepped up cost basis since the home was vested as CP or CPWROS and not held in joint tenancy.

Therefore, a husband and wife should strongly consider holding title to their home as CP or CPWROS because after the death of the first spouse, the surviving spouse can sell the house and not pay any taxes on the appreciated value of the home. However, the best method in vesting title is a living trust.

Monday, March 2, 2015

Selling Your Home? The Importance of Using an Agent

“Home buyers are more informed than ever with their Internet searches and ongoing research; however, there’s a critical need to transform that information into analysis and advice that helps consumers make the best home-buying and selling decisions.”The plethora of information now available has resulted in an increase in the percentage of buyers that reach out to real estate professionals to “connect the dots”. This is obvious as the percentage of overall buyers who used an agent to buy their home has steadily increased from 69% in 2001.

Bottom Line

If you are thinking of selling your home, don’t underestimate the role a real estate professional can play in the process.

Subscribe to:

Posts (Atom)