Just like the paint on the rest of your home, your front door can be subject to things like peeling, cracking and fading over time. The freeze/thaw cycle in the winter can make this even more obvious, as can things like salt or ice melt getting splashed on the door by slush as people make their way indoors. Repainting your door is fairly easy and inexpensive, and can really give your home’s curb appeal a big boost.

Money Saving Tips

The best way to save money on front door paint jobs is to invest in high quality enamel paints for the job. They’re less likely to need touch ups as frequently as other paints, which means you need to paint less often. If you’re comfortable painting the door yourself, tackling this job DIY can really save you a lot of money as well. Just be sure to use a primer and two coats of paint to ensure you’re doing it right.

DIY Considerations

Most people can comfortably tackle the job of painting themselves. The only time you may want to leave it to the professionals is if you have a door with windows, glass inserts, or a lot of carvings and features that may take a specialized approach.

Stain Your Deck

All that snow, ice and freezing rain hitting your deck this winter could have done a lot of damage to the stain and finish of the wood. Stain is necessary not only to keep your deck looking great, it also helps prevent the wood from absorbing moisture and rotting over time. So if your deck has begun to peel and show the wood through in places, it’s time to put on a new coat of stain. Doing so will not only help protect your deck from the elements, it will also improve your home’s curb appeal.

Money Saving Tips

Your deck will need to be power washed before it can be stained, and this needs time to dry before the stain can be applied. Save time and money by doing the power washing yourself; schedule the professionals to come in after the deck has had a chance to dry. If you’re comfortable with tackling the job yourself, DIY can also save you professional fees, as most pros will take about 4-5 hours to do the job, and charge for their time.

DIY Considerations

Most able bodied homeowners will be able to tackle this job on their own. Keep in mind that you will need to rent or purchase a power washer to thoroughly clean the deck. You’ll also need to remove old, peeling stain, and apply at least two coats to ensure good coverage.

Air Duct Cleaning

After running your furnace all winter, it’s a good idea to get your air ducts cleaned come spring. This is particularly crucial if you’ve had any work done indoors over the past year, as construction dust and debris can build up in your ducts, reducing your HVAC system’s efficiency. Likewise, if you or your family suffer from allergies, cleaning out the ducts periodically can help improve your air quality.

CostThe average

cost of having your ducts cleaned is between $300 and $500 for a professional cleaning. The total range of costs is between $200 for cleaning the ducts in a small house to $900 for older ductwork that may need some upgrades done at the same time.

Money Saving Tips

Change your filter regularly on your HVAC system to help prevent dust and dirt build up in your ducts. You should change these seasonally at a minimum, but some brands recommend changing them monthly. Remove your filter and hold it up to the light; if you can’t see through it, it’s time to replace it. Clean and wipe down your grates periodically as well to help get rid of buildup that could be falling into the ducts, necessitating their cleaning.

DIY Considerations

Special equipment and knowledge is required to clean out the ducts properly. While you could possibly clean around the openings and the grates, cleaning the ducts themselves should be left to the professionals.

Fertilize Your Lawn

Help bring your lawn back to life after a cold, snowy winter with fertilizer. Fertilizing your lawn helps feed it with nutrients it needs to grow. Some fertilizers can also help eliminate weeds, and improve the overall quality of your lawn at the same time, so it requires less water or maintenance in the future.

CostThe average

cost to fertilize your lawn is around $.03 a square foot, assuming a 6,000 square foot lawn. The total costs range from around $.02 a square foot for a DIY job to $.04 a square foot during the peak season.

Money Saving Tips

Make the most of your lawn fertilization by ensuring that you water your lawn either early in the morning or late in the evening to prevent the sun from drying out both your grass and the fertilizer at the same time. If you have your lawn professionally serviced regularly, ask about bundling in fertilization with other services such as mowing to help reduce costs.

DIY Considerations

Nearly any able bodied homeowner should be able to tackle this job. All you need is a spreader and the ability to traverse your entire lawn. If you have a lot of steep hills or other issues, however, it may be better to hire a professional.

Keeping your home looking and functioning well in the springtime doesn’t have to cost a fortune. Follow these tips to help ensure your home looks and functions its best this year. For more cost savings, visit these

Cost Guides.

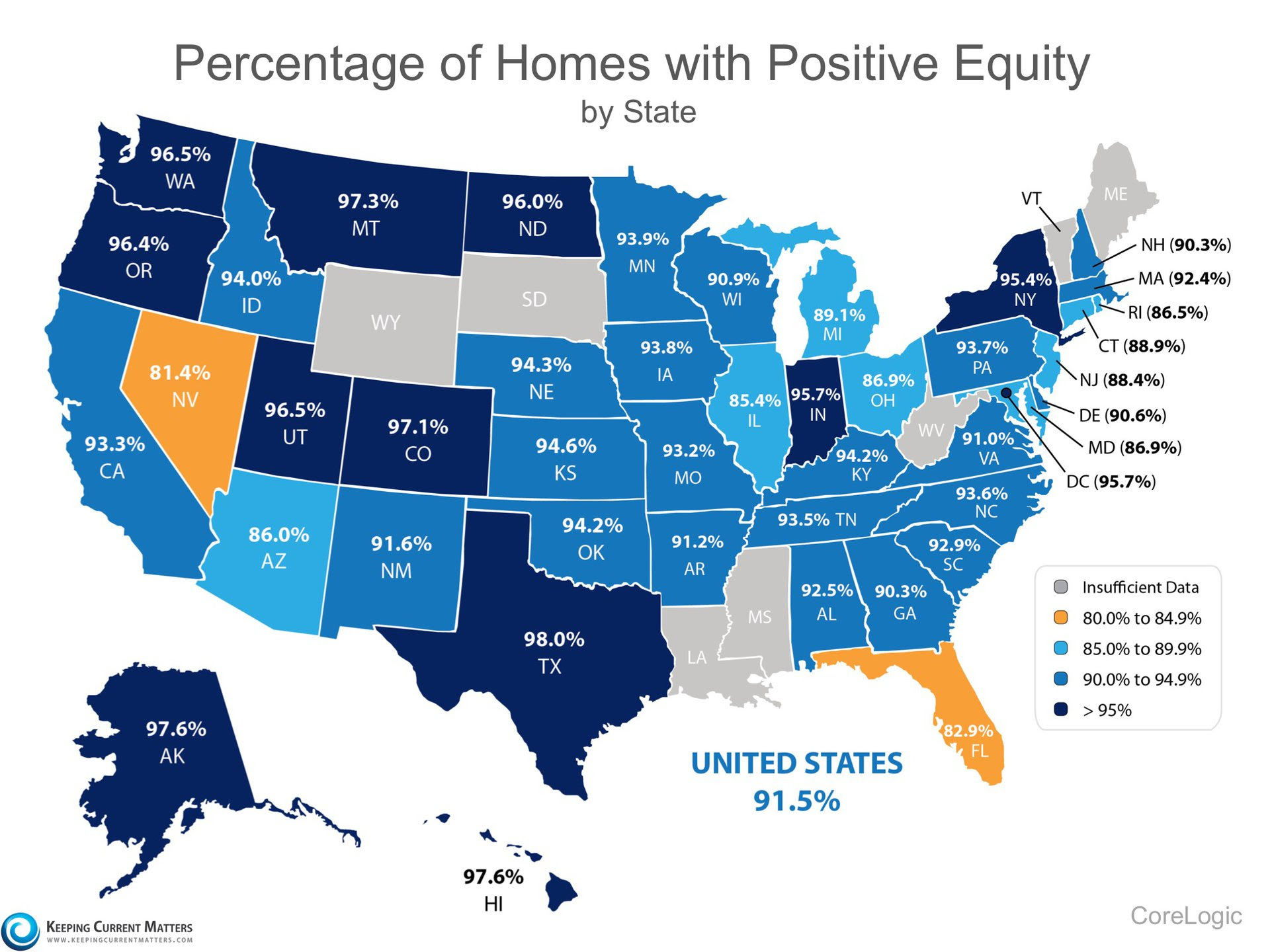

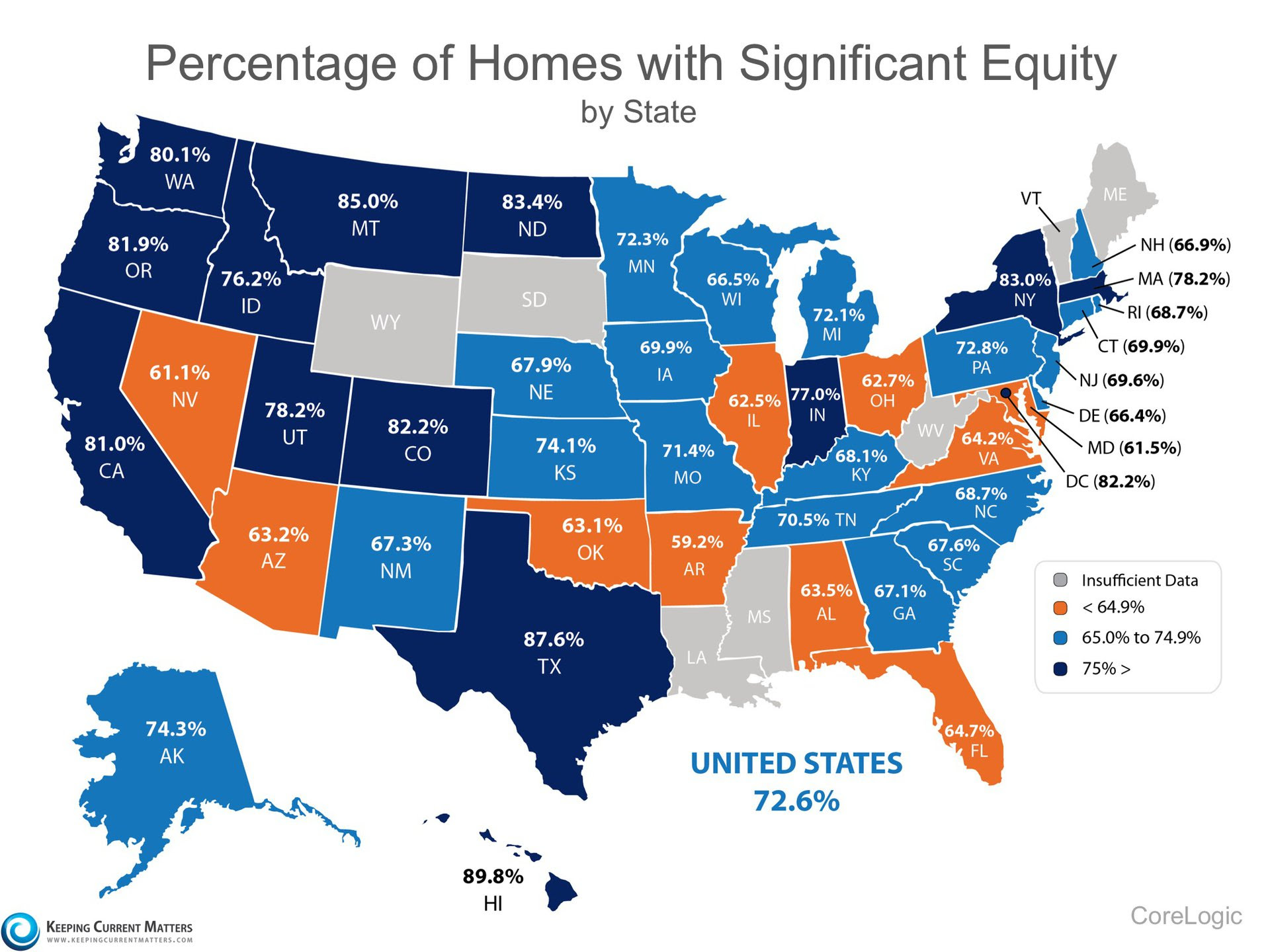

CoreLogic’s

CoreLogic’s

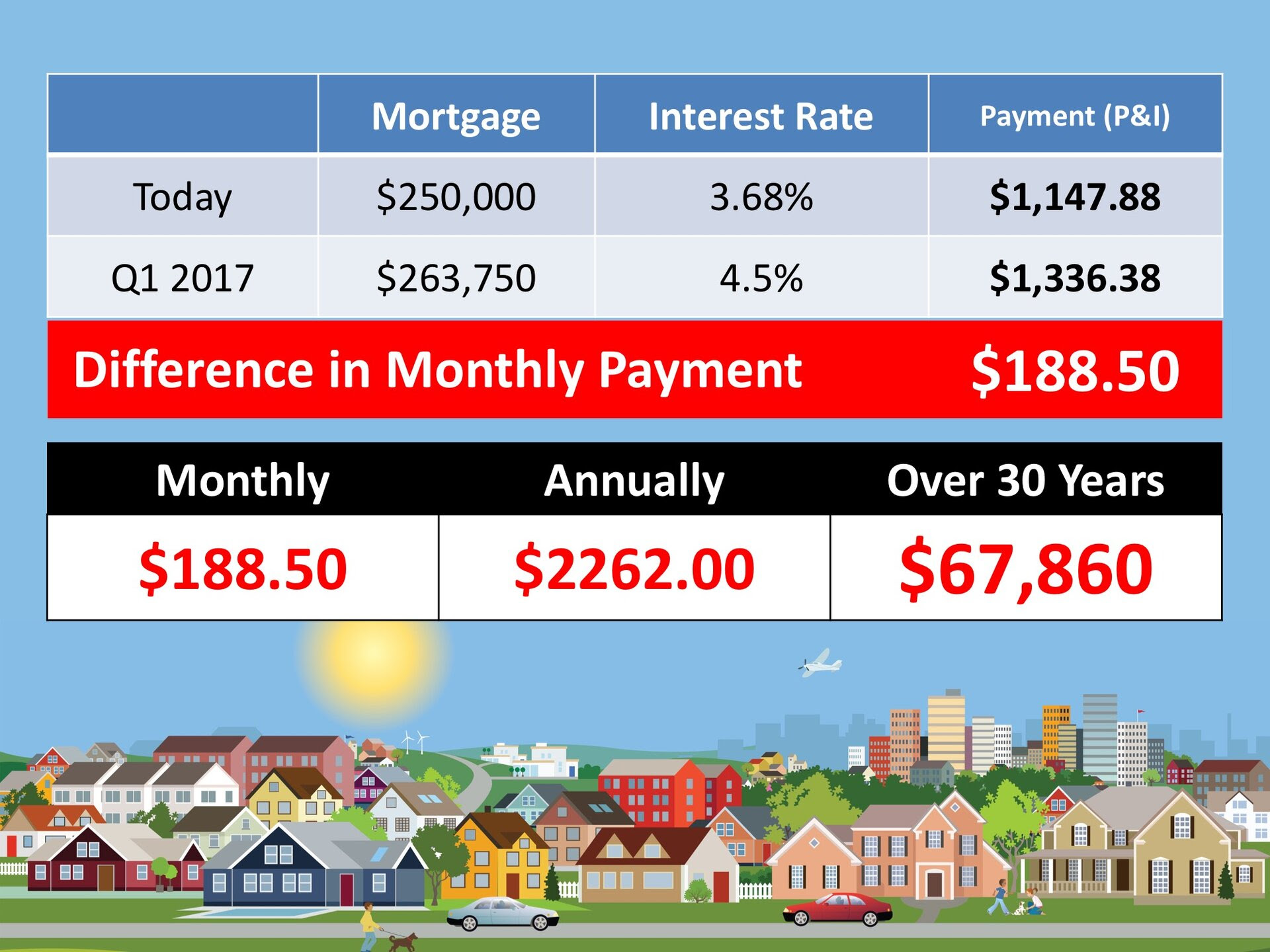

As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first-time or repeat buyer, you must not be concerned only about price but also about the ‘long term cost’ of the home.

As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first-time or repeat buyer, you must not be concerned only about price but also about the ‘long term cost’ of the home.