What You Really Need To Qualify For A Mortgage

| ||||||||||||

Thursday, December 17, 2015

Friday, December 11, 2015

HFF Closes Sale of 6-Property, Multi-State Seniors Housing Portfolio

DALLAS--(BUSINESS WIRE)--Holliday Fenoglio Fowler, L.P. (HFF) announced today that it has closed the sale of a six-property seniors housing portfolio totaling 596 units located in Southern California, Michigan, Philadelphia and Washington, D.C.

HFF marketed the portfolio exclusively on behalf of the seller, a joint venture between The Carlyle Group and Capitol Seniors Housing. ROC Seniors Housing Fund Manager, LLC acquired the portfolio free and clear of existing debt.

The portfolio has 114 independent living, 329 assisted living, 136 memory care and 17 skilled nursing units. The properties in the portfolio are: Crown Cove in Corona Del Mar, California; Raincross at Riverside in Riverside, California; Whittier Place in Whittier, California; Regent Street of West Bloomfield in West Bloomfield, Michigan; Arbor Terrace at Chestnut Hill in Philadelphia, Pennsylvania; and The Residences at Thomas Circle in Washington, D.C. The portfolio is 89.1 percent leased overall.

The HFF investment sales team representing the seller was led by managing directors Ryan Maconachy and Chad Lavender along with senior managing director Gerry Rohm.

About The Carlyle Group

The Carlyle Group (Carlyle) is a global alternative asset manager with $188 billion of assets under management across 126 funds and 160 fund of funds vehicles. Founded in 1987 in Washington, D.C., Carlyle has grown into one of the world’s largest and most successful investment firms, with more than 1,700 professionals operating in 35 offices in North America, South America, Europe, the Middle East, North Africa, Sub-Saharan Africa, Japan, Asia and Australia.

About Capitol Seniors Housing

Capitol Seniors Housing (CSH) is a boutique real estate private equity group focusing exclusively on the seniors housing sector. Since its inception in 2003, it has successfully acquired or developed more than 60 seniors housing communities throughout the continental U.S. CSH is a joint venture operating partner with The Carlyle Group, the $188 billion global alternative asset manager based in Washington, D.C. and one of the largest university endowments in the United States. The company utilizes third party seniors housing operating companies to manage the day-to-day oversight of its communities. By year’s end, CSH will have 25 operational communities nationwide and $750 million in assets under management in its portfolio. CSH headquarters are located on Pennsylvania Avenue in Washington, D.C.

About ROC Seniors Housing Fund Manager, LLC

ROC Seniors Housing Fund Manager, LLC (ROC Seniors) is a fund manager for a family of private equity funds that focus on investments in seniors housing communities and healthcare properties. The principals have over $6 billion of investment experience in these sectors. ROC Seniors currently has over $1.1 billion of regulatory assets under management (RAUM) with 41 properties. ROC Seniors is a subsidiary of Bridge Investment Group Partners, LLC (“Bridge-IGP”), a registered investment adviser. Bridge-IGP and ROC Seniors are integrated investment advisers under the Investment Advisers Act of 1940. Bridge-IGP, headquartered in Salt Lake City, Utah, has over $4.3 billion of RAUM and its affiliates own/manage an additional $400 million in real estate assets.

About HFF

HFF and HFFS (HFF Securities L.P.) are owned by HFF, Inc. (NYSE: HF). HFF operates out of 22 offices nationwide and is a leading provider of commercial real estate and capital markets services to the U.S. commercial real estate industry. HFF together with its affiliate HFFS offer clients a fully integrated national capital markets platform including debt placement, investment sales, equity placement, advisory services, loan sales and commercial loan servicing. For more information please visit hfflp.com or follow HFF on Twitter @HFF.

Holliday Fenoglio Fowler, L.P., acting by and through Holliday GP Corp., a real estate broker licensed with the California Department of Real Estate, License Number 01385740.

Tuesday, December 8, 2015

The Impact of Higher Interest Rates

Last week, an article in the Washington Post discussed a new ‘threat’ homebuyers will soon be facing: higher mortgage rates. The article revealed:

Last week, an article in the Washington Post discussed a new ‘threat’ homebuyers will soon be facing: higher mortgage rates. The article revealed:“The Mortgage Bankers Association expects that rates on 30-year loans could reach 4.8 percent by the end of next year, topping 5 percent in 2017. Rates haven’t been that high since the recession.”

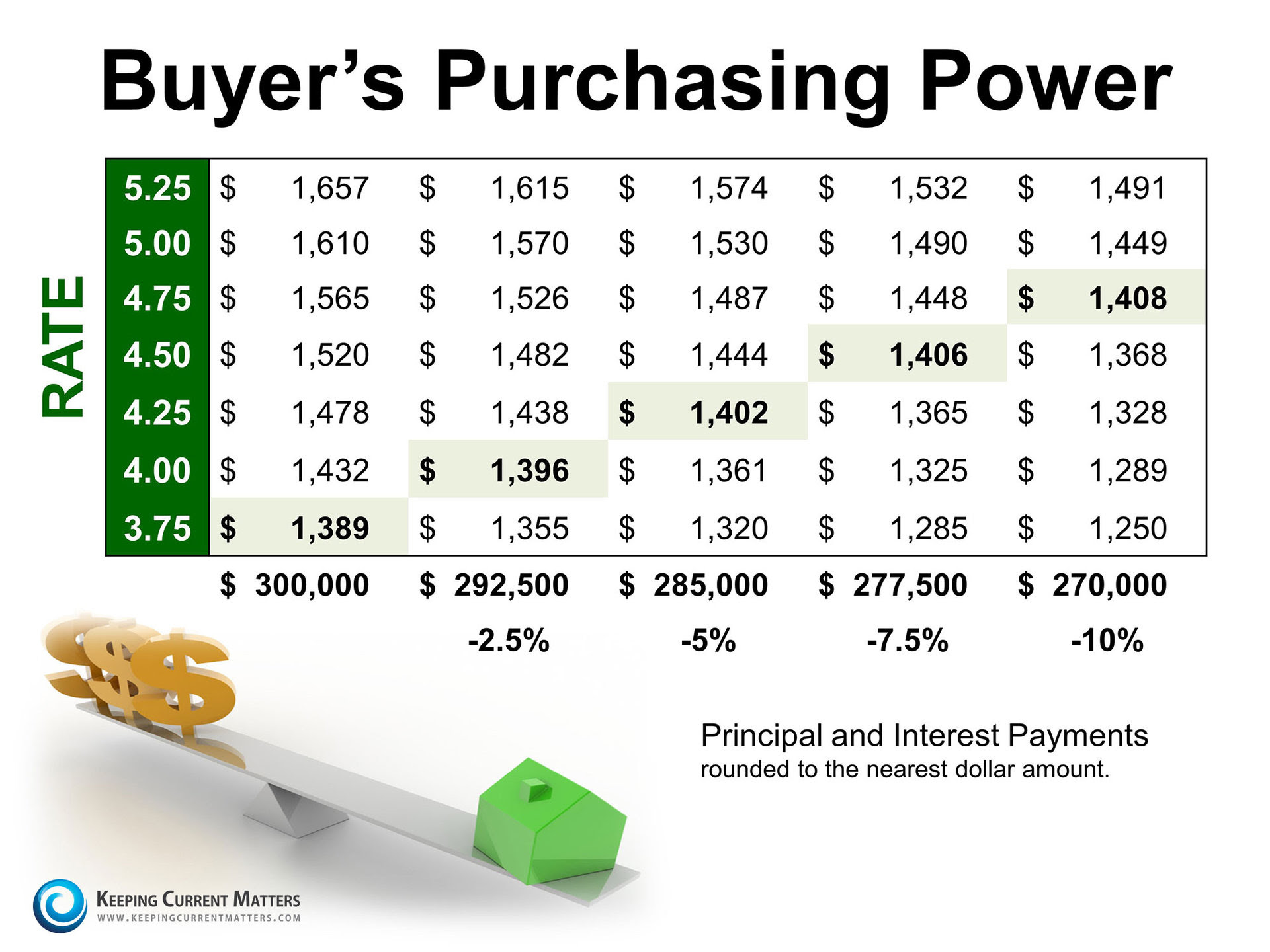

How can this impact the housing market?

The article reported that recent analysis from Realtor.com found that -“…as many as 7% of people who applied for a mortgage during the first half of the year would have had trouble qualifying if rates rose by half a percentage point.”This doesn’t necessarily mean that those buyers negatively impacted by a rate increase would not purchase a home. However, it would mean that they would either need to come up with substantially more cash for a down payment or settle for a lesser priced home. Below is a table showing how a jump in mortgage interest rates would impact the purchasing power of a prospective buyer on a $300,000 home.

Saturday, December 5, 2015

Thursday, December 3, 2015

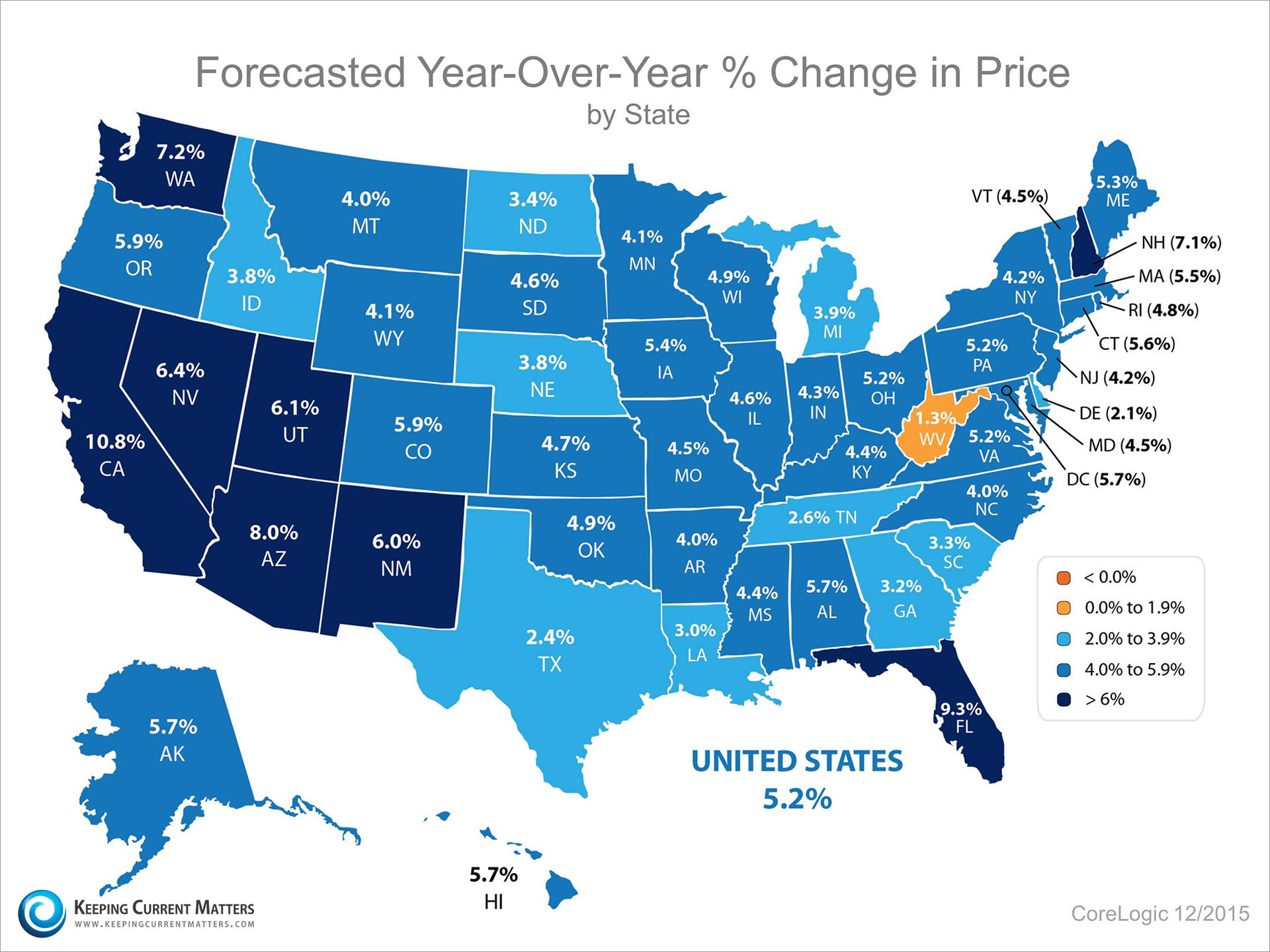

Prices & Mortgage Rates Going Up in 2016

The monthly mortgage payment on a home is determined by two elements: the price of the house and the interest rate you pay on your mortgage. Recently released reports are revealing that the experts expect both elements to increase in 2016.

The monthly mortgage payment on a home is determined by two elements: the price of the house and the interest rate you pay on your mortgage. Recently released reports are revealing that the experts expect both elements to increase in 2016.HOME PRICES

CoreLogic has projected a nationwide 5.2% home value appreciation for the next twelve months. Here is their breakdown by state:

MORTGAGE INTEREST RATES

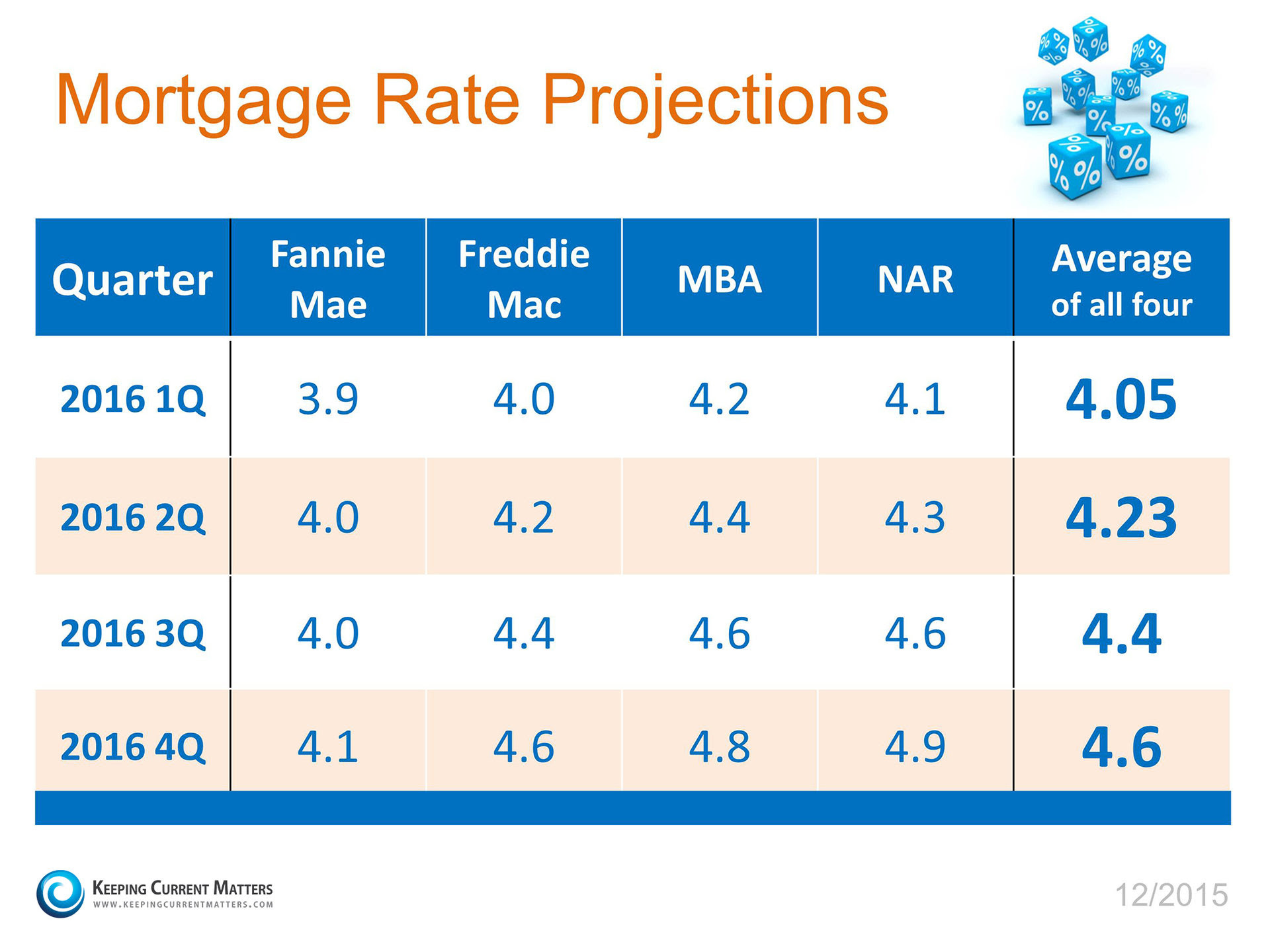

All four of the entities that provide projections on mortgage interest rates agree: they’re going up in 2016. Here are the predictions over the next four quarters:

Bottom Line

With both home values and interest rates projected to increase over the next twelve months, buying (or moving-up), sooner rather than later, makes sense.Wednesday, December 2, 2015

7 Threats to Your Home and What You Can Do to Prevent Them

What do mold, pests, old windows, leaky toilets and carbon monoxide have in common? They are all silent, and often hidden, dangers capable of causing significant damage to your home. But just because they're out of sight doesn't mean they should be out of mind.

When you bought your home, you had it inspected. The question is: How thorough of an inspection did it receive? If this was your first house; if you followed advice from friends, family or your realtor; or if you didn't perform the proper due diligence, you may not have received the home inspection you thought you did.

Many homeowners are under the false impression that a home inspector inspects every element of the home. In fact, unless you add it to the inspection (i.e., pay for it yourself), inspectors typically do not check for asbestos, radon gas, lead paint, toxic mold and/or pests. Left unmitigated, these contaminants can cause serious damage to your house and your health.

If you suspect that your home is at risk, we recommend meeting with a specialist. In addition to inspecting your home for contaminants, a specialist will identify the best course of action to remove any offending contaminants from your home

Many homeowners are under the false impression that a home inspector inspects every element of the home. In fact, unless you add it to the inspection (i.e., pay for it yourself), inspectors typically do not check for asbestos, radon gas, lead paint, toxic mold and/or pests. Left unmitigated, these contaminants can cause serious damage to your house and your health.

If you suspect that your home is at risk, we recommend meeting with a specialist. In addition to inspecting your home for contaminants, a specialist will identify the best course of action to remove any offending contaminants from your home

Home experts advise that you replace your windows every 25 years. And while you likely already know why you should replace them, you also know how expensive it can be. However, the benefits of replacing your windows could be reason enough to make you reconsider putting it off.

First, new windows improve the look of your home. Granted, this might not be something you're overly concerned about, but it is something appraisers, and potential buyers, will keep in mind - especially if you're the only house in your neighborhood without new windows. Why is this important? Because improved looks usually correlate to improved home values.

Second, new windows improve the comfort of your home. Old, single-pane windows are drafty, poorly insulated, vulnerable to condensation and often borderline inoperable. If you are tired of dealing with any one of the above, new windows are the solution.

Finally, new windows improve your home's energy efficiency. The obvious payback here is decreased utility bills. How much you save will depend on how efficient the windows are. However, this alone is not reason enough to replace all of your windows. Even if they reduce your utility bill $500 per year, you're still looking at a payback period of nearly 10 years.

So, why replace your windows? Because you want to improve the look, comfort and efficiency of your home. If that's not reason enough, what is?

First, new windows improve the look of your home. Granted, this might not be something you're overly concerned about, but it is something appraisers, and potential buyers, will keep in mind - especially if you're the only house in your neighborhood without new windows. Why is this important? Because improved looks usually correlate to improved home values.

Second, new windows improve the comfort of your home. Old, single-pane windows are drafty, poorly insulated, vulnerable to condensation and often borderline inoperable. If you are tired of dealing with any one of the above, new windows are the solution.

Finally, new windows improve your home's energy efficiency. The obvious payback here is decreased utility bills. How much you save will depend on how efficient the windows are. However, this alone is not reason enough to replace all of your windows. Even if they reduce your utility bill $500 per year, you're still looking at a payback period of nearly 10 years.

So, why replace your windows? Because you want to improve the look, comfort and efficiency of your home. If that's not reason enough, what is?

If your water heater is older than 10 years old, doesn't heat efficiently or requires constant repair, it could be time to replace it. Thankfully, a new water heater isn't nearly as expensive as new windows. According to our True Cost Guide, the average replacement cost comes in at just under $1,000. When you compare that against the average repair cost of $516, you can quickly see why, in most cases, it's better to replace than repair. Need a new water heater?

According to the National Fire Protection Association, approximately 14,000 fires are caused each year by improper dryer ventilation and maintenance. Many of those fires can be traced back to lint accumulation. You might be wondering how that's possible given that you make it a point to clean out your dryer's lint trap. The problem is that you're neglecting to properly clean out your dryer's exhaust vent — that tube that snakes from your dryer to the outside of your house. Over time, lint buildup can restrict airflow and increase the temperatures in the dryer, leading to increased fire danger

Termites cause billions of dollars of damage each year before unsuspecting homeowners even know what hit them. The good news is there are steps you can take to protect your home from these irksome pests. The bad news is you probably won't know you have a problem until the termites are already well established. If you live in an area that is prone to termites, or if you suspect that your home has termite damage, consult a pest specialist to see what you should do.

Did you know that, on average, leaks account for 10,000 gallons of wasted water each year? That's enough to fill a swimming pool. So, what part of your home is responsible for the greatest amount of water waste? If you said toilet, you pass. In fact, if your toilet is constantly running you could be blowing through 200 or more gallons of water per day. That's 73,000 gallons of water! Do the math and you'll quickly see how much that adds to your water bill. Thankfully, fixing your leaky pipes is as easy as hiring a plumber

Carbon monoxide, or CO, is often called the silent killer as this odorless, colorless gas can cause sudden illness and death. It's a gas that nearly every homeowner is aware of, yet far too many either ignore the risks it poses or are unaware of their home's vulnerabilities. Fortunately, there are a few things you can do to protect your home and family — the easiest of which is installing carbon monoxide detectors and ensuring the proper function of your gas, oil and charcoal burning appliances. Want to make sure you're protected? Talk to a fire protection and prevention specialist.

If you need recommendations for any of these issues please feel free to contact me!! Wendy 562 243 2966 or wendy@wendyj4homes.com

Subscribe to:

Comments (Atom)

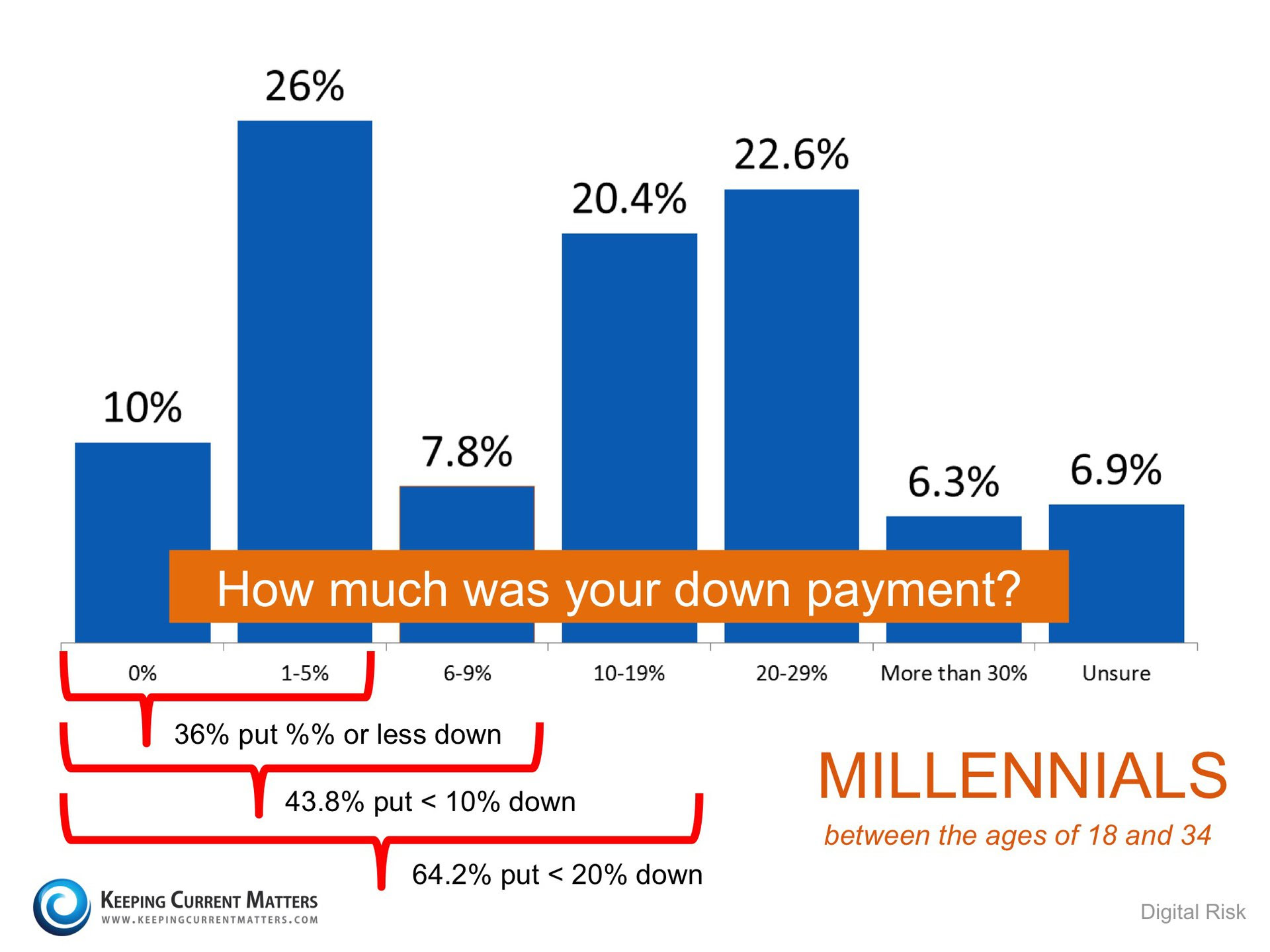

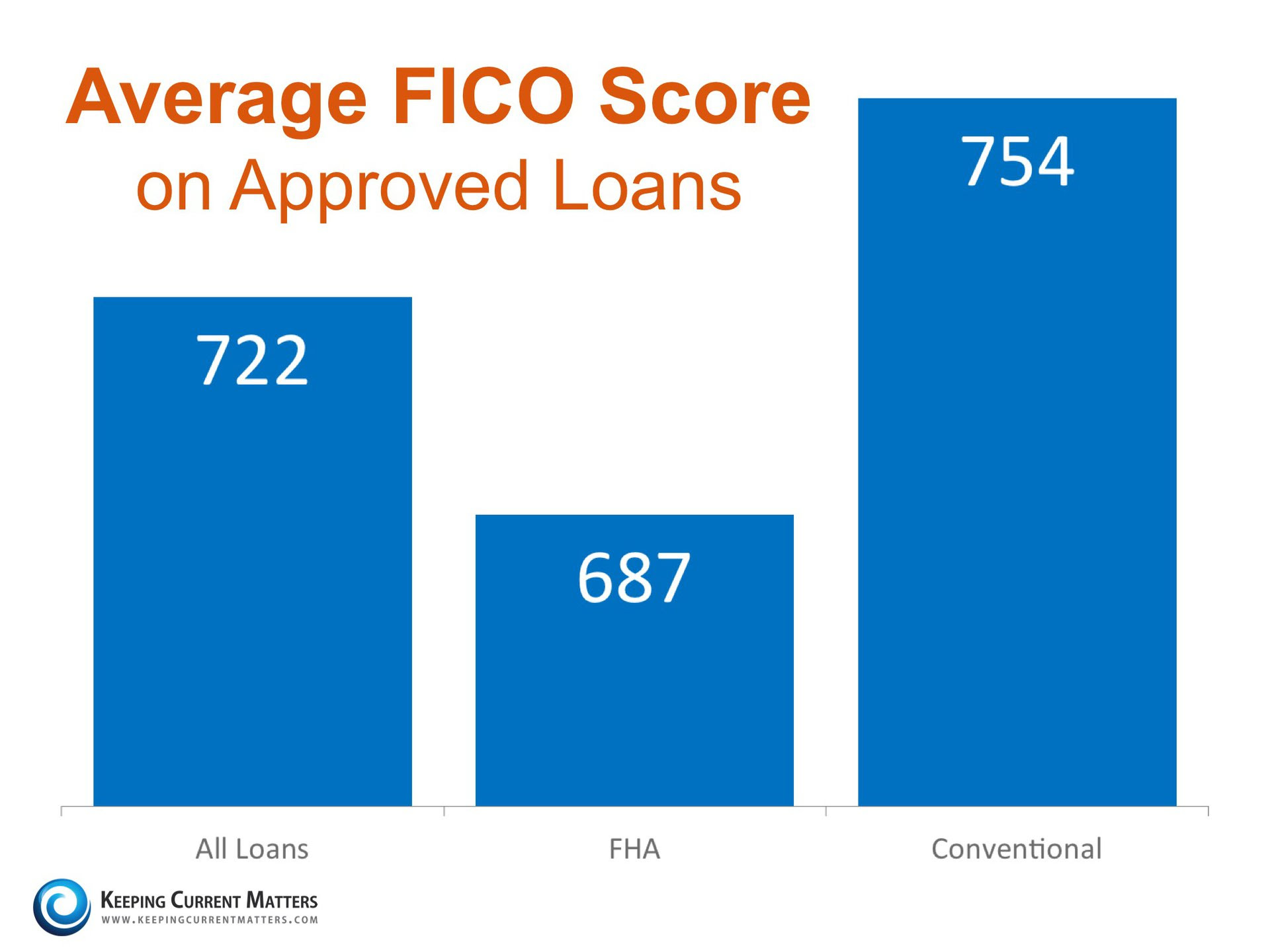

A recent survey by Ipsosfound that the American public is still somewhat confused about what is actually necessary to qualify for a home mortgage loan in today’s housing market. The study pointed out two major misconceptions that we want to address today.

A recent survey by Ipsosfound that the American public is still somewhat confused about what is actually necessary to qualify for a home mortgage loan in today’s housing market. The study pointed out two major misconceptions that we want to address today.