Saturday, August 31, 2019

Friday, August 30, 2019

MARKET UPDATE FOR JULY 2019

In July, the U.S. economic expansion that began in June 2009 became the longest in the nation's history, marking 121 straight months of gross domestic product growth and surpassing the 120-month expansion from 1991 to 2001. The average rate of growth during this expansion has been a milder 2.3 percent per year compared to 3.6 percent during the 1990s. Although the economy should continue to perform well for the rest of 2019, most economists see a mild recession on the horizon

New Listings were down 7.3 percent for Single Family homes and 2.0 percent for Townhouse-Condo properties. Pending Sales decreased 38.1 percent for Single Family homes and 43.4 percent for Townhouse-Condo properties.

The Median Sales Price was up 0.5 percent to $725,000 for Single Family homes but decreased 0.4 percent to $464,000 for Townhouse-Condo properties. Months Supply of Inventory increased 12.1 percent for Single Family units and 46.2 percent for Townhouse-Condo units.

During the record-setting 121-month economic expansion, the unemployment rate has dropped from 10.0 percent in 2009 to 3.7 percent, yet many consumers continue to struggle financially. Low mortgage interest rates have helped offset low housing affordability, but high home prices are outpacing median household income growth. In a move to stoke continued economic prosperity, the Federal Reserve reduced the benchmark interest rate by a quarter point to about 2.25 percent, marking the first reduction in more than a decade.

The Median Sales Price was up 0.5 percent to $725,000 for Single Family homes but decreased 0.4 percent to $464,000 for Townhouse-Condo properties. Months Supply of Inventory increased 12.1 percent for Single Family units and 46.2 percent for Townhouse-Condo units.

During the record-setting 121-month economic expansion, the unemployment rate has dropped from 10.0 percent in 2009 to 3.7 percent, yet many consumers continue to struggle financially. Low mortgage interest rates have helped offset low housing affordability, but high home prices are outpacing median household income growth. In a move to stoke continued economic prosperity, the Federal Reserve reduced the benchmark interest rate by a quarter point to about 2.25 percent, marking the first reduction in more than a decade.

Thursday, August 29, 2019

Wednesday, August 28, 2019

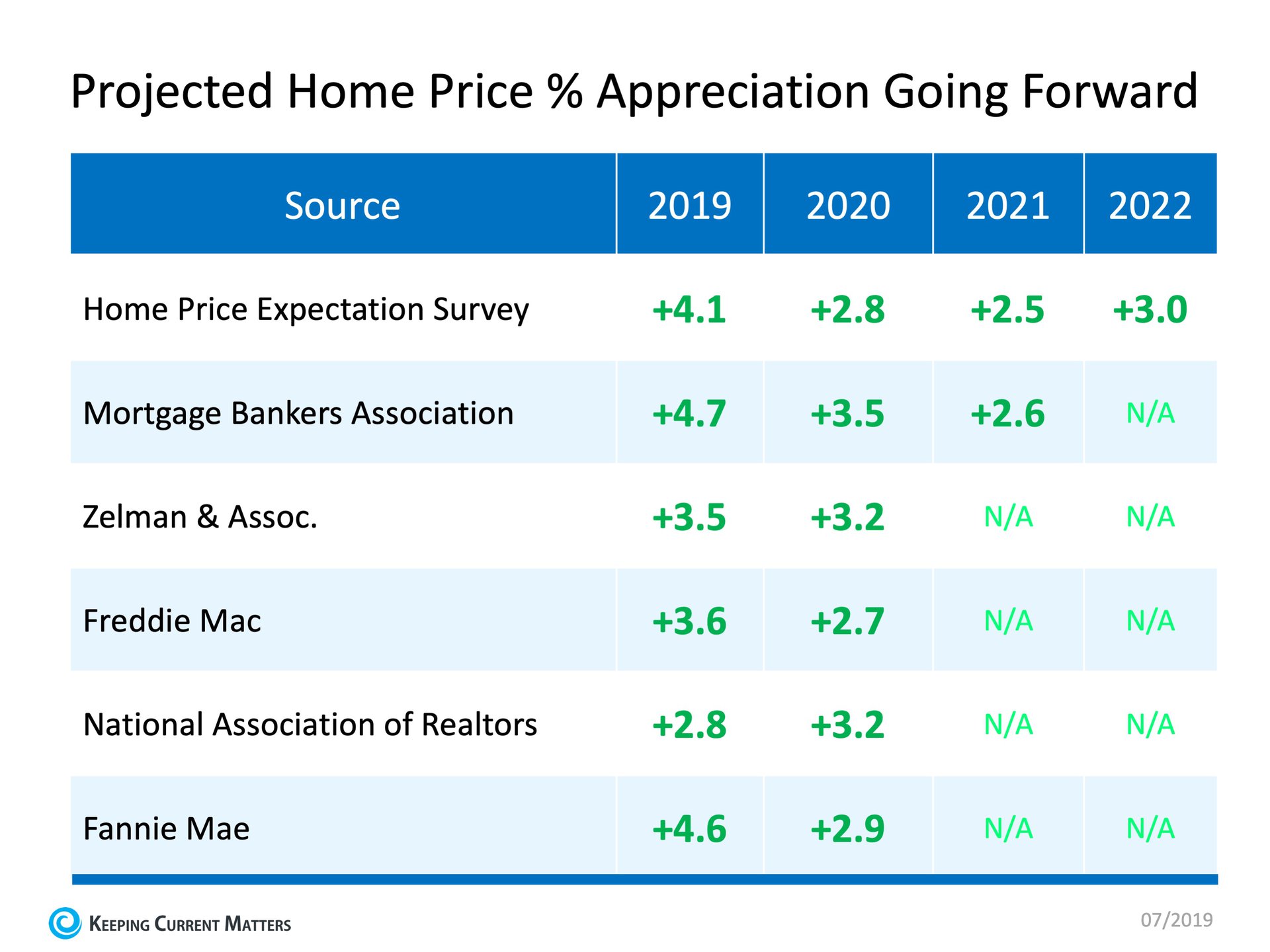

Home Price Appreciation Forecast

Questions continue to come up about where home prices will head throughout the rest of this year, as well as where they may be going over the few years beyond.

Questions continue to come up about where home prices will head throughout the rest of this year, as well as where they may be going over the few years beyond.

We’ve gathered current data from the industry’s most reliable sources to help answer these questions:

The Home Price Expectation Survey – A survey of over 100 market analysts, real estate experts, and economists conducted by Pulsenomics each quarter.

Mortgage Bankers Association (MBA) – As the leading advocate for the real estate finance industry, the MBA enables members to successfully deliver fair, sustainable, and responsible real estate financing within ever-changing business environments.

Zelman & Associates – The firm leverages unparalleled housing market expertise, extensive surveys of industry executives, and rigorous financial analysis to deliver proprietary research and advice to leading global institutional investors and senior-level company executives.

Freddie Mac – An organization whose mission is to provide liquidity, stability, and affordability to the U.S. housing market in all economic conditions extending to all communities from coast to coast.

The National Association of Realtors (NAR) – The largest association of real estate professionals in the world.

Fannie Mae – A leading source of financing for mortgage lenders, providing access to affordable mortgage financing in all markets.

Here’s the home price appreciation these experts are projecting over the next few years:

Bottom Line

Every source sees home prices continuing to appreciate, which is great news for the strength of the market. The increase is steepest throughout the rest of 2019, and prices should continue to rise as we move through 2020 and beyond.

Tuesday, August 27, 2019

Monday, August 26, 2019

There are many mortgage loans available that require as little as 3% down for first-time buyers, and some ask for only 3.5% down from repeat buyers. There are even loans available for Veterans that provide 0% down payment options too.

There are many mortgage loans available that require as little as 3% down for first-time buyers, and some ask for only 3.5% down from repeat buyers. There are even loans available for Veterans that provide 0% down payment options too.

We’ve mentioned recently that you don’t need to come up with a 20% down payment to buy, and we’ve also shared how quickly you can save for a 3% or 10% down payment, depending on where you live. If you’re planning to put down just 3%, the research shows it may be possible in most states to have enough saved for a down payment in less than a year. That puts homeownership in a much closer reach for many potential buyers, maybe even you!

2. How can I get help with my down payment?

Regardless of the loans available, many buyers still need assistance with a down payment. The great news is, there are a lot of ways to tap into down payment assistance options. Here are just a couple of them:

Assistance from Family Members

The National Association of Realtors (NAR) said, “a third of recent first-time buyers received down payment assistance from family members.” They also mentioned, “the average net worth of those aged 75 and over stands at $264,800…They just might offer the boost the next generation needs to become homeowners.”

That means one of the ways to find help with a down payment is to accept a gift from a family member. If this is an option for you, make sure you talk to your loan officer before you accept the money, to ensure you document the process the way it is required by your loan. This way, it will be received properly and you can still potentially qualify.

Down Payment Assistance Programs

The reality is, not everyone has a loved one or a family member who can provide help with a down payment. There are, however, more than 2,500 down payment assistance programs available (by local areas like city, county, or neighborhood), and some of them are even specifically for first-time buyers.

The gap, as mentioned in the same survey, is “only 23% of consumers are familiar with low down payment programs.”

That’s why it is so important to get familiar with these options by doing your homework before you plan to buy a home. Determine what is available in the area where you ultimately want to live, so you have all the details you need to take advantage of the down payment assistance option that is best for your family.

Bottom Line

If buying a home is one of your long-term goals, you may be able to get there sooner than you think by tapping into one of the many down payment assistance programs available.

Sunday, August 25, 2019

Saturday, August 24, 2019

Friday, August 23, 2019

![A Latte a Day Keeps Homeownership Away [INFOGRAPHIC] | Keeping Current Matters](https://blogger.googleusercontent.com/img/proxy/AVvXsEhNxEx92lmrL77jQDGjsyI8QxOxRvHQzOzbNNuWkc9a-J6_-Y39T9_cQ8AaF9zl15jzxiOSrVhrNMeKU9S-4MGG6F23WRaOLlVoDGB6VWDxjkRTGYVWCAt4oMVQa0YNgV3YXIZ6iij8kd16cNVNOFnlrLBvtSOfSFjiTyTonrlDvkX8qCf9OEx3KJoyHf-4w-E2cEqkvnQTYfvxtpzp9e8rt9I=s0-d-e1-ft)

Some Highlights:

- The pumpkin spice latte is launching soon, so you may be tempted to spend your extra cash on a daily caffeine fix, but that small expense can add up to a big number – fast!

- Saving for a down payment takes a little discipline, so limiting your extra purchases (like a latte a day from your favorite coffee shop) will help you get there faster.

- Depending on where you live, putting away just a small amount each day will get you to the average down payment you may need for homeownership faster than you think.

Tuesday, August 20, 2019

Monday, August 19, 2019

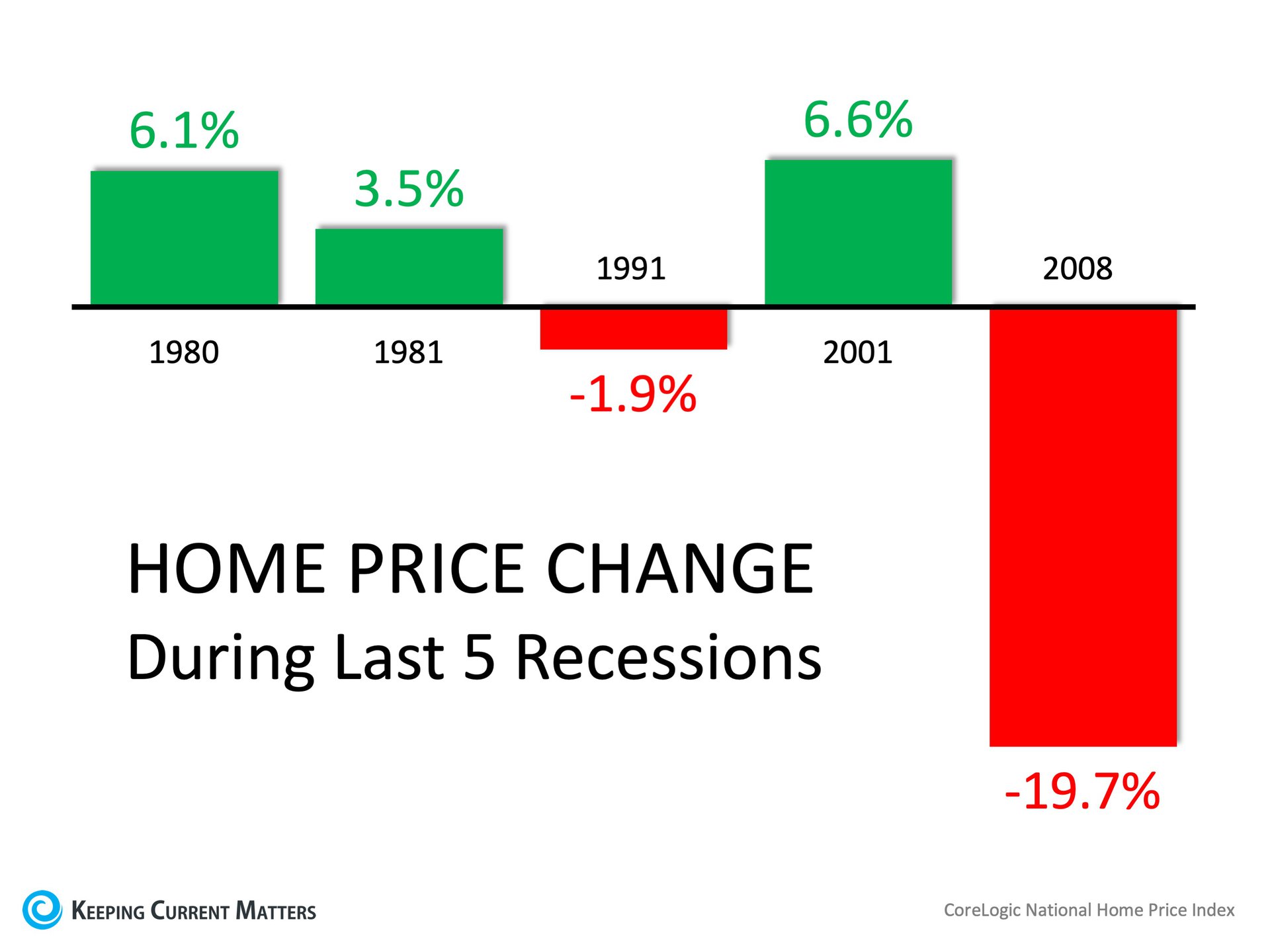

We’ve experienced economic growth for almost a decade, which is the longest recovery in the nation’s history. Experts know a recession can’t be too far off, but when will this economic slowdown actually occur?

We’ve experienced economic growth for almost a decade, which is the longest recovery in the nation’s history. Experts know a recession can’t be too far off, but when will this economic slowdown actually occur?

Pulsenomics just released a special report revealing that nearly 6 out of 10 of the 90 economists, investment strategists, and market analysts surveyed believe the next recession will occur by the end of next year. Here’s the breakdown:

- 9% believe a recession will occur this year

- 50% believe it will occur in 2020

- 35% believe it will occur in 2021

- 6% believe it will occur after 2021

When asked what would trigger the next recession, the three most common responses by those surveyed were:

- Trade Policy

- Stock Market Correction

- Geopolitical Crisis

How might the recession impact real estate?

Challenges in the housing and mortgage markets were major triggers of the last recession. However, a housing slowdown ranked #9 on the list of potential triggers for the next recession, behind such possibilities as fiscal policy and political gridlock.

As far as the impact the recession may have on home values, the experts surveyed indicated home prices would continue to appreciate over the next few years. They called for a 4.1% appreciation rate this year, 2.8% in 2020, and 2.5% in 2021.

Bottom Line

On the same day, in the same survey, the same experts who forecasted a recession happening within the next 18 months also claimed housing will not be the trigger, and home values will still continue to appreciate.

Sunday, August 18, 2019

Saturday, August 17, 2019

Thursday, August 15, 2019

Why Now Is the Perfect Time to Sell Your House

s a homeowner, it’s always tempting to dream about the next big project you’re going to tackle. The possibilities are endless. Should I renovate? Should I refinance? Should I stay? Should I move? The list goes on and on.

s a homeowner, it’s always tempting to dream about the next big project you’re going to tackle. The possibilities are endless. Should I renovate? Should I refinance? Should I stay? Should I move? The list goes on and on.

In today’s housing market, it’s actually a great time to shift your thoughts toward selling your house and moving up into the home of your dreams. Here’s why:

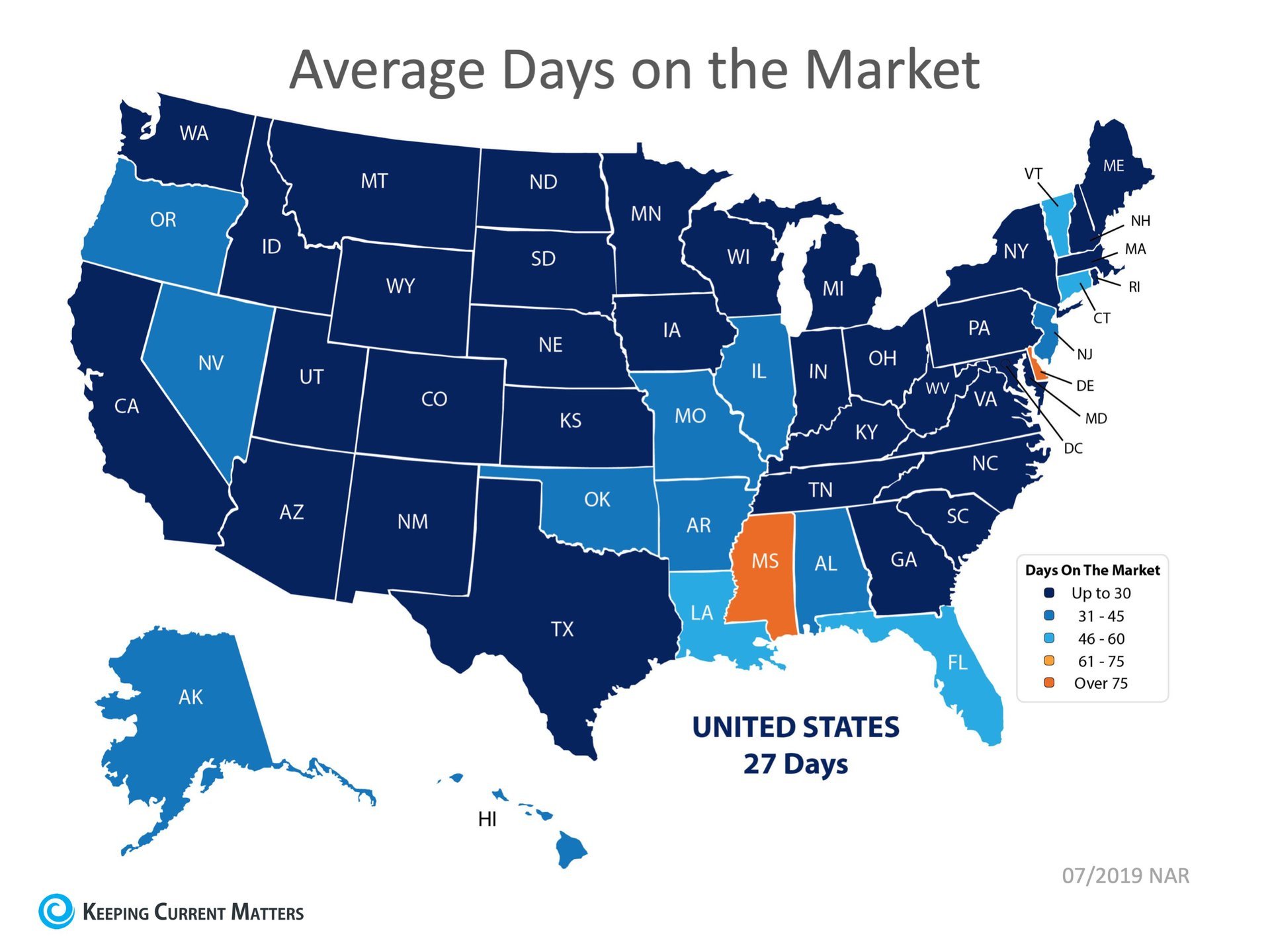

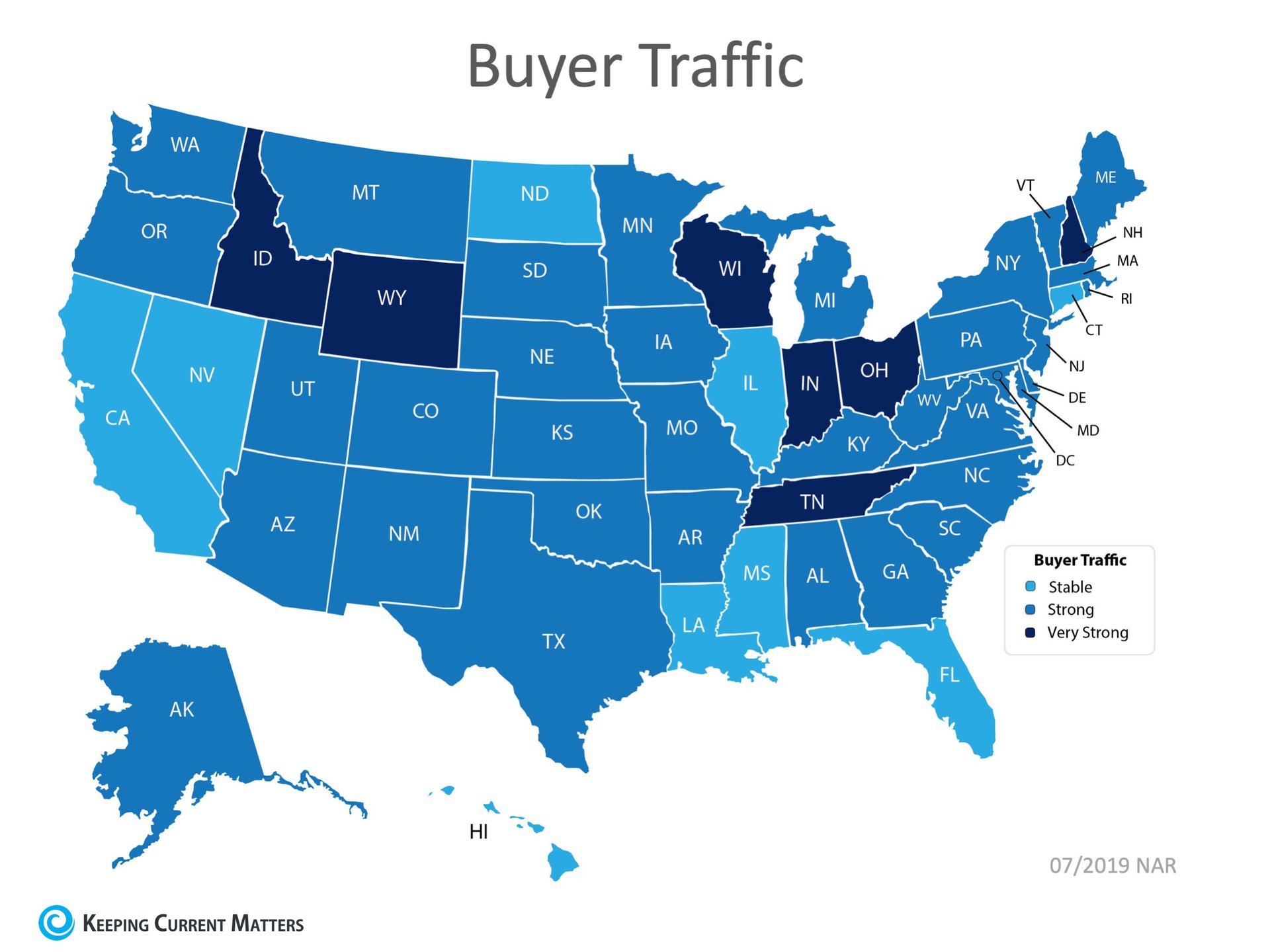

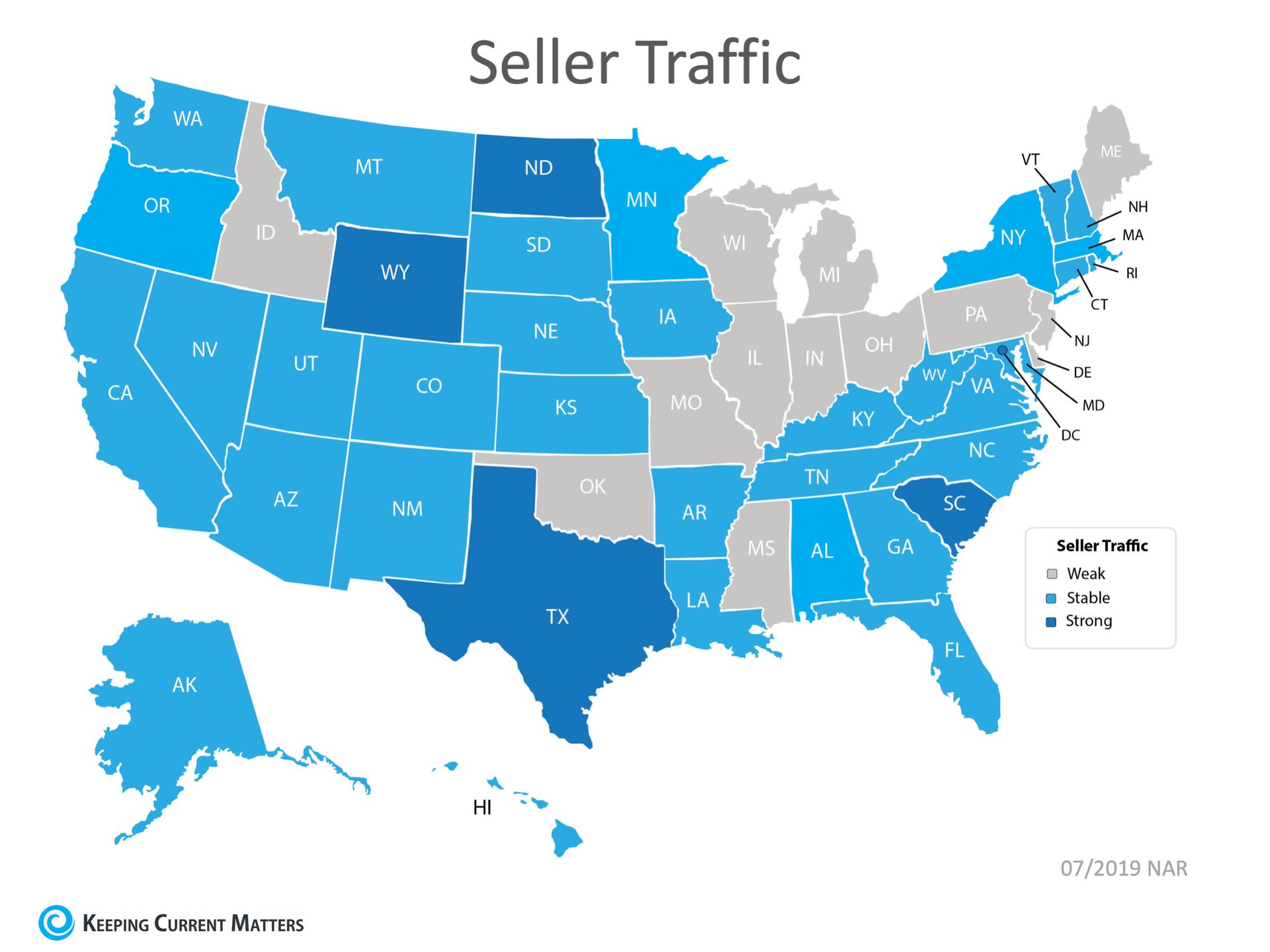

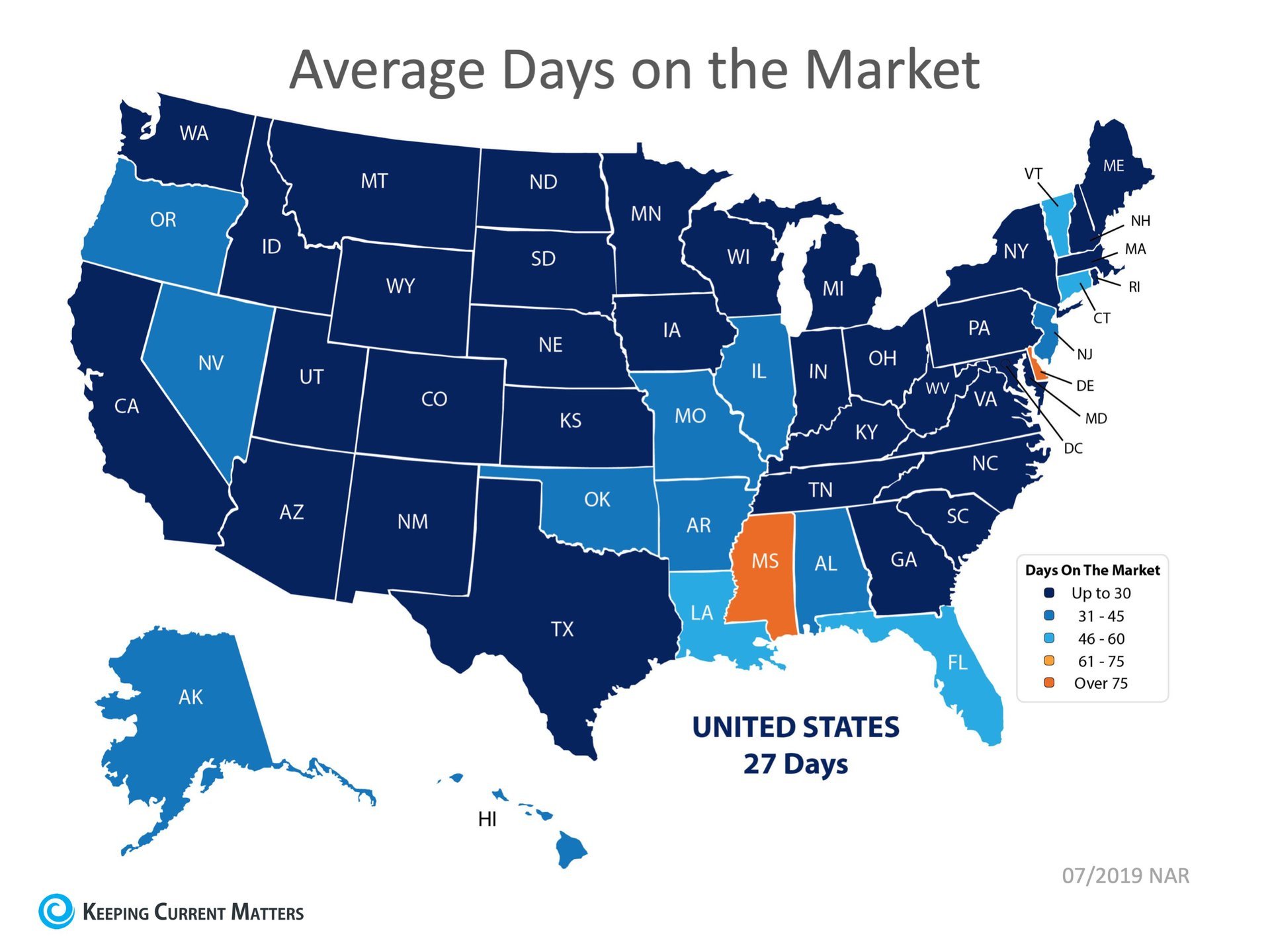

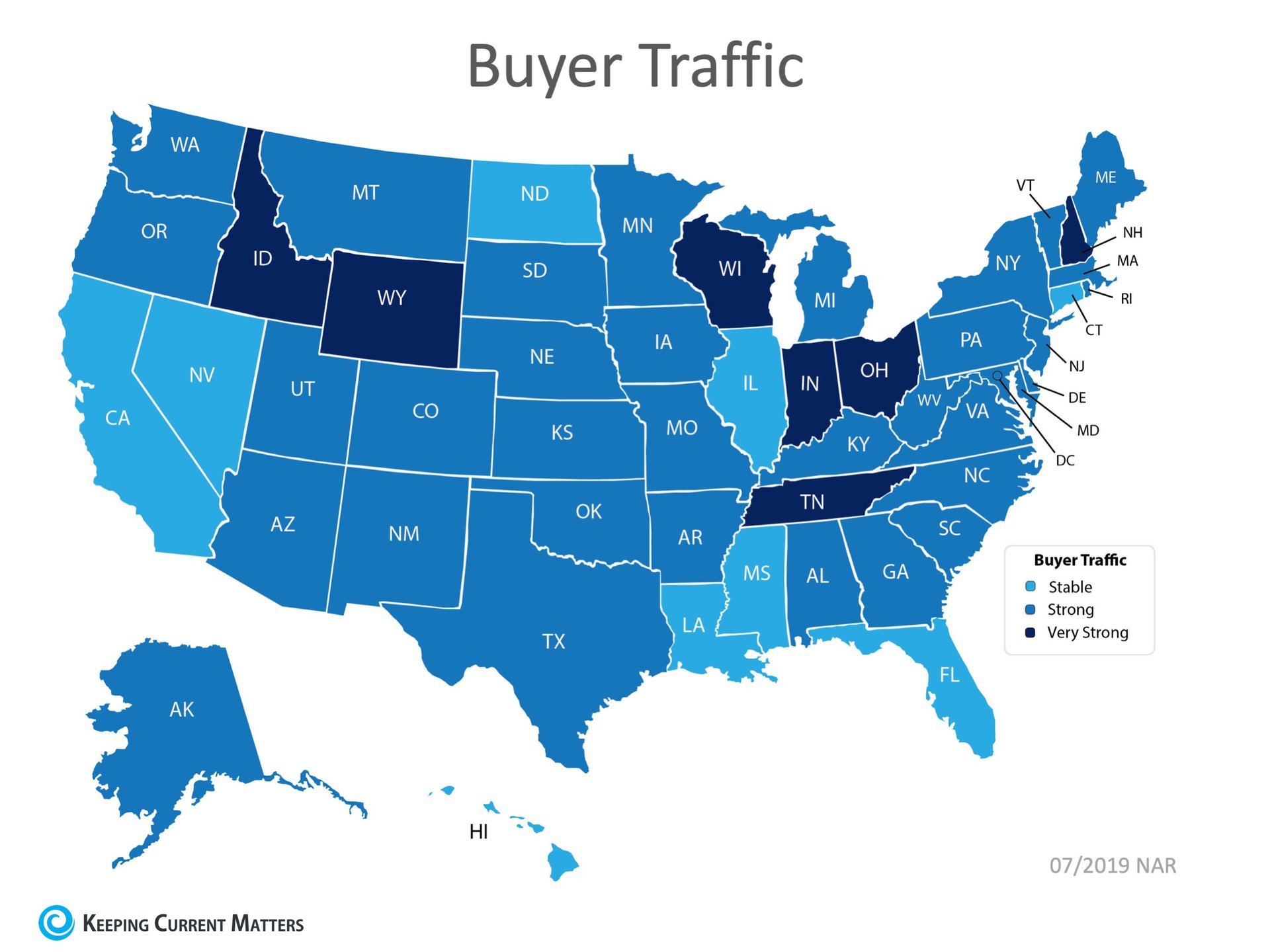

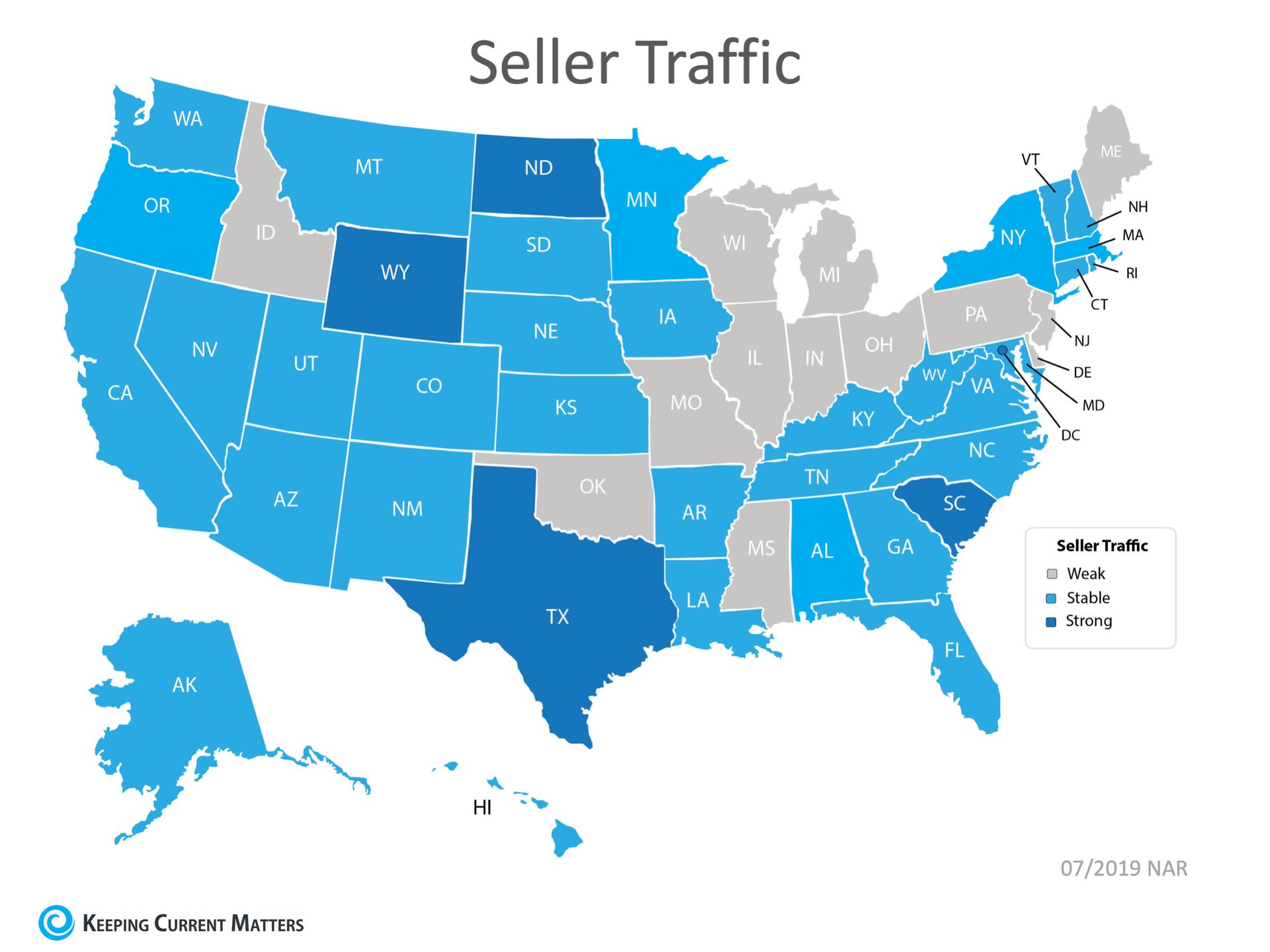

Inventory is on the rise, but there’s still an overall shortage of houses for sale (less than a 6-month supply found in a more normal market), so homes are going under contract quickly. In fact, the National Association of Realtors (NAR) Realtors® Confidence Index Survey reports that right now homes are only staying on the market for an average of 27 days. That’s less than one month, an even more accelerated pace from the 36-day trend we saw last spring. The same report also indicates there are more interested buyers than active sellers today, which is one of the big factors driving home prices higher.

The same report also indicates there are more interested buyers than active sellers today, which is one of the big factors driving home prices higher.

This power combination provides an ideal environment for sellers aiming to close a quick sale and earn a big return as we wrap up the summer season.

This power combination provides an ideal environment for sellers aiming to close a quick sale and earn a big return as we wrap up the summer season.

The same report also indicates there are more interested buyers than active sellers today, which is one of the big factors driving home prices higher.

The same report also indicates there are more interested buyers than active sellers today, which is one of the big factors driving home prices higher.

This power combination provides an ideal environment for sellers aiming to close a quick sale and earn a big return as we wrap up the summer season.

This power combination provides an ideal environment for sellers aiming to close a quick sale and earn a big return as we wrap up the summer season.Bottom Line

There’s still time to make a move before the school year starts and the fall weather sets in. Maybe it’s time to make a change. Reach out to a local real estate professional in your area to determine if selling now is the right decision for your family.

Wednesday, August 14, 2019

Monday, August 12, 2019

Shifting trends and industry-leading research are pointing toward some valuable projections about the status of the housing market for the rest of the year.

Shifting trends and industry-leading research are pointing toward some valuable projections about the status of the housing market for the rest of the year.

If you’re thinking of buying or selling, or if you just want to know what experts are saying is on the horizon, here are the top three things to put on your radar as we head into the coming months:

- Home prices are appreciating at a more normal rate: Home prices have been appreciating for about ten years now. Experts at the Home Price Expectation Survey, Mortgage Bankers Association, Freddie Mac, and Fannie Mae are forecasting continued growth throughout the next year, although it should be leveling-off to normal appreciation (3.6%), as we move into 2020.

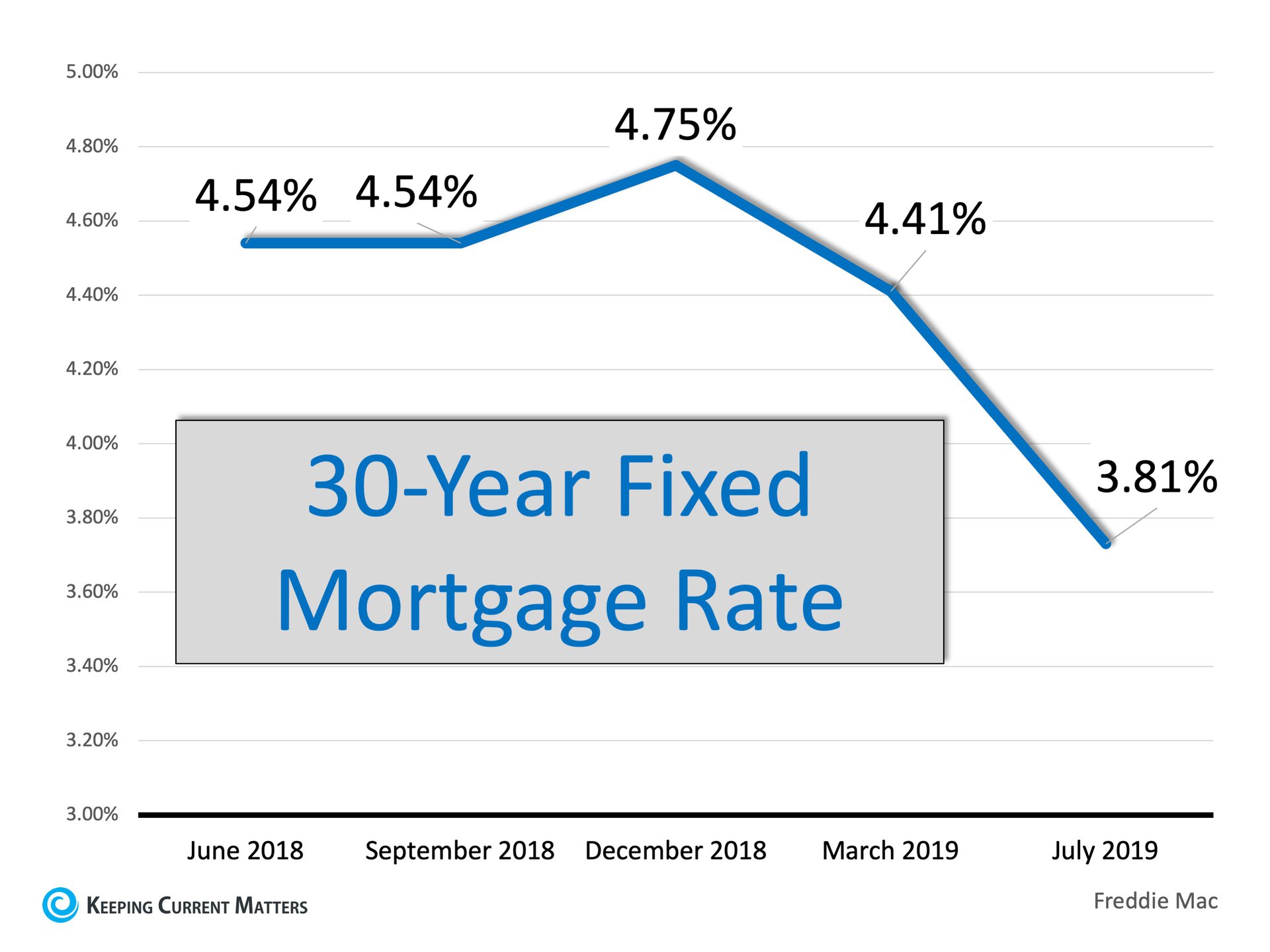

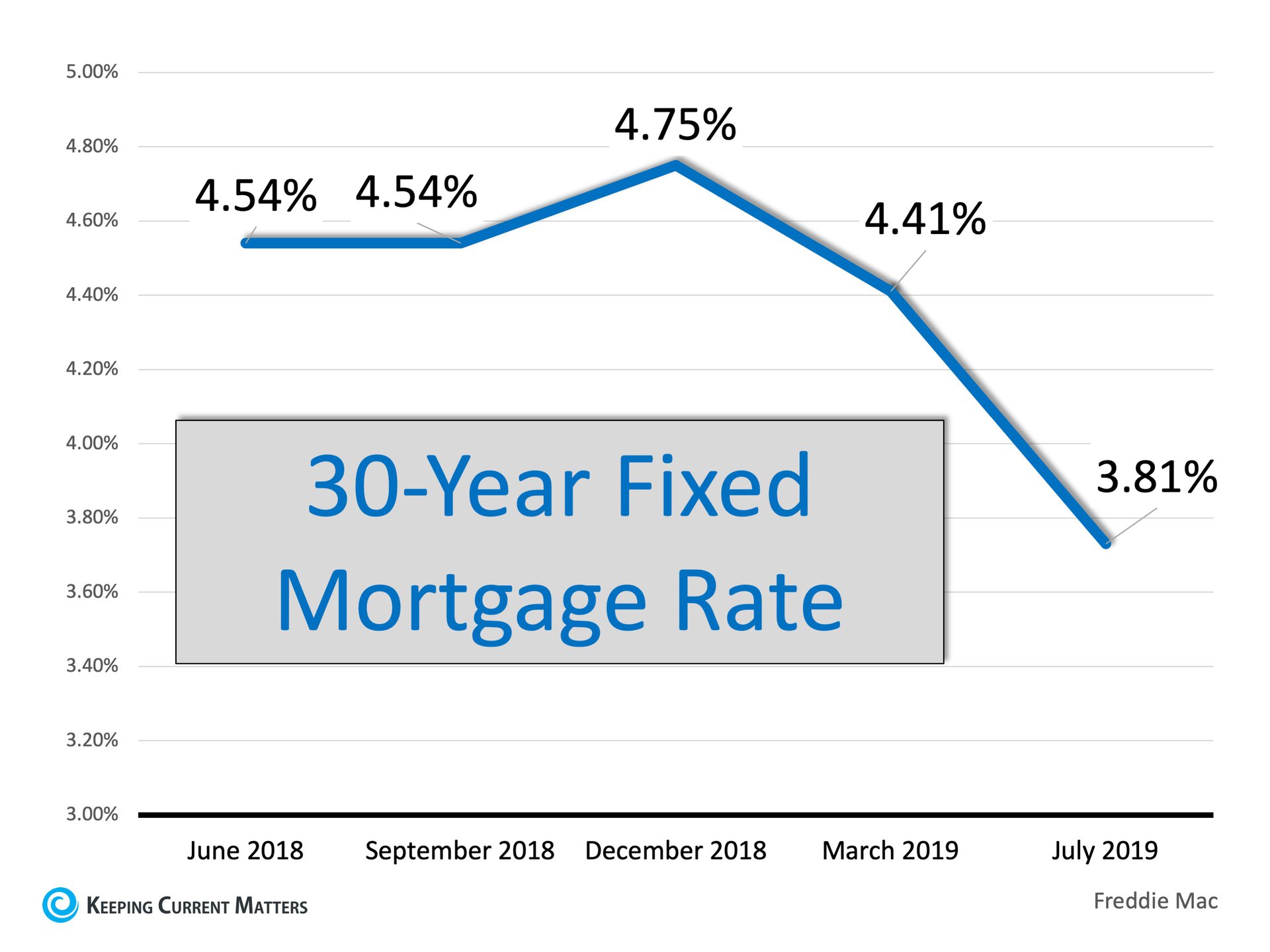

- Interest rates are low: Over the past 30 years, the average mortgage rate in the United States has been 8.27%, and rates even peaked as high as 18% in the 1980s. Today, at 3.81%, the rate is considerably lower than the historical 30-year average. Although experts predict it may climb into the low 4% range in the near future, that’s still remarkably lower than our running average, suggesting a great time to get more for your money over the life of your loan.

- An impending recession does not mean there will be a housing crash: Although expert research studies such as those found in the Duke Survey of American CFOs and the National Association of Business Economics, are pointing toward a recession beginning within the next 18 months, a potential recession isn’t expected to be driven by the housing industry. That means we likely won’t experience a devastating housing crash like the country felt in 2008. Expert financial analyst Morgan Housel tweeted:

“An interesting thing is the widespread assumption that the next recession will be as bad as 2008. Natural to think that way, but, statistically, highly unlikely. Could be over before you realized it began.”

Bottom Line

With prices appreciating and low interest rates available, it’s a perfect time to buy or sell a home. Reach out to a local real estate professional to see how you can take the next step in the exciting journey of homeownership.

Sunday, August 11, 2019

Saturday, August 10, 2019

Friday, August 9, 2019

Thursday, August 8, 2019

Wednesday, August 7, 2019

Tuesday, August 6, 2019

Monday, August 5, 2019

3 Powerful Reasons to Buy a Home Now

Whether you are a first-time buyer or looking to move up to the home of your dreams, now is a great time to purchase a home. Here are three major reasons to buy today.

Whether you are a first-time buyer or looking to move up to the home of your dreams, now is a great time to purchase a home. Here are three major reasons to buy today.1. Affordability

Many people focus solely on price when talking about home affordability. Since home prices have appreciated throughout the past year, they assume homes are less affordable. However, affordability is determined by three components:

- Price

- Wages

- Mortgage Interest Rate

Prices are up, but so are wages – and interest rates have recently dropped dramatically (see #2 below). As a result, the National Association of Realtors’ (NAR) latest Affordability Index report revealed that homes are MORE affordable throughout the country today than they were a year ago.

“All four regions saw an increase in affordability from a year ago. The South had the biggest gain in affordability of 6.9%, followed by the West with a gain of 6.0%. The Midwest had an increase of 5.8%, followed by the Northeast with the smallest gain of 1.8%.”

2. Mortgage Interest Rates

Mortgage rates have dropped almost a full point after heading toward 5% last fall and early winter. Currently, they are below 4%. Additionally, Fannie Mae recently predicted the average rate for a 30-year fixed mortgage will be 3.7% in the second half of 2019. That compares to a 4.4% average rate in the first quarter and 4% in the second quarter.

Additionally, Fannie Mae recently predicted the average rate for a 30-year fixed mortgage will be 3.7% in the second half of 2019. That compares to a 4.4% average rate in the first quarter and 4% in the second quarter.

Additionally, Fannie Mae recently predicted the average rate for a 30-year fixed mortgage will be 3.7% in the second half of 2019. That compares to a 4.4% average rate in the first quarter and 4% in the second quarter.

Additionally, Fannie Mae recently predicted the average rate for a 30-year fixed mortgage will be 3.7% in the second half of 2019. That compares to a 4.4% average rate in the first quarter and 4% in the second quarter.

With mortgage rates remaining near historic lows, Fannie Mae and others have increased their forecasts for housing appreciation for the rest of the year. If home price gains are about to re-accelerate, buying now rather than later makes financial sense.

3. Increase Family Wealth

Homeownership has always been recognized as a sensational way to build long-term family wealth. A new report by ATTOM Data Solutions reveals:

“U.S. homeowners who sold in the second quarter of 2019 realized an average home price gain since purchase of $67,500, up from an average gain of $57,706 in Q1 2019 and up from an average gain of $60,100 in Q2 2018. The average home seller gain of $67,500 in Q2 2019 represented an average 33.9 percent return as a percentage of original purchase price.”

The longer you delay purchasing a home, the longer you are waiting to put the power of home equity to work for you.

Bottom Line

With affordability increasing, mortgage rates decreasing, and home values about to re-accelerate, it may be time to talk with a local real estate professional to determine if buying now makes sense for your family.

Sunday, August 4, 2019

Friday, August 2, 2019

3 Expert Insights On Inventory In The Current Market

The current housing landscape presents greater home values, low interest rates, and high buyer demand. All of these factors point to the strong market forecasted to continue throughout the rest of the year.

There is, however, one thing that may cause the industry to tap the brakes: an overall lack of housing inventory. Buyer demand naturally increases during the summer months, but the current supply is not keeping up.

Here is a look at what a few industry experts have to say:

“Imbalance persists for mid-to-lower priced homes with solid demand and insufficient supply, which is consequently pushing up home prices.”

“Market conditions are ripe for increasing home sales with one glaring exception. The supply of homes for sale remains tight, keeping existing home sales below potential.”

“We’re not seeing as many new listings come up on the market…It was only 18 months ago that the number of homes for sale hit its lowest level in recorded history and sparked the fiercest competition among buyers we’ve ever seen.”

Bottom Line

If you’re thinking of selling, now may be the time. Demand for your house will be strong during a period when there is very little competition, ideally leading to a quick sale and a great return on your investment.

Subscribe to:

Comments (Atom)

![A Latte a Day Keeps Homeownership Away [INFOGRAPHIC] | Keeping Current Matters](https://files.keepingcurrentmatters.com/wp-content/uploads/2019/08/22152746/20190823-NM.jpg)