When you first put your house on the market, you might be hopeful for a quick sale—especially if you've put a lot of money into improving the house over the years and if the neighborhood is one that has historically attracted a lot of buyers. While you shouldn't panic if the house doesn't sell the moment you list it, you should begin to worry if the months start flying by without any real offers. If this is the case, here are 11 reasons why your house may not be selling.

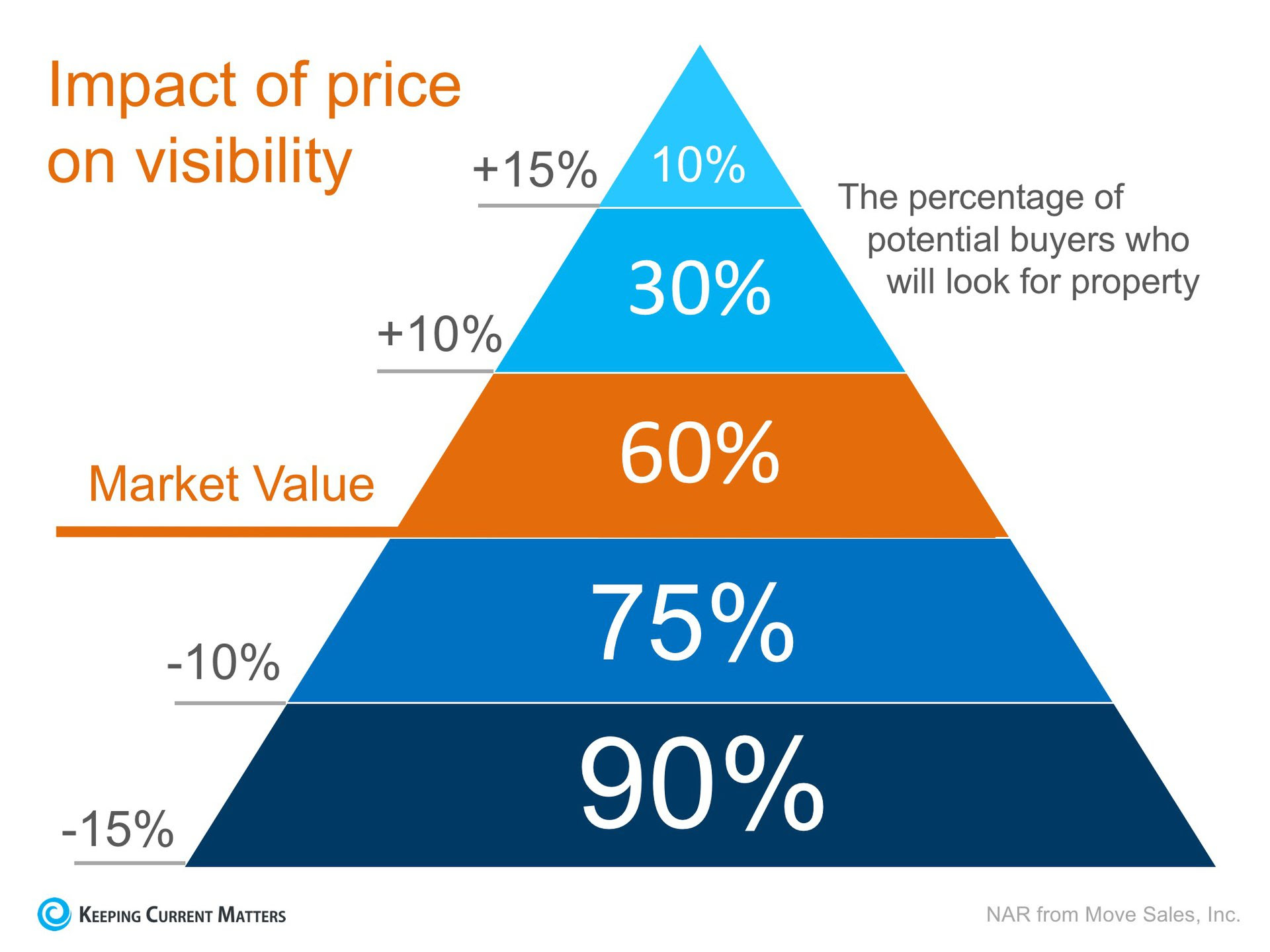

- You overvalued your property. If your house is overpriced, it's simply not going to sell. Compare your property to similar properties that recently sold within your area to get a better idea of its true value. An experienced real estate agent can give you an accurate value of your home. Additionally, don't make the mistake of tacking on the cost of any renovations you made. You can't just assume that the cost of a renovation translates to added value.

- Your listing is poor. If the listing of your home includes a poorly written description without any images, a lot of buyers are going to skip over it. Make sure you and your REALTOR® put an effort into creating a listing that attracts the attention of buyers. Make sure to add high quality photographs of both the interior and exterior of your home. Don't forget to highlight unique features as well.

- You're always present at showings. Let your agent handle your showings. Buyers don't want to have the seller lurking over their shoulder during showings, especially during an open house. This puts unwanted pressure on the buyer, which will make them uncomfortable and likely chase them away.

- You're too attached. If you refuse to negotiate even a penny off your price, then there's a good chance that you've become too attached to your home. If a part of you doesn't want to sell it, or you think your house is the best house in the world, odds are you're going to have a lot of difficulties coming to an agreement with a potential buyer.

- You haven't had your home professionally cleaned. A dirty house is going to leave a bad impression on buyers. Make sure you have a professional clean your carpeting and windows before you begin showing your house.

- You haven't staged your home. If you've already moved out, then don't show an empty house. This makes it difficult for buyers to imagine living in it. Stage your house with furniture and decor to give buyers a better idea of how big every room is and how it can be used. You want the buyer to feel at home when they are taking the tour.

- You kept up all of your personal décor. Buyers are going to feel uncomfortable touring your house if you keep all of your family portraits up. Take down your personal décor so that buyers can have an easier time imagining themselves living there.

- Your home improvements are too personalized. You might think that the comic book mural you painted for your child's room is absolutely incredible, but that doesn't mean potential buyers will agree. If your home improvements are too personalized, it can scare off buyers who don't want to pay for features they don't want.

- Your home is too cluttered. Even if your home is clean, clutter can still be an issue. For example, maybe you simply have too much furniture in one of your rooms. This can make the house feel smaller than it is.

- Your home is in need of too many repairs. The more repairs that are needed, the less likely a buyer will want your house. Many buyers simply don't want to deal with the cost or effort of doing repair work, even if it's just a bunch of small repairs, such as tightening a handrail or replacing a broken tile.

- You chose the wrong real agent. In my opinion, choosing the right real estate is simply the most important decision you make in selling your home. A good REALTOR® makes all the difference in selling your home within a reasonable time.

All these things can be fixed once you realize your mistake; however, the longer your property stays on the market, the less likely it will sell at listing price. One of the best ways to avoid making these common mistakes is by working with a professional real estate agent.

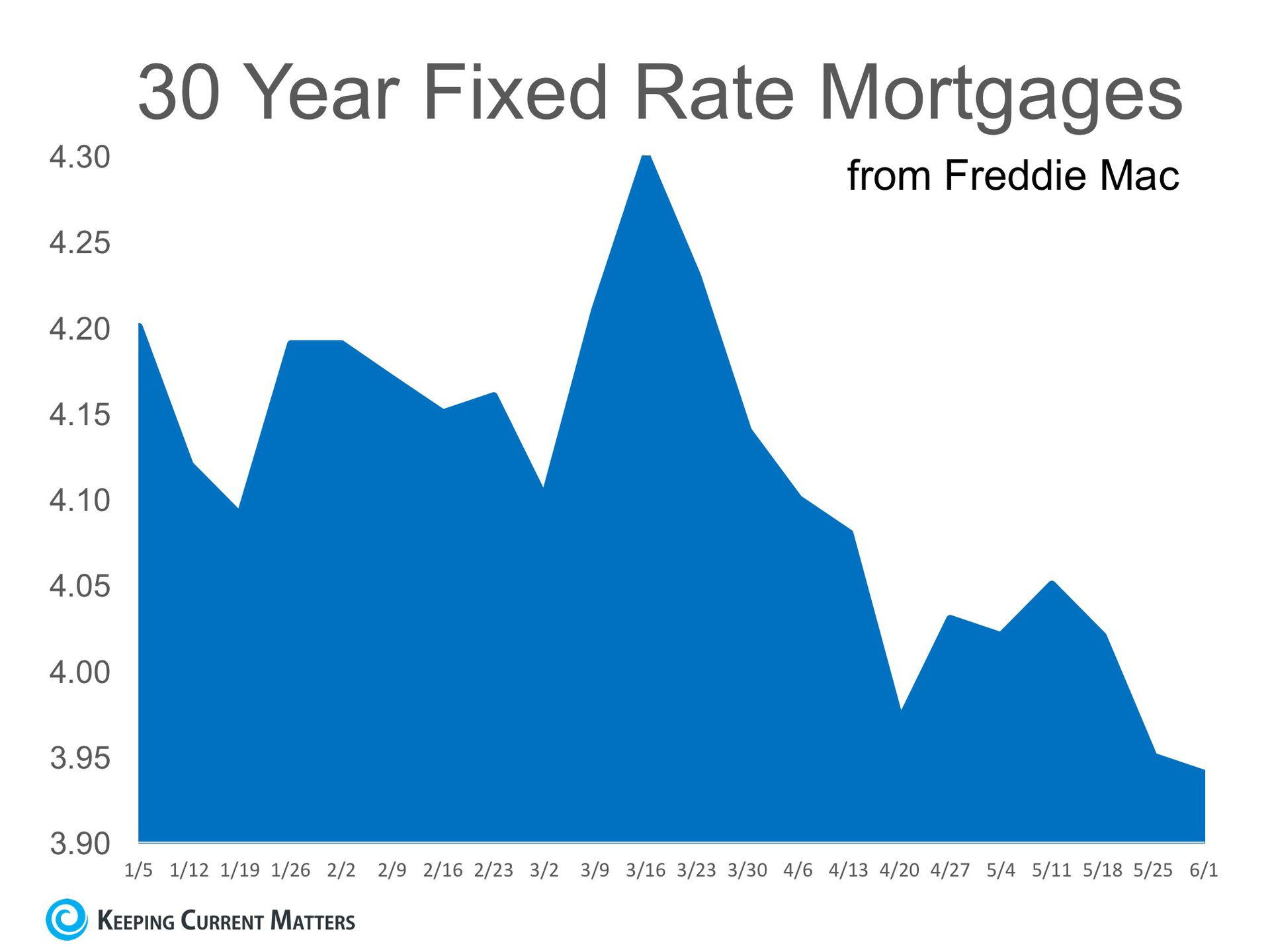

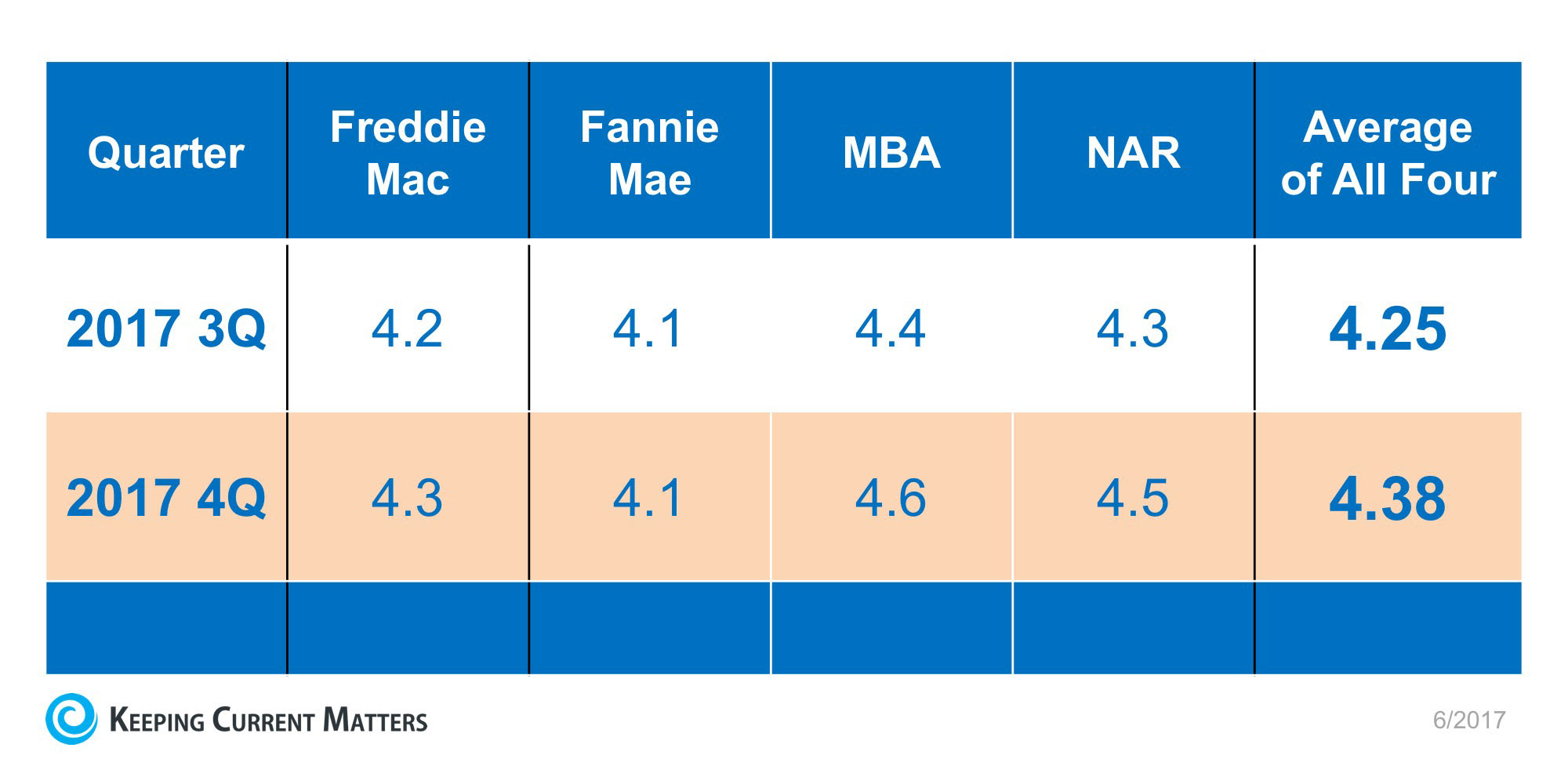

The results of the latest Rent vs. Buy Report from Trulia show that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States. The updated numbers actually show that the range is an average of 3.5% less expensive in San Jose (CA), all the way up to 50.1% less expensive in Baton Rouge (LA), and 33.1% nationwide! Other interesting findings in the report include:

The results of the latest Rent vs. Buy Report from Trulia show that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States. The updated numbers actually show that the range is an average of 3.5% less expensive in San Jose (CA), all the way up to 50.1% less expensive in Baton Rouge (LA), and 33.1% nationwide! Other interesting findings in the report include:

![Top Home Renovations for Maximum ROI [INFOGRAPHIC] | Keeping Current Matters](https://blogger.googleusercontent.com/img/proxy/AVvXsEhq_DlGAl9LvDuINlo_Tjwu_MH25te5qTDKT5-OBIfG8RFQDHiAOojuwHswfZySUyXgg60PUov0IG9JxYgPmVkqwM2ZSbhhimZ9cEDTKz1fikfpVQmo7fMPjaLwgB3UB5ZYkVf3c0Ihnn1FaZ8nipx0iobnNWSp4UBmzK7kt45wB0_iSO381LZrICLZ4ekZ1kTWVJWq-RWpNFd-qUuTTutd6m6EbA=s0-d-e1-ft)

![The Impact Your Interest Rate Makes [INFOGRAPHIC] | Keeping Current Matters](https://blogger.googleusercontent.com/img/proxy/AVvXsEhPWWg4UP3Xc_L6E9LwBodZ1MlCTASIwyiwdQXTPIIXrbsLrF6CDQ3ooRcT-3NidBWg8wCZfXsnNqmNA7iGac-DkYQZL3t4ZjIaNfu_aX4t7nNCCr9M2Dz4m7JxqFa1VGLor1dT8AvTPzbLjmGAMg-QWwbsGUbqOHg5q4MjNiYGnDyuQa8-qaLA19SskfZ_iSnSiVGV5iqbhJUSQP0M3G0HRXClEHYLdELX=s0-d-e1-ft)