It is common knowledge that a large number of homes sell during the spring-buying season. For that reason, many homeowners hold off on putting their homes on the market until then. The question is whether or not that will be a good strategy this year. The other listings that do come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the market in the spring, as compared to the rest of the year? The National Association of Realtors (NAR) recently revealed the months in which most people listed their homes for sale in 2016. Here is a graphic showing the results: It is common knowledge that a large number of homes sell during the spring-buying season. For that reason, many homeowners hold off on putting their homes on the market until then. The question is whether or not that will be a good strategy this year. The other listings that do come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the market in the spring, as compared to the rest of the year? The National Association of Realtors (NAR) recently revealed the months in which most people listed their homes for sale in 2016. Here is a graphic showing the results:  The three months in the second quarter of the year (represented in red) are consistently the most popular months for sellers to list their homes on the market. Last year, the number of homes available for sale in January was 1,820,000. The three months in the second quarter of the year (represented in red) are consistently the most popular months for sellers to list their homes on the market. Last year, the number of homes available for sale in January was 1,820,000.That number spiked to 2,140,000 by May!What does this mean to you?With the national job situation improving, and mortgage interest rates projected to rise later in the year, buyers are not waiting until the spring; they are out looking for a home right now. If you are looking to sell this year, waiting until the spring to list your home means you will have the greatest competition for a buyer.Bottom LineIt may make sense to beat the rush of housing inventory that will enter the market in the spring and list your home today. Agents: To discover proven ways to build an inventory of salable listings right now, join us today at 2PM EST for our free webinar, How to Become a Rainmaker for LISTING LEADS. There are a limited number of seats available, so make sure to save your spot! |

Monday, January 30, 2017

Thinking of Selling? Why Now is the Time

Thursday, January 26, 2017

Have You Saved Enough for Closing Costs?

There are many potential homebuyers, and even sellers, who believe that they need at least a 20% down payment in order to buy a home or move on to their next home. Time after time, we have dispelled this myth by showing that many loan programs allow you to put down as little as 3% (or 0% with a VA loan). If you have saved up your down payment and are ready to start your home search, one other piece of the puzzle is to make sure that you have saved enough for your closing costs. Freddie Mac defines closing costs as: There are many potential homebuyers, and even sellers, who believe that they need at least a 20% down payment in order to buy a home or move on to their next home. Time after time, we have dispelled this myth by showing that many loan programs allow you to put down as little as 3% (or 0% with a VA loan). If you have saved up your down payment and are ready to start your home search, one other piece of the puzzle is to make sure that you have saved enough for your closing costs. Freddie Mac defines closing costs as:“Closing costs, also called settlement fees, will need to be paid when you obtain a mortgage. These are fees charged by people representing your purchase, including your lender, real estate agent, and other third parties involved in the transaction. Closing costs are typically between 2 and 5% of your purchase price.”We’ve recently heard from many first-time homebuyers that they wished that someone had let them know that closing costs could be so high. If you think about it, with a low down payment program, your closing costs could equal the amount that you saved for your down payment. Here is a list of just some of the fees/costs that may be included in your closing costs, depending on where the home you wish to purchase is located:

Is there any way to avoid paying closing costs?Work with your lender and real estate agent to see if there are any ways to decrease or defer your closing costs. There are no-closing mortgages available, but they end up costing you more in the end with a higher interest rate, or by wrapping the closing costs into the total cost of the mortgage (meaning you’ll end up paying interest on your closing costs). Home buyers can also negotiate with the seller over who pays these fees. Sometimes the seller will agree to assume the buyer’s closing fees to get the deal finalized, which is known in the industry as ‘seller’s concession.’Bottom LineSpeak with your lender and agent early and often to determine how much you’ll be responsible for at closing. Finding out you’ll need to come up with thousands of dollars right before closing is not a surprise anyone is ever looking forward to. |

Wednesday, January 25, 2017

Monday, January 23, 2017

If Your Home Hasn't Sold Yet... Check the Price!

The residential housing market has been hot. Home sales have bounced back solidly and are now at their second highest pace since February 2007. Demand has remained strong throughout the winter as many real estate professionals are reporting bidding wars with many homes selling above listing price. What about your house?

The residential housing market has been hot. Home sales have bounced back solidly and are now at their second highest pace since February 2007. Demand has remained strong throughout the winter as many real estate professionals are reporting bidding wars with many homes selling above listing price. What about your house?If your house hasn't sold, it is probably because of the price.

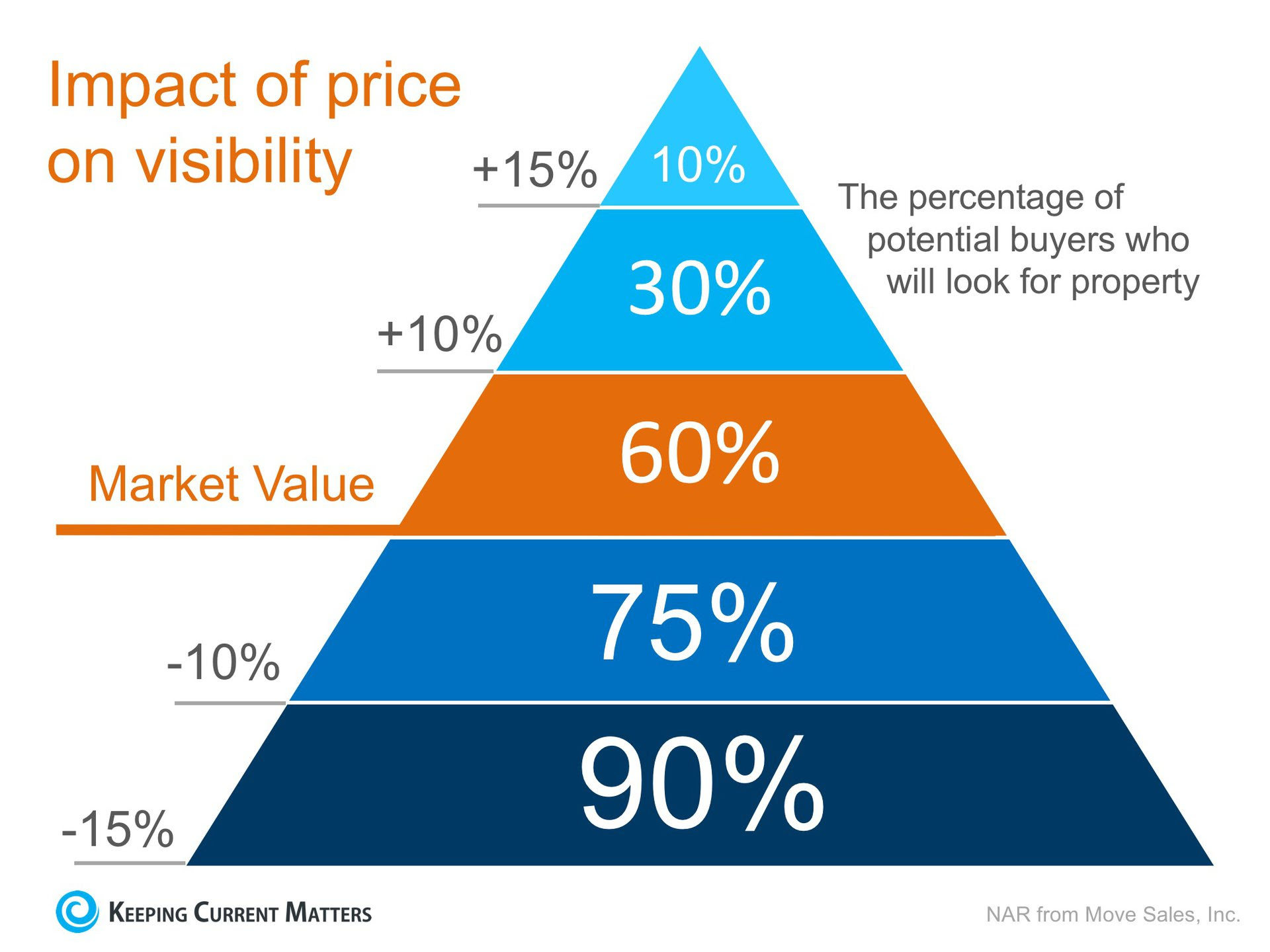

If your home is on the market and you are not receiving any offers, look at your price. Pricing your home just 10% above market value dramatically cuts the number of prospective buyers that will even see your house. See chart below.

Bottom Line

The housing market is hot. If you are not seeing the results you want, sit down with your agent and revisit the pricing conversation.Friday, January 20, 2017

3 Tips for Making Your Dream of Buying a Home Come True [INFOGRAPHIC]

![3 Tips for Making Your Dream of Buying a Home Come True [INFOGRAPHIC] | Keeping Current Matters](https://blogger.googleusercontent.com/img/proxy/AVvXsEhYprg9b4OhaX1mm4SnUkobSlslndjLCrygaeGOmxPR6paOogp7ggYHDVYI4g3dsRNEXtsAQ_keduJatGnVE2lHLKiiQCB8GkFcJU7ttZy1fsxCmCCDUSQe8XhwQwnDtWeyU40UBh2LRGFCZlV6qiMbFYckE1nG7uprsZcdk5qJJaPRamP137erRfQzSgWS=s0-d-e1-ft) Some Highlights:

|

Wednesday, January 18, 2017

Is This the Year to Move Up to Your Dream Home? If So, Do it Early

It appears that Americans are regaining faith in the U.S. economy. The following indexes have each shown a dramatic jump in consumer confidence in their latest surveys: It appears that Americans are regaining faith in the U.S. economy. The following indexes have each shown a dramatic jump in consumer confidence in their latest surveys:

HSH.com:"We think that conforming 30-year fixed rates probably make it into the 4.625 percent to 4.75 percent range at some point during 2017 as a peak." Svenja Gudell, Zillow's Chief Economist:"I wouldn't be surprised if the 30-year fixed mortgage rate hits 4.75 percent." Mark Fleming, the Chief Economist at First American:"[I see] mortgage rates getting much closer to 5 percent at the end of next year." Lawrence Yun, NAR Chief Economist:"By this time next year, expect the 30-year fixed rate to likely be in the 4.5 percent to 5 percent range." Bottom LineIf you are feeling good about your family's economic future and are considering making a move to your dream home, doing it sooner rather than later makes the most sense. |

Monday, January 16, 2017

Top 3 Things Second-Wave Baby Boomers Look for in a Home

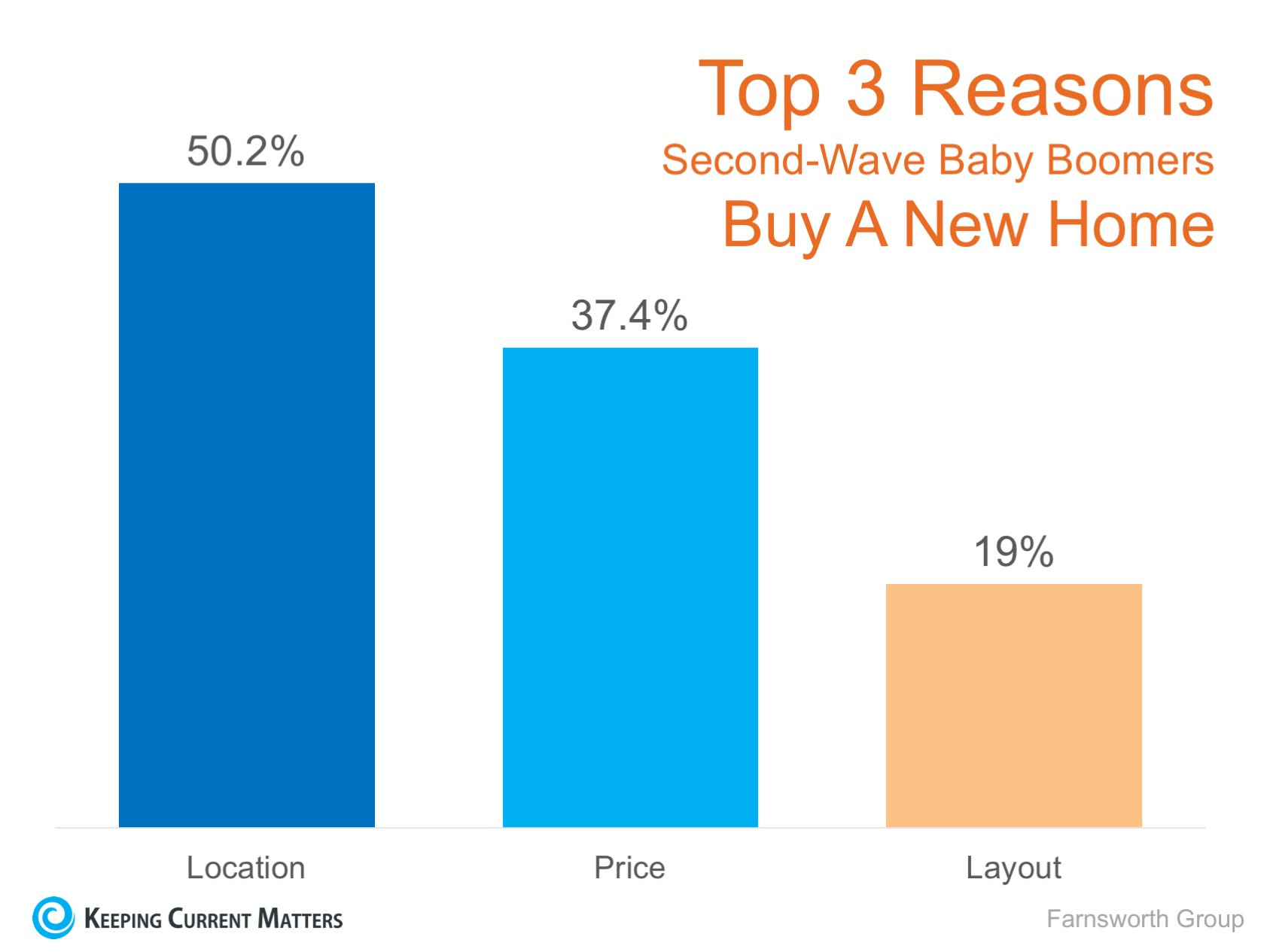

According to data from the U.S Census bureau, there are approximately 76.4 million baby boomers living in the United States today. Contrary to what many think, there are very different segments within this generation, and one piece that sets them apart are their housing needs. John McManus, editorial director of Hanley Wood's Residential Group says his company "is focusing on the preferences of the younger half, or second-wave baby boomers, as they exhibit different needs than the older boomers." According to data from the U.S Census bureau, there are approximately 76.4 million baby boomers living in the United States today. Contrary to what many think, there are very different segments within this generation, and one piece that sets them apart are their housing needs. John McManus, editorial director of Hanley Wood's Residential Group says his company "is focusing on the preferences of the younger half, or second-wave baby boomers, as they exhibit different needs than the older boomers."What are 'second-wave baby boomers' looking for?McManus says, "They are seeking a fun, dynamic lifestyle with a home that can also adjust to their changing needs in the future. Living space should either include accessibility features, such as doorway space, lower shelves, and nonslip surfaces, or be easily adjustable when the time comes." In a homebuyer study performed by The Farnsworth Group, the participants revealed their reasons for purchasing a new home. The top three factors that influence their purchase include area/location (50.2%), price/affordability (37.4%), and the layout of the home (19%) (as shown in the graph below). The report also found that when buying a new home, there were other concerns like quality of construction (9%), a safer neighborhood (8.4%), better floor plans (8.25%). The most important rooms or areas are the kitchen (82.8%), master bedroom (59.2%), and great room (36%). Technology also plays an important role! Second-wave baby boomers prefer wireless security systems (7.1%), lighting that senses and adapts to them (6.3%) and integrated home technology, including "smart" thermostats and lighting controlled by a smartphone (6.2%). Grey Matter Research and Consulting points to a sense of community as a major factor in wanting to purchase: The report also found that when buying a new home, there were other concerns like quality of construction (9%), a safer neighborhood (8.4%), better floor plans (8.25%). The most important rooms or areas are the kitchen (82.8%), master bedroom (59.2%), and great room (36%). Technology also plays an important role! Second-wave baby boomers prefer wireless security systems (7.1%), lighting that senses and adapts to them (6.3%) and integrated home technology, including "smart" thermostats and lighting controlled by a smartphone (6.2%). Grey Matter Research and Consulting points to a sense of community as a major factor in wanting to purchase:"The first impressions are important when entering a new community, as is feeling welcome in the community. Amenities such as clubhouses, pools, and walking trails featured prominently in the decision to purchase in a community. Location was key, as residents want their new homes to be near shopping, dining, medical services and entertainment." Bottom LineIf you are one of the many 'second-wave' baby boomers who is starting to feel like their current homes no longer fits their needs, take advantage of the low inventory of existing homes in today's market by selling your current home and moving on to one that truly fits your new lifestyle. |

Saturday, January 14, 2017

You Need a Professional on Your Team When Buying a Home

Many people wonder whether they should hire a real estate professional to assist them in buying their dream home or if they should first try to do it on their own. In today's market: you need an experienced professional!

Many people wonder whether they should hire a real estate professional to assist them in buying their dream home or if they should first try to do it on their own. In today's market: you need an experienced professional!You Need an Expert Guide if You Are Traveling a Dangerous Path

The field of real estate is loaded with land mines; you need a true expert to guide you through the dangerous pitfalls that currently exist. Finding a home that is priced appropriately and is ready for you to move into can be tricky. An agent listens to your wants and needs, and can sift through the homes that do not fit within the parameters of your "dream home." A great agent will also have relationships with mortgage professionals and other experts that you will need in securing your dream home.You Need a Skilled Negotiator

In today's market, hiring a talented negotiator could save you thousands, perhaps tens of thousands of dollars. Each step of the way - from the original offer to the possible renegotiation of that offer after a home inspection, to the possible cancellation of the deal based on a troubled appraisal - you need someone who can keep the deal together until it closes. Realize that when an agent is negotiating their commission with you, they are negotiating their own salary; the salary that keeps a roof over their family's head; the salary that puts food on their family's table. If they are quick to take less when negotiating for themselves and their families, what makes you think they will not act the same way when negotiating for you and your family? If they were Clark Kent when negotiating with you, they will not turn into Superman when negotiating with the buyer or seller in your deal.Bottom Line

Famous sayings become famous because they are true. You get what you pay for. Just like a good accountant or a good attorney, a good agent will save you money...not cost you money.Friday, January 13, 2017

Wednesday, January 11, 2017

Year-Over-Year Price Appreciation Reaches Double Digits in 5 Price Categories

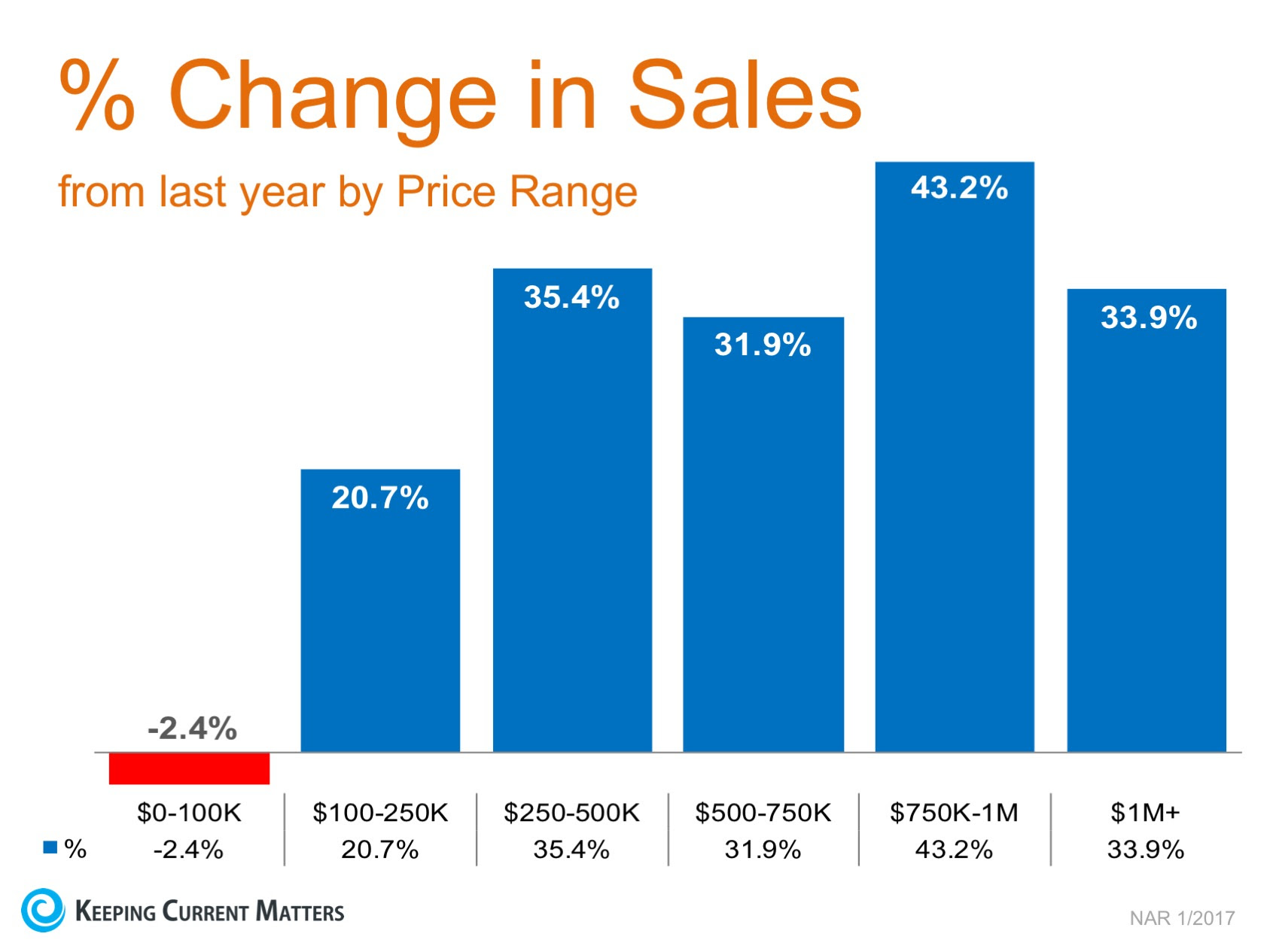

The National Association of Realtors' most recent Existing Home Sales Report revealed that, compared to last year, home sales are up dramatically in five of the six price ranges they measure. Homes priced between $100-250K showed a 20.7% increase year-over-year. This is an impressive increase, showing that November was an excellent month for home sales in this price range. But surprisingly, the 20.7% increase in sales in this range was not the highest percent change achieved, as sales of homes over $250,000 increased by double-digit percentages with sales in the $750,000- $1 million range showing the largest increase, up 43.2%! As prices in many markets continue to accelerate, it is no surprise to see the percentage of homes in the higher price ranges increasing.

The National Association of Realtors' most recent Existing Home Sales Report revealed that, compared to last year, home sales are up dramatically in five of the six price ranges they measure. Homes priced between $100-250K showed a 20.7% increase year-over-year. This is an impressive increase, showing that November was an excellent month for home sales in this price range. But surprisingly, the 20.7% increase in sales in this range was not the highest percent change achieved, as sales of homes over $250,000 increased by double-digit percentages with sales in the $750,000- $1 million range showing the largest increase, up 43.2%! As prices in many markets continue to accelerate, it is no surprise to see the percentage of homes in the higher price ranges increasing.Here is the breakdown:

Homes under $100,000 were the only group to show negative appreciation of sales at -2.4%. This not only points to the lower inventory of homes available for sale in this price range but also speaks to the overall strength of the housing market.

Homes under $100,000 were the only group to show negative appreciation of sales at -2.4%. This not only points to the lower inventory of homes available for sale in this price range but also speaks to the overall strength of the housing market.What does that mean to you if you are selling?

Houses are definitely selling. If your house has been on the market for any length of time and has not yet sold, perhaps it is time to sit down with your agent to see if it is priced appropriately to compete in today's market.Monday, January 9, 2017

Homeowner's Net Worth Is 45x Greater Than A Renter's

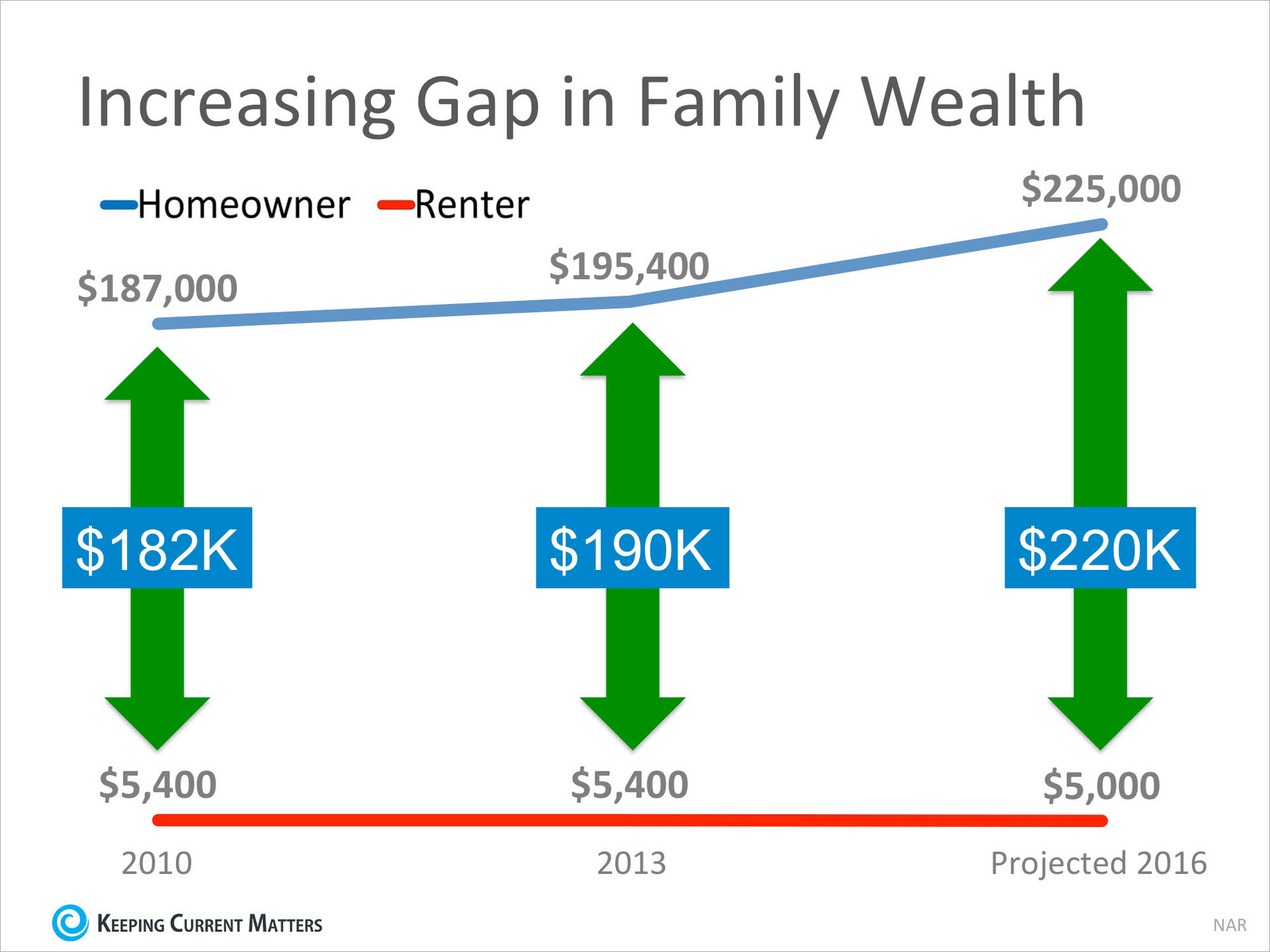

Every three years, the Federal Reserve conducts a Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey, which includes data from 2010-2013, reports that a homeowner's net worth is 36 times greater than that of a renter ($194,500 vs. $5,400). In a Forbes article, the National Association of Realtors' (NAR) Chief Economist Lawrence Yun predicts that by the end of 2016, the net worth gap will widen even further to 45 times greater. The graph below demonstrates the results of the last two Federal Reserve studies and Yun's prediction:

Every three years, the Federal Reserve conducts a Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey, which includes data from 2010-2013, reports that a homeowner's net worth is 36 times greater than that of a renter ($194,500 vs. $5,400). In a Forbes article, the National Association of Realtors' (NAR) Chief Economist Lawrence Yun predicts that by the end of 2016, the net worth gap will widen even further to 45 times greater. The graph below demonstrates the results of the last two Federal Reserve studies and Yun's prediction:

Put Your Housing Cost to Work for You

As we've said before, simply put, homeownership is a form of 'forced savings.' Every time you pay your mortgage, you are contributing to your net worth. Every time you pay your rent, you are contributing to your landlord's net worth. The latest National Housing Pulse Survey from NAR reveals that 85% of consumers believe that purchasing a home is a good financial decision. Yun comments: "Though there will always be discussion about whether to buy or rent, or whether the stock market offers a bigger return than real estate, the reality is that homeowners steadily build wealth. The simplest math shouldn't be overlooked."Bottom Line

If you are interested in finding out if you could put your housing cost to work for you by purchasing a home, meet with a real estate professional in your area who can guide you through the process.Saturday, January 7, 2017

Inadequate Inventory Driving Prices Up

The latest Existing Home Sales Report from the National Association of Realtors (NAR) revealed a direct correlation between a lack of inventory and rising prices. We are all familiar with the concept of supply and demand. As the demand for an item increases the supply of that same item goes down, driving prices up. Year-over-year inventory levels have dropped each of the last 18 months, as inventory now stands at a 4.0-month supply, well below the 6.0-month supply needed for a 'normal' market. The median price of homes sold in November (the latest data available) was $234,900, up 6.8% from last year and marking the 57th consecutive month with year-over-year gains. NAR's Chief Economist, Lawrence Yun had this to say:

"Existing housing supply at the beginning of the year was inadequate and is now even worse heading into 2017. Rental units are also seeing this shortage. As a result, both home prices and rents continue to far outstrip incomes in much of the country."But there is good news about rising prices. More and more homeowners are recovering from a negative equity situation and learning that they are able to sell their homes and either move up to their dream home or downsize to a property that will better suit their needs. Look for these homes to come to market soon.

Bottom Line

Buyer demand continues to outpace the supply of homes for sale. Listing your home in the winter attracts serious buyers who are looking to close the transaction quickly.Thursday, January 5, 2017

You Need an Agent Who Will Put You First

When it comes to buying a home, whether you are a rookie homebuyer or have gone through the process many times, having a local real estate expert who is well versed in the neighborhood you are looking to move into, as well as the trends of that area, should be your goal. One great example of an agent who is in your corner and is always looking out for your best interests is one of the main characters on ABC's Modern Family, Phil Dunphy. For those who aren't familiar, the character Phil is a Realtor with a huge heart who always strives to do his best for his family and his clients. In one recent episode, Phil even shared the oath that he created and holds himself accountable to:

When it comes to buying a home, whether you are a rookie homebuyer or have gone through the process many times, having a local real estate expert who is well versed in the neighborhood you are looking to move into, as well as the trends of that area, should be your goal. One great example of an agent who is in your corner and is always looking out for your best interests is one of the main characters on ABC's Modern Family, Phil Dunphy. For those who aren't familiar, the character Phil is a Realtor with a huge heart who always strives to do his best for his family and his clients. In one recent episode, Phil even shared the oath that he created and holds himself accountable to:"On my honor, I promise to aid in man's quest for shelter, to recognize I'm not just in the business of houses -- I'm in the business of dreams in the shape of houses. To disclose all illegal additions, shoddy construction, murders, and ghosts. And to put my clients' needs before my own."While this might seem silly, and it was definitely written with humor in mind, the themes of helping someone achieve the American Dream and putting a client's needs above your own are not to be taken lightly.

Bottom Line

When you make the decision to enter the housing market, as either a buyer or a seller, make sure you look for an agent who exemplifies these values and will help you through every step of the process.

Subscribe to:

Comments (Atom)