So you made an offer, it was accepted, and now your next task is to have the home inspected prior to closing. More often than not, your agent may have made your offer contingent on a clean home inspection. This contingency allows you to renegotiate the price paid for the home, ask the sellers to cover repairs, or even, in some cases, walk away. Your agent can advise you on the best course of action once the report is filed. So you made an offer, it was accepted, and now your next task is to have the home inspected prior to closing. More often than not, your agent may have made your offer contingent on a clean home inspection. This contingency allows you to renegotiate the price paid for the home, ask the sellers to cover repairs, or even, in some cases, walk away. Your agent can advise you on the best course of action once the report is filed.How to Choose an InspectorYour agent will most likely have a short list of inspectors that they have worked with in the past that they can recommend to you. Realtor.com suggests that you consider the following 5 areas when choosing the right home inspector for you:

Bottom LineThey say 'ignorance is bliss,' but not when investing your hard-earned money in a home of your own. Work with a professional you can trust to give you the most information possible about your new home so that you can make the most educated decision about your purchase |

Saturday, October 29, 2016

What to Expect When Home Inspecting

Thursday, October 27, 2016

Starting to Look for a Home? Know What You WANT vs. What You NEED

In this day and age of being able to shop for anything anywhere, it is really important to know what you're looking for when you start your home search. If you've been thinking about buying a home of your own for some time now, you've probably come up with a list of things that you'd LOVE to have in your new home. Many new homebuyers fantasize about the amenities that they see on television or Pinterest, and start looking at the countless homes listed for sale with rose-colored glasses. Do you really need that farm sink in the kitchen in order to be happy with your home choice? Would a two-car garage be a convenience or a necessity? Could the man cave of your dreams be a future renovation project instead of a make or break now? The first step in your home buying process should be to get pre-approved for your mortgage. This allows you to know your budget before you fall in love with a home that is way outside of it. The next step is to list all the features of a home that you would like, and to qualify them as follows:

In this day and age of being able to shop for anything anywhere, it is really important to know what you're looking for when you start your home search. If you've been thinking about buying a home of your own for some time now, you've probably come up with a list of things that you'd LOVE to have in your new home. Many new homebuyers fantasize about the amenities that they see on television or Pinterest, and start looking at the countless homes listed for sale with rose-colored glasses. Do you really need that farm sink in the kitchen in order to be happy with your home choice? Would a two-car garage be a convenience or a necessity? Could the man cave of your dreams be a future renovation project instead of a make or break now? The first step in your home buying process should be to get pre-approved for your mortgage. This allows you to know your budget before you fall in love with a home that is way outside of it. The next step is to list all the features of a home that you would like, and to qualify them as follows:- 'Must Haves' - if this property does not have these items, then it shouldn't even be considered. (ex: distance from work or family, number of bedrooms/bathrooms)

- 'Should Haves' - if the property hits all of the must haves and some of the should haves, it stays in contention, but does not need to have all of these features.

- 'Absolute Wish List' - if we find a property in our budget that has all of the 'must haves,' most of the 'should haves,' and ANY of these, it's the winner!

Bottom Line

Having this list flushed out before starting your search will save you time and frustration, while also letting your agent know what features are most important to you before starting to show you houses in your desired area.Wednesday, October 26, 2016

Do You Know the Cost of Renting vs. Buying?

![Do You Know the Cost of Renting vs. Buying? [INFOGRAPHIC] | Keeping Current Matters](https://blogger.googleusercontent.com/img/proxy/AVvXsEiWzjy8aamGNoZbskyHB-odbbbaaQEf4uRmweFe2aI5pmiWOEJlQKwtZz1CPccz84_LaiRLRKI6XdQhTt4Z3NwmDk-eGTAGGbYVWOEAf02Xsj0OgTz515ADv9GicQ2LA7nD_Eg9_v0NKBJf89VCIwgat0oVWQPOzf0tFWofMPNF27E__i8cw9ypYehw5ilGkUOITEDpMIvrCuY-ZQ_9=s0-d-e1-ft)

Some Highlights:

- Historically, the choice between renting or buying a home has been a close decision.

- Looking at the percentage of income needed to rent a median priced home today (30%) vs. the percentage needed to buy a median priced home (15%), the choice becomes obvious.

- Every market is different. Before you renew your lease again, find out if you could use your housing costs to own a home of your own!

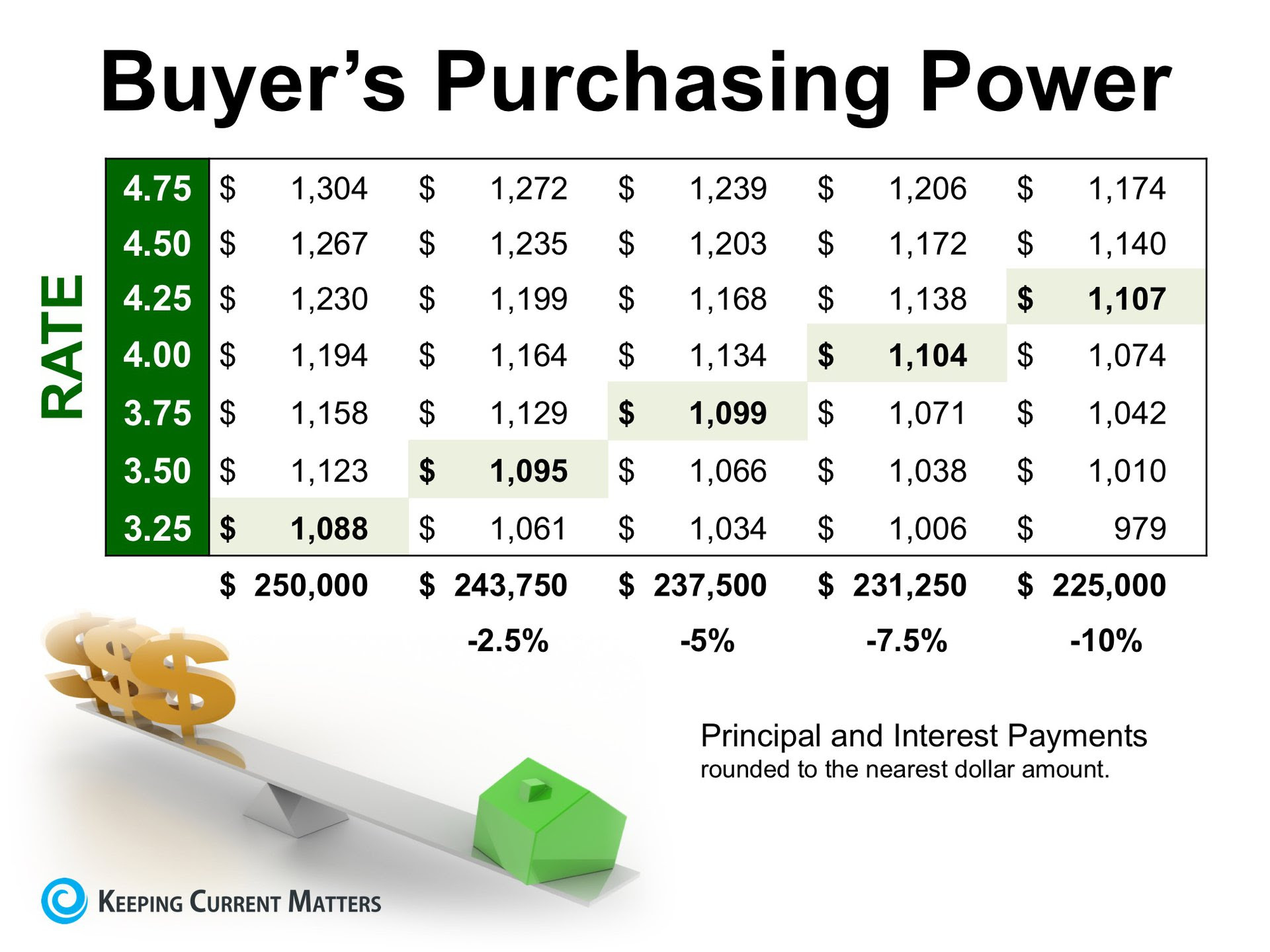

How Historically Low Interest Rates Increase Your Purchasing Power

According to Freddie Mac's latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 3.47%. Rates have remained at or below 3.5% each of the last 16 weeks, marking a historic low. The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power. Purchasing power, simply put, is the amount of home you can afford buy for the budget you have available to spend. As rates increase, the price of the house you can afford will decrease if you plan to stay within a certain monthly housing budget. The chart below shows what impact rising interest rates would have if you planned to purchase a home within the national median price range, and planned to keep your principal and interest payments at or about $1,100 a month.

According to Freddie Mac's latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 3.47%. Rates have remained at or below 3.5% each of the last 16 weeks, marking a historic low. The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power. Purchasing power, simply put, is the amount of home you can afford buy for the budget you have available to spend. As rates increase, the price of the house you can afford will decrease if you plan to stay within a certain monthly housing budget. The chart below shows what impact rising interest rates would have if you planned to purchase a home within the national median price range, and planned to keep your principal and interest payments at or about $1,100 a month.  With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5%, (in this example, $6,250). Experts predict that mortgage rates will be closer to 4% by this time next year. Act now to get the most house for your hard earned money.

With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5%, (in this example, $6,250). Experts predict that mortgage rates will be closer to 4% by this time next year. Act now to get the most house for your hard earned money.

Friday, October 21, 2016

The Role Access Plays in Getting Your House SOLD!

So you've decided to sell your house. You've hired a real estate professional to help you with the entire process and they have asked you what level of access you want to provide to potential buyers. There are four elements to a quality listing. At the top of the list is Access, followed by Condition, Financing and Price. There are many levels of access that you could provide to your agent to be able to show your home.

So you've decided to sell your house. You've hired a real estate professional to help you with the entire process and they have asked you what level of access you want to provide to potential buyers. There are four elements to a quality listing. At the top of the list is Access, followed by Condition, Financing and Price. There are many levels of access that you could provide to your agent to be able to show your home.Here are five levels of access that you could give a buyer with a brief description:

- Lockbox On the Door - this allows buyers the ability to see the home as soon as they are aware of the listing, or at their convenience.

- Providing a Key to the Home - although the buyer's agent may need to stop by an office to pick up the key, there is little delay in being able to show the home.

- Open Access with a Phone Call - the seller allows showing with just a phone call's notice.

- By Appointment Only (example: 48 Hour Notice) - Many out-of-town/state buyers and relocation buyers visit an area they would like to move to and only have the weekend to view homes. They may not be able to plan that far in advance, or may be unable to wait the 48 hours to be shown the house.

- Limited Access (example: the home is only available on Mondays or Tuesdays at 2pm or for only a couple of hours a day) - This is the most difficult way to be able to show your house to potential buyers.

Wednesday, October 19, 2016

Friday, October 14, 2016

Home Sales Expected to Increase Nicely in 2017

Wednesday, October 12, 2016

The Effect of Student Loan Debt

The Effect of Student Loan Debt on

Homeownership

Writers and politicians are very concerned about

increasing costs of college and student loans on

the average young person. The amount of

outstanding student debt in the US is now $1.25

trillion, and debt is a prerequisite in getting a

degree and joining the labor force. This has

coincided with a decline in homeownership in the

US to a period we haven’t seen in the 60s, with

similar low rates for young buyers. As home

prices are higher in California, expenses that hurt

young people's ability to save translate into more

drastic effects on Millennial homeownership in

California.

A recent C.A.R. poll showed that almost 60% of

California Millennials said that they were very

concerned about their overall debt; further student

loans were rated as the most worrisome type of

debt. In the U.S. as a whole, student loans have

replaced credit cards as the second most amount

of debt held (behind mortgage debt).

Do higher levels of loan debts affect

homeownership? As it turns out, having a college

degree is a much bigger determinant of

homeownership than the amount or existence of

student debt and that the weak labor market since

the Great Recession has affected homeownership

more than debt. Between the recession and now,

the rate of homeownership dropped from 35% to

26% for degree holding millennials, and from 23%

to 17% for non-degree holding millennials.

There is ample evidence that student loans hinder

the ability to accumulate wealth and thus delays

homeownership. But over the long term this evens

out. People who have successfully completed

college degrees have higher earnings over their lifetimes than those without. While non-degree seekers own more homes than degree seekers in their early 20s, by the time they turn 27, that reverses. By the age of 30, people who graduated with student debt have the same homeownership rates as people who graduated debt free. The amount student loan debt is much less than what is often written about in the media. The typical borrower has an average debt of $25k, with a median of $13k. Thirteen percent of borrowers have more than $50k of debt, and 3% of borrowers have more than $100k (a majority of these borrowers have also gone to graduate school). C.A.R. asked millennials who have purchased whether they thought that student loans were delaying their homeownership. Of millennials who were most worried about debt, 76% claimed that it kept them from homeownership; but only 25% of all millennials said that it was. When Millennial home purchasers were asked same question, 27% said that debt delayed purchasing. Homeownership and student loans are linked, but not in as drastic a way that many writers worry about.

college degrees have higher earnings over their lifetimes than those without. While non-degree seekers own more homes than degree seekers in their early 20s, by the time they turn 27, that reverses. By the age of 30, people who graduated with student debt have the same homeownership rates as people who graduated debt free. The amount student loan debt is much less than what is often written about in the media. The typical borrower has an average debt of $25k, with a median of $13k. Thirteen percent of borrowers have more than $50k of debt, and 3% of borrowers have more than $100k (a majority of these borrowers have also gone to graduate school). C.A.R. asked millennials who have purchased whether they thought that student loans were delaying their homeownership. Of millennials who were most worried about debt, 76% claimed that it kept them from homeownership; but only 25% of all millennials said that it was. When Millennial home purchasers were asked same question, 27% said that debt delayed purchasing. Homeownership and student loans are linked, but not in as drastic a way that many writers worry about.

Tuesday, October 11, 2016

Market Update for September

MARKET UPDATE FOR SEPTEMBER

As anticipated at the outset of the year, demand has remained high through the first three quarters of 2016, propping up sales and prices despite heavy reductions in inventory and months of supply across the country. With rental prices and employment opportunities in a consistent climb, year-over-year increases in home buying are probable for the rest of the year but not guaranteed.

New Listings were down 3.6 percent for Single Family homes but increased 3.5 percent for Townhouse-Condo properties. Pending Sales decreased 40.1 percent for Single Family homes and 43.8 percent for Townhouse-Condo properties.

The Median Sales Price was up 5.3 percent to $632,000 for Single Family homes and 2.9 percent to $410,000 for Townhouse-Condo properties. Months Supply of Inventory increased 2.9 percent for Single Family units and 3.6 percent for Townhouse-Condo units.

In general, today's demand is driven by three factors: Millennials are reaching prime home-buying age, growing families are looking for larger homes and empty nesters are downsizing. However, intriguingly low interest rates often prompt refinancing instead of listing, contributing to lower inventory. Recent studies have also shown that short-term rentals are keeping a collection of homes off the market.

The Median Sales Price was up 5.3 percent to $632,000 for Single Family homes and 2.9 percent to $410,000 for Townhouse-Condo properties. Months Supply of Inventory increased 2.9 percent for Single Family units and 3.6 percent for Townhouse-Condo units.

In general, today's demand is driven by three factors: Millennials are reaching prime home-buying age, growing families are looking for larger homes and empty nesters are downsizing. However, intriguingly low interest rates often prompt refinancing instead of listing, contributing to lower inventory. Recent studies have also shown that short-term rentals are keeping a collection of homes off the market.

Monday, October 10, 2016

Have you put aside enough money for closing costs?

Have You Put Aside Enough for Closing Costs?

There are many potential homebuyers, and even sellers, who believe that you need at least a 20% down payment in order to buy a home, or move on to their next home. Time after time, we have dispelled this myth by showing that there are many loan programs that allow you to put down as little as 3% (or 0% with a VA loan). If you have saved up your down payment and are ready to start your home search, one other piece of the puzzle is to make sure that you have saved enough for your closing costs. Freddie Mac defines closing costs as: There are many potential homebuyers, and even sellers, who believe that you need at least a 20% down payment in order to buy a home, or move on to their next home. Time after time, we have dispelled this myth by showing that there are many loan programs that allow you to put down as little as 3% (or 0% with a VA loan). If you have saved up your down payment and are ready to start your home search, one other piece of the puzzle is to make sure that you have saved enough for your closing costs. Freddie Mac defines closing costs as:"Closing costs, also called settlement fees, will need to be paid when you obtain a mortgage. These are fees charged by people representing your purchase, including your lender, real estate agent, and other third parties involved in the transaction. Closing costs are typically between 2 and 5% of your purchase price."We've recently heard from many first-time homebuyers that they wished that someone had let them know that closing costs could be so high. If you think about it, with a low down payment program, your closing costs could equal the amount that you saved for your down payment. Here is a list of just some of the fees/costs that may be included in your closing costs, depending on where the home you wish to purchase is located:

Is there any way to avoid paying closing costs?Work with your lender and real estate agent to see if there are any ways to decrease or defer your closing costs. There are no-closing mortgages available, but they end up costing you more in the end with a higher interest rate, or by wrapping the closing costs into the total cost of the mortgage (meaning you'll end up paying interest on your closing costs). Home buyers can also negotiate with the seller over who pays these fees. Sometimes the seller will agree to assume the buyer's closing fees in order to get the deal finalized.Bottom LineSpeak with your lender and agent early and often to determine how much you'll be responsible for at closing. Finding out you'll need to come up with thousands of dollars right before closing is not a surprise anyone is ever looking forward to. |

Saturday, October 8, 2016

Mortgage Rates by Decade

Mortgage Rates by Decade Compared to Today [INFOGRAPHIC]

Monday, October 3, 2016

Think You Should FSBO? 5 Reasons to Think Again!

Think You Should FSBO? 5 Reasons to Think Again!

In today's market, with home prices rising and a lack of inventory, some homeowners may consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons why this might not be a good idea for the vast majority of sellers. Here are the top five reasons: In today's market, with home prices rising and a lack of inventory, some homeowners may consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons why this might not be a good idea for the vast majority of sellers. Here are the top five reasons:1. Exposure to Prospective BuyersRecent studies have shown that 88% of buyers search online for a home. That is in comparison to only 21% looking at print newspaper ads. Most real estate agents have an internet strategy to promote the sale of your home. Do you?2. Results Come from the InternetWhere did buyers find the home they actually purchased?

3. There Are Too Many People to Negotiate WithHere is a list of some of the people with whom you must be prepared to negotiate if you decide to For Sale By Owner:

4. FSBOing Has Become More And More DifficultThe paperwork involved in selling and buying a home has increased dramatically as industry disclosures and regulations have become mandatory. This is one of the reasons that the percentage of people FSBOing has dropped from 19% to 8% over the last 20+ years.The 8% share represents the lowest recorded figure since NAR began collecting data in 1981.5. You Net More Money When Using an AgentMany homeowners believe that they will save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real estate agent's commission. The seller and buyer can't both save the commission. Studies have shown that the typical house sold by the homeowner sells for $210,000, while the typical house sold by an agent sells for $249,000. This doesn't mean that an agent can get $39,000 more for your home, as studies have shown that people are more likely to FSBO in markets with lower price points. However, it does show that selling on your own might not make sense.Bottom LineBefore you decide to take on the challenges of selling your house on your own, sit with a real estate professional in your marketplace and see what they have to offer. |

Subscribe to:

Comments (Atom)

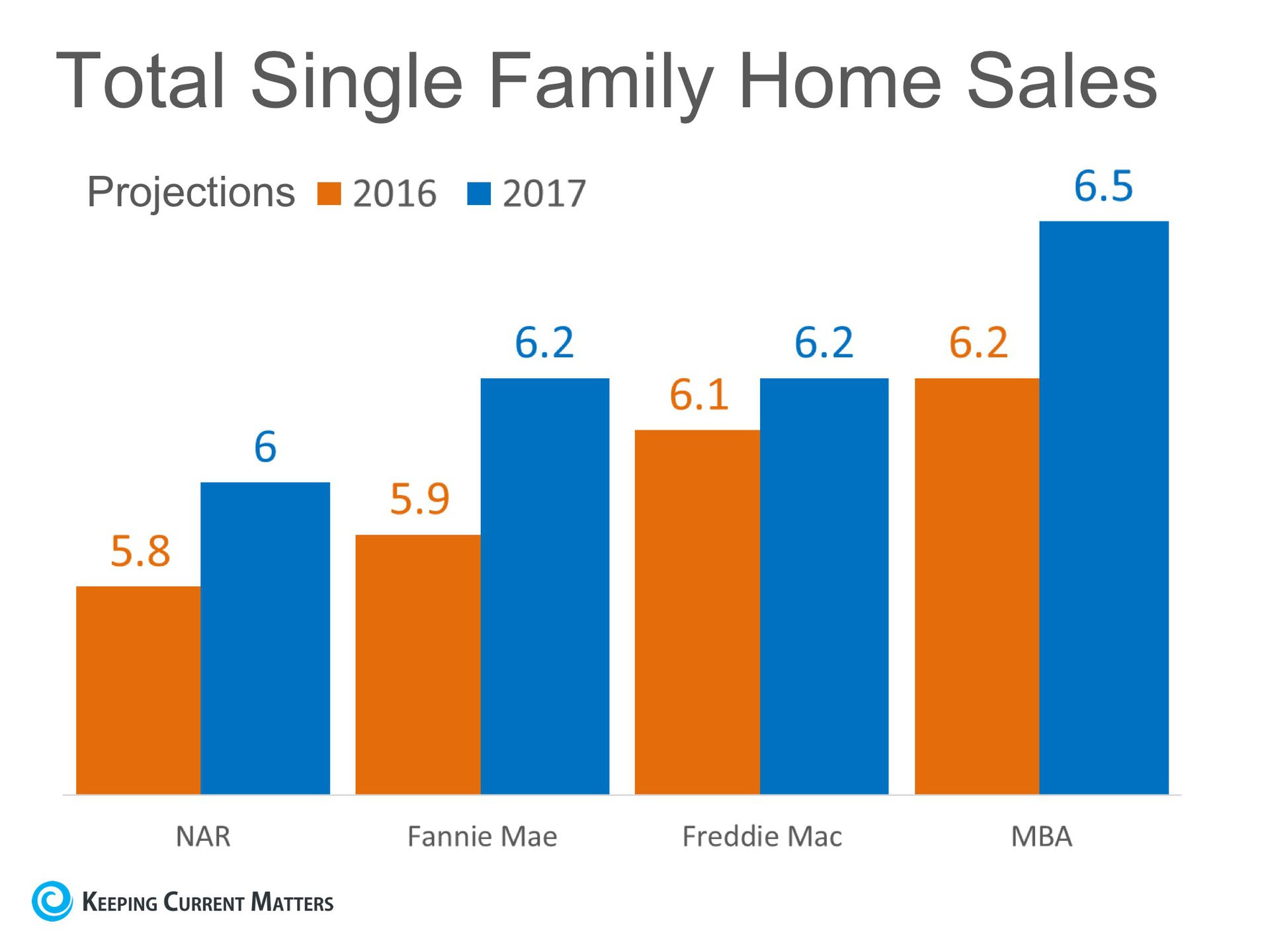

The National Association of Realtors, The Mortgage Bankers' Association, Freddie Mac and Fannie Mae are all projecting that home sales will increase in 2017. Here is a chart showing what each entity is projecting in sales for this year and the next.

The National Association of Realtors, The Mortgage Bankers' Association, Freddie Mac and Fannie Mae are all projecting that home sales will increase in 2017. Here is a chart showing what each entity is projecting in sales for this year and the next.

![Mortgage Rates by Decade Compared to Today [INFOGRAPHIC] | Keeping Current Matters](https://blogger.googleusercontent.com/img/proxy/AVvXsEjCp80Ct4c_K1VbY7ljX0YRQlS2GpiIAWiFgv41HsKEHzQvt1EZE2uArrNo3vRjNEVr4-1StHXSgIBd_Kl3m7-93USNEatOXBITdK9Nk_nF_YB8gWpHWVHnhxvSwC8iBnwgpFDVmyktQudXkKcpgQN3AJqwBAdAmu0990HLgL1KsPjKL9tA7Xq_YWPB31-lTcNvhP1pQ3QQeFZJJrVIWVA=s0-d-e1-ft)