Have you ever been flipping through the channels, only to find yourself glued to the couch in an HGTV 'show hole'*? We've all been there... watching entire seasons of "Love it or List it," "Fixer Upper," "House Hunters," "Flip or Flop," "Property Brothers," and so many more, just in one sitting. When you're in the middle of your real estate themed show marathon, you might start to think that everything you see on TV must be how it works in real life, but you may need a reality check.

Have you ever been flipping through the channels, only to find yourself glued to the couch in an HGTV 'show hole'*? We've all been there... watching entire seasons of "Love it or List it," "Fixer Upper," "House Hunters," "Flip or Flop," "Property Brothers," and so many more, just in one sitting. When you're in the middle of your real estate themed show marathon, you might start to think that everything you see on TV must be how it works in real life, but you may need a reality check.Monday, August 29, 2016

Real Life vs. Reality TV: 5 Myths Explained

Have you ever been flipping through the channels, only to find yourself glued to the couch in an HGTV 'show hole'*? We've all been there... watching entire seasons of "Love it or List it," "Fixer Upper," "House Hunters," "Flip or Flop," "Property Brothers," and so many more, just in one sitting. When you're in the middle of your real estate themed show marathon, you might start to think that everything you see on TV must be how it works in real life, but you may need a reality check.

Have you ever been flipping through the channels, only to find yourself glued to the couch in an HGTV 'show hole'*? We've all been there... watching entire seasons of "Love it or List it," "Fixer Upper," "House Hunters," "Flip or Flop," "Property Brothers," and so many more, just in one sitting. When you're in the middle of your real estate themed show marathon, you might start to think that everything you see on TV must be how it works in real life, but you may need a reality check.Thursday, August 25, 2016

Friday, August 19, 2016

Wednesday, August 17, 2016

Would You Qualify for a Mortgage Now?

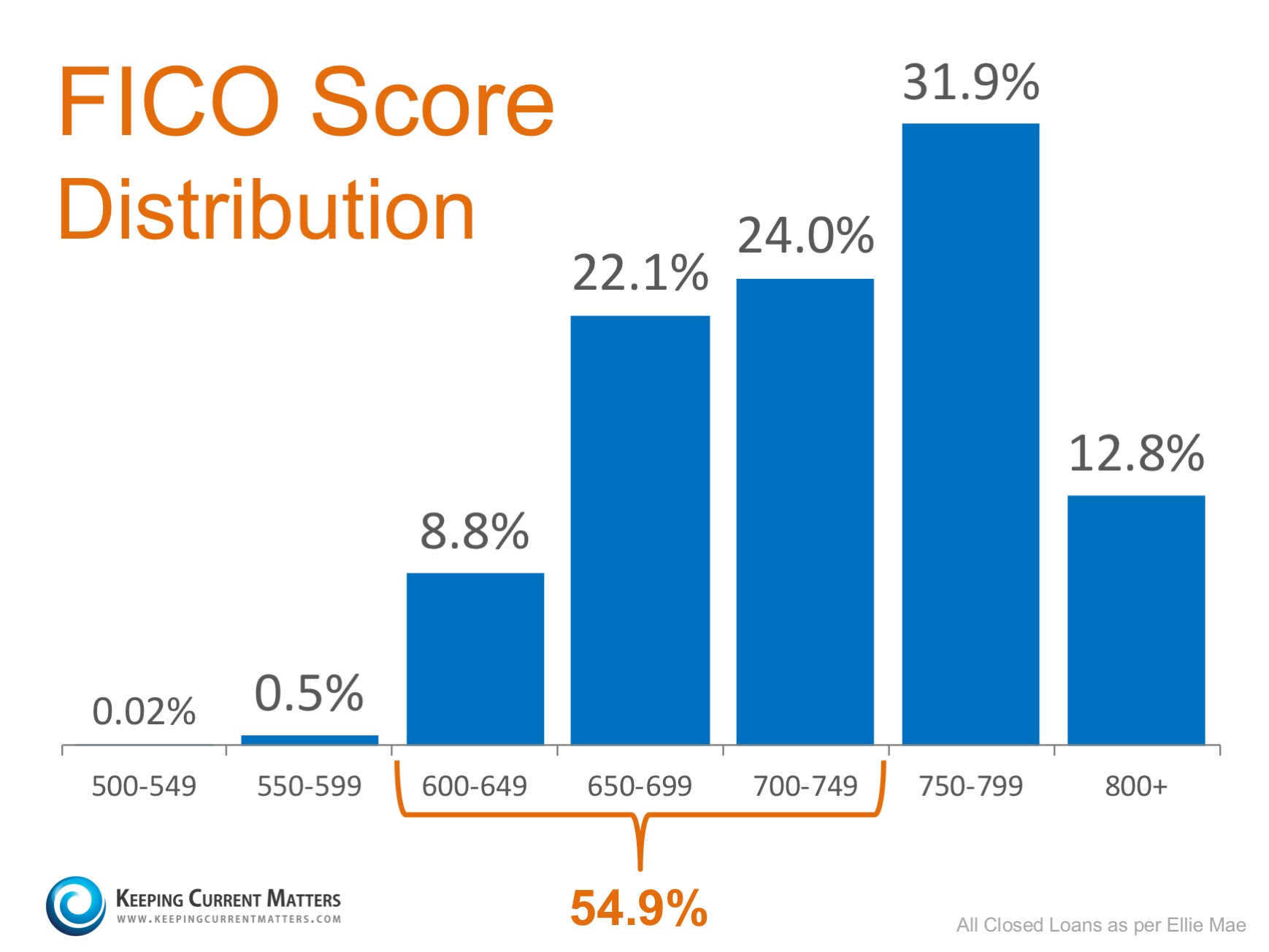

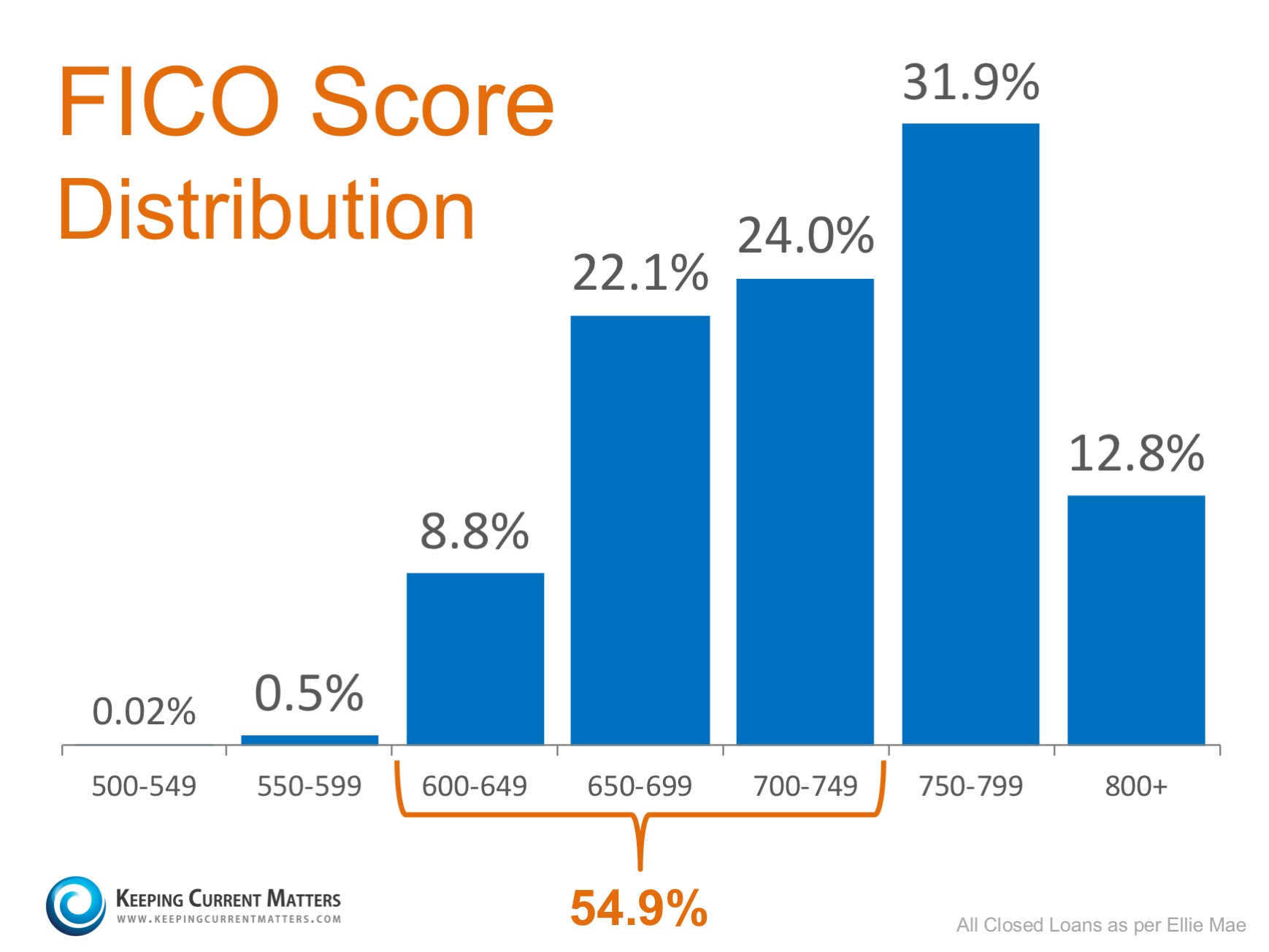

The widespread myth that perfect credit and large down payments are necessary to buy a home are holding many potential home buyers on the sidelines. According to Ellie Mae's latest Origination Report, the average FICO score for all closed loans in May was 724, far lower than the 750 or 800 that many buyers believe to be true. Below is a graph of the distribution of FICO scores of approved loans in May (the latest available data): The widespread myth that perfect credit and large down payments are necessary to buy a home are holding many potential home buyers on the sidelines. According to Ellie Mae's latest Origination Report, the average FICO score for all closed loans in May was 724, far lower than the 750 or 800 that many buyers believe to be true. Below is a graph of the distribution of FICO scores of approved loans in May (the latest available data):  Looking at the chart above, it becomes obvious that not only do you not need a 750+ credit score, but 54.9% of approved loans actually had a score between 600 and 749. More and more experts are speaking up about the fact that if potential buyers realized they could be approved for a mortgage with a credit score at, or above, 600, the distribution in the chart above would shift further to the left. Ellie Mae's Vice President, Jonas Moe encouraged buyers to know their options before assuming that they do not qualify for a mortgage: Looking at the chart above, it becomes obvious that not only do you not need a 750+ credit score, but 54.9% of approved loans actually had a score between 600 and 749. More and more experts are speaking up about the fact that if potential buyers realized they could be approved for a mortgage with a credit score at, or above, 600, the distribution in the chart above would shift further to the left. Ellie Mae's Vice President, Jonas Moe encouraged buyers to know their options before assuming that they do not qualify for a mortgage:"The high median credit score is due to many millennials believing they won't qualify with the score they have - and are therefore waiting to apply for a mortgage until they have the score they think they need." (emphasis added)CoreLogic's latest MarketPulse Report agrees that the median FICO score does not always tell the whole story: "The observed decline in originations could be a result of potential applicants being either too cautious or discouraged from applying, more so than tight underwriting as the culprit in lower mortgage activity."It's not just millennials who believe high credit scores and large down payments are needed. Many current homeowners are delaying moving on to a home that better fits their current needs due to a belief that they would not qualify for a mortgage today. So what does this all mean?Moe put it this way:"Many potential home buyers are 'disqualifying' themselves. You don't need a 750 FICO Score and a 20% down payment to buy." Bottom LineIf you are one of the many Americans who has always thought homeownership was out of their reach, meet with a local real estate professional who can help you start the process of being pre-qualified to see if you are able to buy now! |

Tuesday, August 16, 2016

MARKET UPDATE FOR JULY

MARKET UPDATE FOR JULY

Even as prices rise in many communities, homes are selling faster now than they have in the past several years. This creates a situation where buyers need to move fast in order to secure homes, and they may have to pay more for them. While increasing prices generally coax more selling activity, there has been some hesitancy among potential sellers who worry that they will not be able to buy a desirable and reasonably priced home once they sell.

New Listings were down 5.0 percent for Single Family homes and 3.1 percent for Townhouse-Condo properties. Pending Sales decreased 47.1 percent for Single Family homes and 50.4 percent for Townhouse-Condo properties.

The Median Sales Price was up 3.9 percent to $639,000 for Single Family homes and 6.5 percent to $410,000 for Townhouse-Condo properties. Months Supply of Inventory increased 8.6 percent for Single Family units and 10.3 percent for Townhouse-Condo units. Low housing supply has already prevented an outright national boon in sales activity, despite a continuation of near record-low mortgage rates and an unemployment rate under 5.0 percent deep into 2016.

The issue is not purchasing power. Many areas are falling behind last year's closed sales totals simply because of lack of available inventory. As this continues, higher prices may put a deeper squeeze on the current buyer pool.

The Median Sales Price was up 3.9 percent to $639,000 for Single Family homes and 6.5 percent to $410,000 for Townhouse-Condo properties. Months Supply of Inventory increased 8.6 percent for Single Family units and 10.3 percent for Townhouse-Condo units. Low housing supply has already prevented an outright national boon in sales activity, despite a continuation of near record-low mortgage rates and an unemployment rate under 5.0 percent deep into 2016.

The issue is not purchasing power. Many areas are falling behind last year's closed sales totals simply because of lack of available inventory. As this continues, higher prices may put a deeper squeeze on the current buyer pool.

Saturday, August 13, 2016

Thinking of Selling Your House? Pick the Right Agent!

Today, more and more sellers are stepping back, taking a look at the advice real estate professionals give them, and asking themselves whether they can trust that advice. And that is exactly what they should do. The most important question you can ask when you are choosing a real estate agent is whether you feel you can trust them. You must know that they're giving you great advice, and that they're going to be able to help you accomplish your family's goals. You must trust your listing agent enough to allow them to:

Today, more and more sellers are stepping back, taking a look at the advice real estate professionals give them, and asking themselves whether they can trust that advice. And that is exactly what they should do. The most important question you can ask when you are choosing a real estate agent is whether you feel you can trust them. You must know that they're giving you great advice, and that they're going to be able to help you accomplish your family's goals. You must trust your listing agent enough to allow them to:- Handle the liquidation of possibly the largest asset your family has

- Help set the market value of that asset (get the price right)

- Set the timetable for the liquidation of that asset

- Set a fair fee for the services required to liquidate that asset

Thursday, August 11, 2016

What Does Home Mean To You?

No matter what shape or size your living space is, the concept and feeling of home can mean different things to different people. Whether it's a certain scent or a favorite chair, the emotional reasons why we choose to buy our own home are, more often than not, the more powerful or compelling ones. Every year, The Joint Center for Housing Studies at Harvard Universityconducts a survey to find driving factors behind why Americans decide to buy a home. The top 4 reasons to own a home cited by participants of the survey were not financial.

No matter what shape or size your living space is, the concept and feeling of home can mean different things to different people. Whether it's a certain scent or a favorite chair, the emotional reasons why we choose to buy our own home are, more often than not, the more powerful or compelling ones. Every year, The Joint Center for Housing Studies at Harvard Universityconducts a survey to find driving factors behind why Americans decide to buy a home. The top 4 reasons to own a home cited by participants of the survey were not financial.1. It means having a good place to raise children & provide them with a good education

From the best neighborhoods to the best school districts, even those without children at the time of purchase may have this in the back of their mind as a major reason for choosing the location of the home that they purchase.2. You have a physical structure where you & your family feel safe

It is no surprise that having a place to call home with the means for comfort and security is the number two reason.3. It allows you to have more space for your family

Whether your family is expanding, or an older family member is moving in, having a home that fits your needs is a close third on the list.4. It gives you control over what you do with your living space, like renovations and updates

Looking to actually try one of those complicated wall treatments that you saw on Pinterest? Tired of paying an additional pet deposit for your apartment building, or do you want to finally adopt that puppy or kitten you've seen online 100 times? Who's to say that you can't in your own home? The 5th reason on the list, is the #1 financial reason to buy a home as seen by respondents:5. Owning a home is a good way to build up wealth that can be passed along to my family

Either way you are paying a mortgage. Why not lock in your housing expense now with an investment that will build equity that you can borrow against in the future?Bottom Line

Whether you are a first time homebuyer or a move-up buyer who wants to start a new chapter in your life, now is a great time to reflect on the intangible factors that make a house a home.Tuesday, August 9, 2016

Home Sales Up in Every Price Range over $100K!

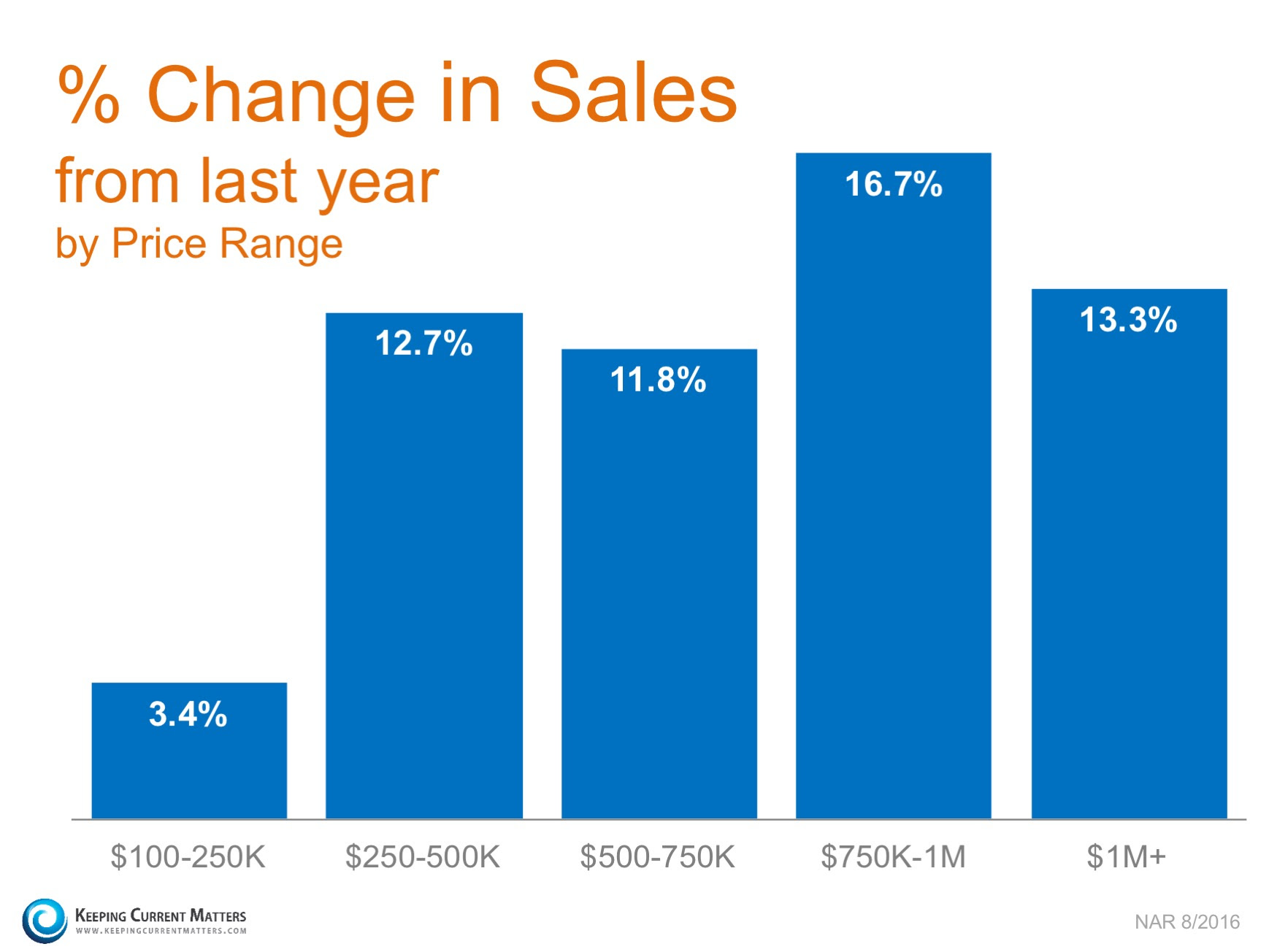

The National Association of Realtors' most recent Existing Home Sales Report revealed that home sales were up rather dramatically over last year in five of the six price ranges they measure. Homes priced between $100-250K showed a modest increase at 3.4%. This not only points to the lower inventory of homes available for sale in this price range but also speaks to the overall strength of the housing market. Sales of homes over $250,000 increased by double digit percentages with sales in the $750,000- $1 million range showing the largest increase, up 16.7%! As prices in many markets continue to accelerate, it is no surprise to see the percentage of homes in the higher price ranges increasing.

The National Association of Realtors' most recent Existing Home Sales Report revealed that home sales were up rather dramatically over last year in five of the six price ranges they measure. Homes priced between $100-250K showed a modest increase at 3.4%. This not only points to the lower inventory of homes available for sale in this price range but also speaks to the overall strength of the housing market. Sales of homes over $250,000 increased by double digit percentages with sales in the $750,000- $1 million range showing the largest increase, up 16.7%! As prices in many markets continue to accelerate, it is no surprise to see the percentage of homes in the higher price ranges increasing.Here is the breakdown:

What does that mean to you if you are selling?

Houses are definitely selling. If your house has been on the market for any length of time and has not yet sold, perhaps it is time to sit with your agent and see if it is priced appropriately to compete in today's market.Wednesday, August 3, 2016

Why You Should Hire a Real Estate Professional When Buying a Home!

Many people wonder whether they should hire a real estate professional to assist them in buying their dream home or if they should first try to go it on their own. In today's market: you need an experienced professional! Many people wonder whether they should hire a real estate professional to assist them in buying their dream home or if they should first try to go it on their own. In today's market: you need an experienced professional!You Need an Expert Guide if You Are Traveling a Dangerous PathThe field of real estate is loaded with land mines. You need a true expert to guide you through the dangerous pitfalls that currently exist. Finding a home that is priced appropriately and ready for you to move in to can be tricky. An agent listens to your wants and needs, and can sift through the homes that do not fit within the parameters of your "dream home." A great agent will also have relationships with mortgage professionals and other experts that you will need in securing your dream home.You Need a Skilled NegotiatorIn today's market, hiring a talented negotiator could save you thousands, perhaps tens of thousands of dollars. Each step of the way - from the original offer, to the possible renegotiation of that offer after a home inspection, to the possible cancellation of the deal based on a troubled appraisal - you need someone who can keep the deal together until it closes. Realize that when an agent is negotiating their commission with you, they are negotiating their own salary; the salary that keeps a roof over their family's head; the salary that puts food on their family's table. If they are quick to take less when negotiating for themselves and their families, what makes you think they will not act the same way when negotiating for you and your family? If they were Clark Kent when negotiating with you, they will not turn into Superman when negotiating with the buyer or seller in your deal.Bottom LineFamous sayings become famous because they are true. You get what you pay for. Just like a good accountant or a good attorney, a good agent will save you money...not cost you money. |

Tuesday, August 2, 2016

Would You Qualify for a Mortgage Now?

The widespread myth that perfect credit and large down payments are necessary to buy a home are holding many potential home buyers on the sidelines. According to Ellie Mae's latest Origination Report, the average FICO score for all closed loans in May was 724, far lower than the 750 or 800 that many buyers believe to be true. Below is a graph of the distribution of FICO scores of approved loans in May (the latest available data):

The widespread myth that perfect credit and large down payments are necessary to buy a home are holding many potential home buyers on the sidelines. According to Ellie Mae's latest Origination Report, the average FICO score for all closed loans in May was 724, far lower than the 750 or 800 that many buyers believe to be true. Below is a graph of the distribution of FICO scores of approved loans in May (the latest available data):  Looking at the chart above, it becomes obvious that not only do you not need a 750+ credit score, but 54.9% of approved loans actually had a score between 600 and 749. More and more experts are speaking up about the fact that if potential buyers realized they could be approved for a mortgage with a credit score at, or above, 600, the distribution in the chart above would shift further to the left. Ellie Mae's Vice President, Jonas Moe encouraged buyers to know their options before assuming that they do not qualify for a mortgage:

Looking at the chart above, it becomes obvious that not only do you not need a 750+ credit score, but 54.9% of approved loans actually had a score between 600 and 749. More and more experts are speaking up about the fact that if potential buyers realized they could be approved for a mortgage with a credit score at, or above, 600, the distribution in the chart above would shift further to the left. Ellie Mae's Vice President, Jonas Moe encouraged buyers to know their options before assuming that they do not qualify for a mortgage:"The high median credit score is due to many millennials believing they won't qualify with the score they have - and are therefore waiting to apply for a mortgage until they have the score they think they need." (emphasis added)CoreLogic's latest MarketPulse Report agrees that the median FICO score does not always tell the whole story:

"The observed decline in originations could be a result of potential applicants being either too cautious or discouraged from applying, more so than tight underwriting as the culprit in lower mortgage activity."It's not just millennials who believe high credit scores and large down payments are needed. Many current homeowners are delaying moving on to a home that better fits their current needs due to a belief that they would not qualify for a mortgage today.

So what does this all mean?

Moe put it this way:"Many potential home buyers are 'disqualifying' themselves. You don't need a 750 FICO Score and a 20% down payment to buy."

Bottom Line

If you are one of the many Americans who has always thought homeownership was out of their reach, meet with a local real estate professional who can help you start the process of being pre-qualified to see if you are able to buy now!

Subscribe to:

Comments (Atom)