Does student debt help young homebuyers qualify for mortgages?

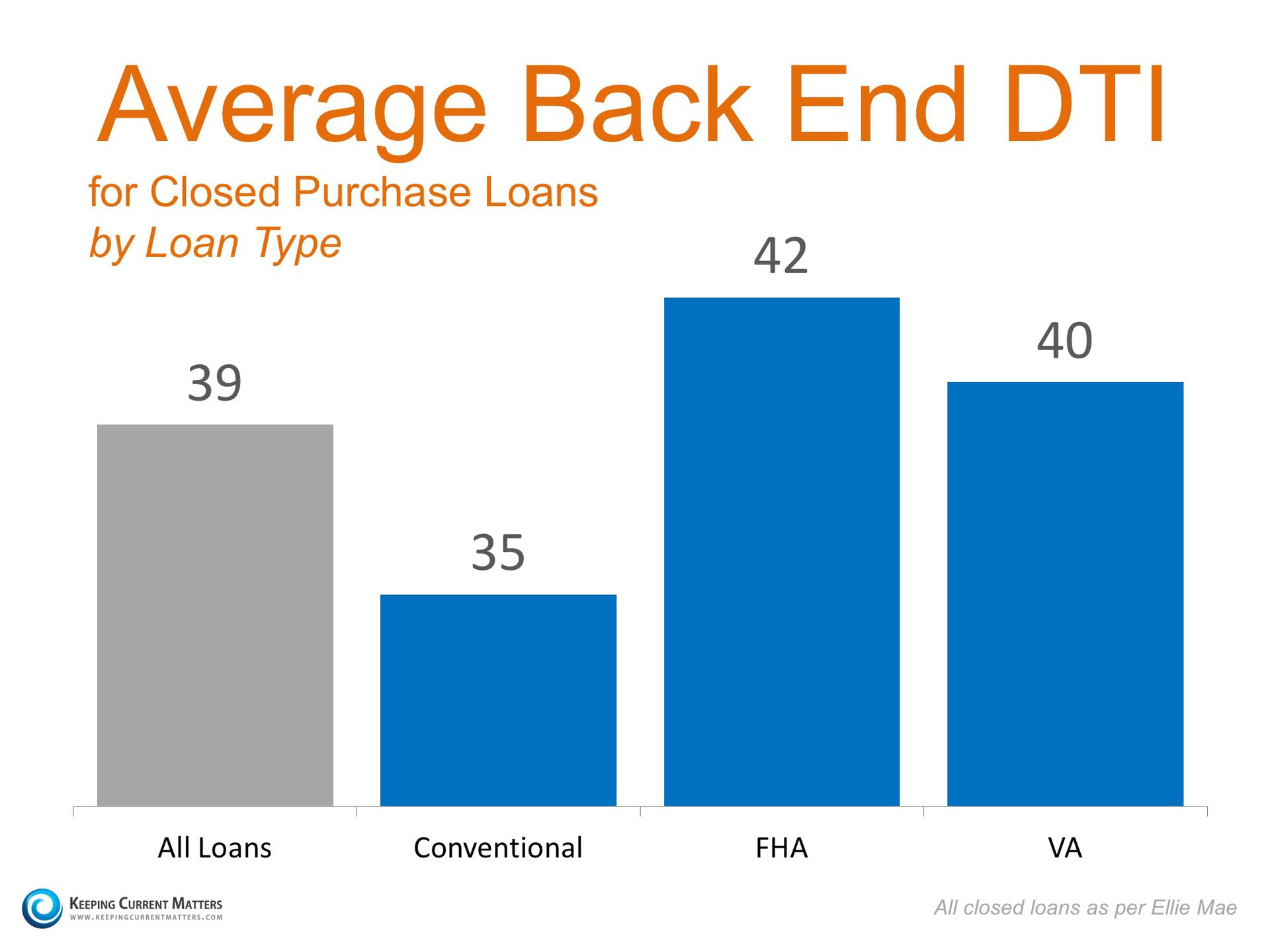

At face value, the answer is very clearly no — student debt increases the homebuyer’s debt-to-income ratio (DTI), making it more difficult to qualify for a mortgage. But that’s not the full story.

The combined amount of student loan debt borrowed has increased roughly 300% since 2005, according to the Federal Reserve Bank of New York’s (FRBNY’s)

Consumer Credit Panel. On an individual basis, the average 25-year-old student loan borrower owes about $22,000 in student loans, according to a report published by the

FRBNY.

So how can having student debt possibly help a young person qualify for a mortgage?

Student debt is increasingly a necessary burden for young people who want to make a solid living, as

the cost of education rises. And since high incomes are a necessity in California’s pricey homebuying environment, those without college educations are often unable to qualify.

In fact, California has the highest

total loan balance per capita compared to other states, according to the FRBNY’s

Consumer Credit Panel. Most of this debt by far is due to

mortgage debt. In fact, California’s per capita mortgage debt alone is higher than all debt combined of any other state except New Jersey.

One might assume California’s high mortgage debt per capita means our state has a higher than average number of homeowners. However, we know the opposite is true. With a homeownership rate of just 54% as of Q3 2015, California’s rate of homeownership is well below the nationwide average of 63%. Therefore, California’s high mortgage debt per capita is due entirely to high home values, particularly those found in its coastal, urban centers, nearest to stable, well-paying jobs.

Student debt is evidence of a college education (be it complete or incomplete). College educated individuals make more money — twice as much as high school grads on average, according to the

National Center for Education Statistics — and are better situated to become homebuyers, despite the extra debt. In California, the share of

individuals with a college degree has increased steadily since 2000, evidenced by the increased student debt balance per capita.

On the other side of the picture, high levels of student debt increases the potential homebuyer’s

DTI. Student debt is increasingly taking up space in the DTIs of young adults which would otherwise be used to fund mortgage payments. Nationwide, the percentage of young adults taking out mortgages has declined for both student loan borrowers and non-borrowers alike. This decrease has been largest for student loan borrowers, according to the

Cleveland Federal Reserve Bank. Still, young adults with student loans continue to take out mortgages more often than those without student loans.

The chart above shows the mortgage borrowing difference between 25-30 year-olds saddled with student debt and those free of student debt. Even as the percentage of 25-30 year-olds originating a mortgage declined in the aftermath of the Millennium Boom, those borrowing with student debt remained greater than those borrowing without student debt.

For those who wish to become homeowners, getting a college degree is still more likely to help achieve the dream than skipping college due to student loans. However, homebuyers with student loans need to accept the reality that even with a significantly higher income, their mortgage size will be reduced to suit the size of their student loan bill. Thus, less expensive homes will have to do for the next generation of first-time homebuyers, at least until their student loan balances are paid off, which will take ten years or longer.

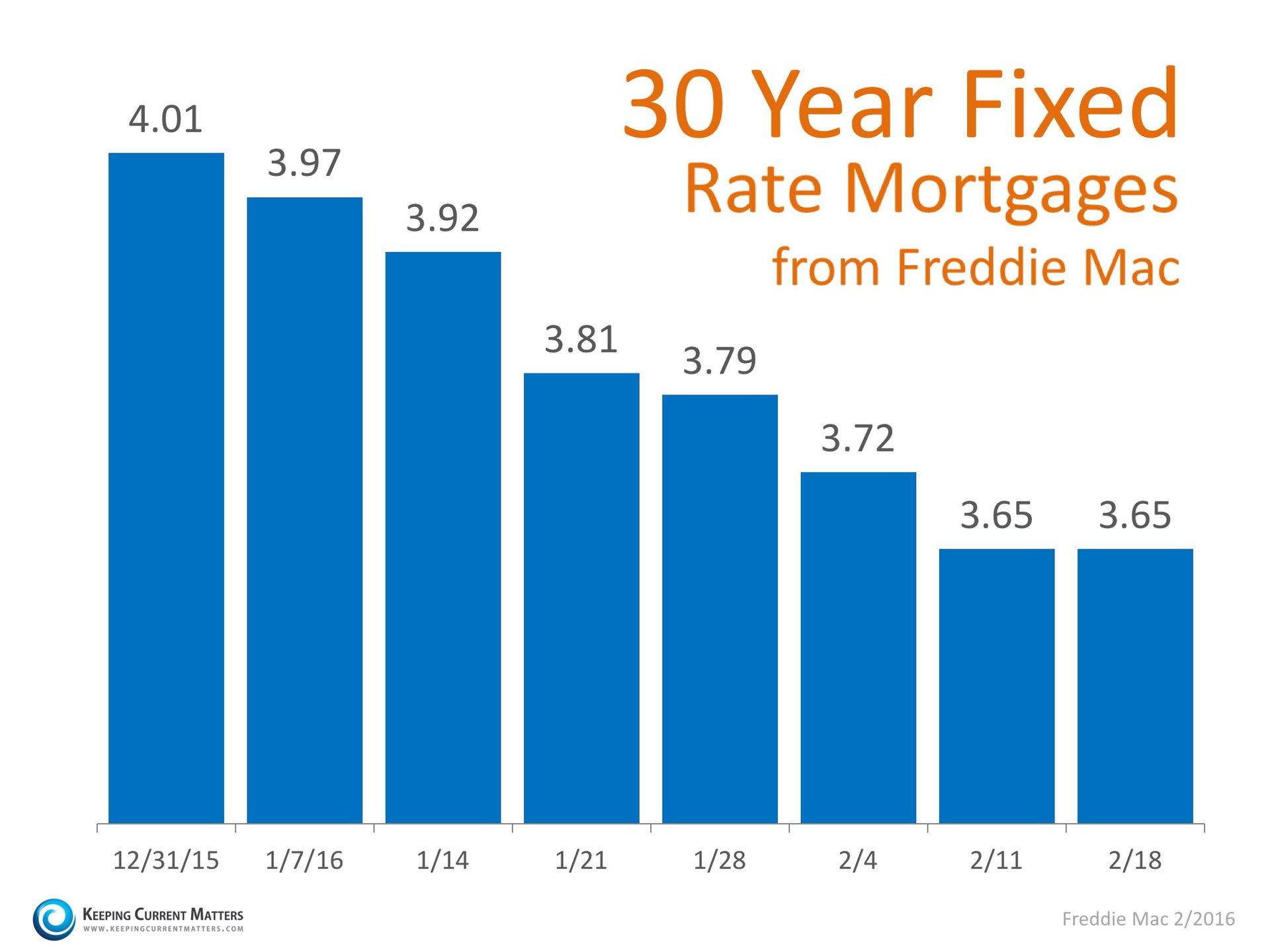

Just two weeks ago, we posted an article discussing where mortgage interest rates may be heading over the next twelve months. We quoted projections from Fannie Mae, Freddie Mac, the Mortgage Bankers’ Association and the National Association of Realtors. Each predicted that rates would begin to rise slowly and steadily throughout 2016. However, shaky economic news and a volatile stock market have actually caused rates to drop six out of the last seven weeks, and have remained at 3.65% for the past two weeks.

Just two weeks ago, we posted an article discussing where mortgage interest rates may be heading over the next twelve months. We quoted projections from Fannie Mae, Freddie Mac, the Mortgage Bankers’ Association and the National Association of Realtors. Each predicted that rates would begin to rise slowly and steadily throughout 2016. However, shaky economic news and a volatile stock market have actually caused rates to drop six out of the last seven weeks, and have remained at 3.65% for the past two weeks.  Rates have again fallen to historic lows yet many experts still expect them to increase in 2016. The only thing we know for sure is that, according to Freddie Mac, current rates are the best they have been since last April.

Rates have again fallen to historic lows yet many experts still expect them to increase in 2016. The only thing we know for sure is that, according to Freddie Mac, current rates are the best they have been since last April.