Tuesday, December 30, 2014

More on Buying a property on Leased Land

Generally, a person purchasing a home buys the house and the land upon which it is situated. But there is a form of home buying where only the house is purchased and the land is leased. This form of financial arrangement is called a land lease. There are various reasons why one might wish to enter into a land lease agreement rather than a home purchase.

A common situation is one where an investor wants to retain ownership of a parcel of land but not develop it. The owner would enter into the land lease contract with a developer to build a home and then sell it. But the land would not come with the house. Usually a land lease will be for between 50 and 99 years. If the lease is near the end, the owner will generally renew it, although with a rental increase. There are advantages and disadvantages to this form of home ownership.

The advantages of land lease contracts

The most significant advantage of a land lease is that the purchase price is almost always much less than that for a home bought in the traditional manner. Not buying the land saves money. This enables you to purchase a higher quality home in a more expensive residential area than you might otherwise be able to do. Also, because you don't own the land itself, you will have no or low property taxes to pay.

Typically land lease homes are part of residential communities that provide common services and facilities. Amenities might include private playgrounds, swimming pools, tennis courts, party or conference rooms and so forth. There would be homeowner association (HOA) fees. But they would most likely cover lawn mowing, snow removal and similar services.

The disadvantages of land lease contracts

There are downsides to holding property under a land lease contract. It is often problematic finding financing for land lease homes. This makes them harder to sell. HOA fees for these properties are invariably higher than those for comparable houses owned outright or for condos. The residents generally share in the cost of the lease of the land. That portion of the lease might appear in the monthly HOA bill. In addition, the HOA might make large assessments to cover major community improvements. If you don't use certain costly amenities such as a golf course, you might find maintenance or major upgrades to be overly burdensome. You also might wish to do your own landscaping.

The most significant disadvantages are economic issues. Home ownership is a good hedge against inflation. When you are paying off a fixed-rate mortgage, your monthly payment remains the same when inflation rises. For a leased-land property, the lease payments and monthly HOA fees will increase at the rate of inflation or greater. At the same time, your home will decrease in value as the lease term approaches its end. Also, you will not be building any equity in your leased land residence. At the expiration of the lease, you could lose all of your equity according to the surrender clause of the lease.

Other land lease agreement considerations

Other considerations to examine before signing a land lease agreement include the amount of time remaining on the lease. If it is less than the time you plan to live in the house, you need to know your status at the expiration of the lease. This information is also critical in financing the home. If the remaining lease term is less years than what you want a mortgage for, it will be very difficult to obtain the financing. You also need to be fully aware of the terms of the surrender clause. The amounts of the monthly lease payment and HOA fees, how often they are adjusted, and by how much, are very important.

Buying a home through a land lease contract can be an attractive option in light of the lower purchase price. It is essential that you study the matter and obtain advice from professionals who are knowledgeable about land lease agreements.

Monday, December 29, 2014

Rescuing Your Home from the Holidays

The holiday season can be tough on your home. Getting it back into shape can be even tougher. Part of that can be attributed to the overwhelming list of what you need to do. But the biggest barrier is often finding the time and motivation to start knocking out your to-do list. If you don’t feel like tackling all the projects yourself (and we don’t blame you) you might want to think about hiring a pro.

Cleaning a room or two isn’t a big deal. Giving your home a room-by-room deep cleaning is. And after a month of entertaining and holiday traffic your home could probably use a good scrubbing. Instead of spending a day doing it yourself, take a break and hire a cleaning service to give your home the floor-to-ceiling cleaning it deserves. You’ll be pleased with the results, and even more pleased to know that most homeowners only spend between $162 and $202 to have their homes professionally cleaned.

Nothing makes a room look more rundown than dirty, worn out carpet. And while you keep them vacuumed and stain-free, they’re probably not as clean as they could be. Most experts recommend having them professionally cleaned at least once a year (twice if subjected to heavy traffic). Now, you could rent a steam cleaner and do the job yourself. But when you factor in the rental fee, cost of cleaning solutions, and time it’ll take you to do the job and compare it to the cost of hiring a pro, you might find that it makes more sense to pay a pro to do the job for you.

People like stuff. We accumulate a lot of it over the holidays. Over time we amass more stuff than we have space for. When that happens our houses become claustrophobic and we start threatening to throw stuff away. And while you could certainly benefit from getting rid of a few things, you could really benefit from adding a closet or two, because if there’s one thing a home can never have too much of, it’s closet space. Whether you’re looking to expand an existing closet or add built-ins to your family room, adding closet space is an investment that pays dividends right away. And with an average cost of $2,054, it’s a project that could be more accessible than you think.

Wednesday, December 24, 2014

Should you buy property on "Leased Land?"

For most "condos", you "own" an "air parcel", no actual land. The "home owner association", usually ends up owning the land, and all "air parcel owners" become manditory members of the "home owner association". The legal documents forming the "home owner association" are usually very specific about what the association can do with the land and the responsibilities and options of the "members".

A leased land situation is entirely different. Sometimes a developer is not able to buy out the land from the owner and can only get a long term lease. This often happens when property is owned by non-profit entities (such as churches), or when it is official "native american" property, or when it is owned by the Federal Government (such as in a national forest).

And of course most "trailer parks" and "modular home" parks are leased property with the landlord owning and maintaining the site and providing utility connections.

YES, you can buy your own home in the "national forest"; but most of the homes are not on private land. The same is true of many camp properties. For the Federal Government, the most common leases are 20 year leases, and 99 year leases, and they tend not to issue new ones, but only renew existing ones. Usually the leases are transferable with the sale of the structure.

A leased land situation is entirely different. Sometimes a developer is not able to buy out the land from the owner and can only get a long term lease. This often happens when property is owned by non-profit entities (such as churches), or when it is official "native american" property, or when it is owned by the Federal Government (such as in a national forest).

And of course most "trailer parks" and "modular home" parks are leased property with the landlord owning and maintaining the site and providing utility connections.

YES, you can buy your own home in the "national forest"; but most of the homes are not on private land. The same is true of many camp properties. For the Federal Government, the most common leases are 20 year leases, and 99 year leases, and they tend not to issue new ones, but only renew existing ones. Usually the leases are transferable with the sale of the structure.

Friday, December 19, 2014

Wednesday, December 17, 2014

Friday, December 12, 2014

What Homes Do Millennials Buy?

New NAHB research shows that millennials tend to buy homes that are smaller, older, and less expensive than homes bought by older generations. Being the youngest home buyers with little or no accumulated wealth also affects how millennials shop and buy their homes.

The majority of millennials are buying homes for the first time in their lives. Three out of four millennials who purchased a home were first-time buyers, but a quarter traded their existing homes.

Compared to older generations, millennials are less likely to buy a new home. Less than 9 percent of millennial home buyers bought a new home. The share was close to 12 percent among older home buyers.

More than two-thirds of millennials who bought homes purchased single-family detached properties. Nevertheless, compared to older home buyers, the millennial generation shows a slightly higher preference for multifamily condominiums. Close to 9 percent of millennial home buyers bought a multifamily property compared to less than 6 percent of older home buyers.

Consistent with being the youngest and largely first-time home buyers, millennials tend to buy homes that are, on average, smaller and concentrated in the lower price ranges compared to homes purchased by older generations. Half of all homes purchased by millennials averaged less than 1,650 square feet of living space and cost less than $148,500.

The most common reason for moving reported by millennial home buyers is to establish their own household, followed by the desire to have a larger unit and own it.

Consistent with being the youngest and largely first-time home buyers, millennials tend to buy homes that are, on average, smaller and concentrated in the lower price ranges compared to homes purchased by older generations. Half of all homes purchased by millennials averaged less than 1,650 square feet of living space and cost less than $148,500.

The most common reason for moving reported by millennial home buyers is to establish their own household, followed by the desire to have a larger unit and own it.

When choosing a particular home, millennials are more likely to let financial reasons influence their choice, while older generations consider the right size most often.

When selecting a new neighborhood, the right house most often influences the decision for both millennial and older home buyers. However, millennials are more likely to also pay attention to proximity to work and having good schools.

Compared to older generations of home buyers, millennials are more likely to finance home purchases out of current income rather than out of accumulated wealth, and when taking out mortgages they are more likely to use unconventional zero-down mortgages.

The research is based on the 2013 American Housing Survey (AHS), the most recent release of this ongoing biennial housing data collection. Only housing units purchased in the two years preceding the 2013 AHS interviews are considered. Housing unit characteristics are tabulated by the age of the household of head, a person in whose name the housing unit is owned. Millennial home buyers are householders that were 33 years old or younger in 2013 and bought homes within the two years prior to the AHS interviews.

The research is based on the 2013 American Housing Survey (AHS), the most recent release of this ongoing biennial housing data collection. Only housing units purchased in the two years preceding the 2013 AHS interviews are considered. Housing unit characteristics are tabulated by the age of the household of head, a person in whose name the housing unit is owned. Millennial home buyers are householders that were 33 years old or younger in 2013 and bought homes within the two years prior to the AHS interviews.

Saturday, December 6, 2014

Home Prices Continue to Rise

“Broad-based Slowdown for Home Prices”

That is a headline you might have seen over the past weekend. And though it is true, we must understand the story behind the headline. Case Shiller reports on the year-over-year difference in home values. Their latest report revealed that the rate of appreciation has slowed – not that prices are falling!! Here is exactly what they said:“The 20-City Composite gained 4.9% year-over-year, compared to 5.6% in August.”Prices are still up this month over last year’s values (4.9%) just not as much as they were last month (5.6%).Home Prices are NOT Falling.

As a matter of fact, the latest Home Price Expectation Survey by Pulsenomics (a survey of a nationwide panel of over one hundred economists, real estate experts and investment & market strategists) showed that home prices will continue to appreciate for the next several years.

Bottom Line

Both first time buyers and families thinking of moving-up to their dream home can be assured that their investment in their new home makes sense.Friday, December 5, 2014

The Real Estate Market Has Turned The Corner

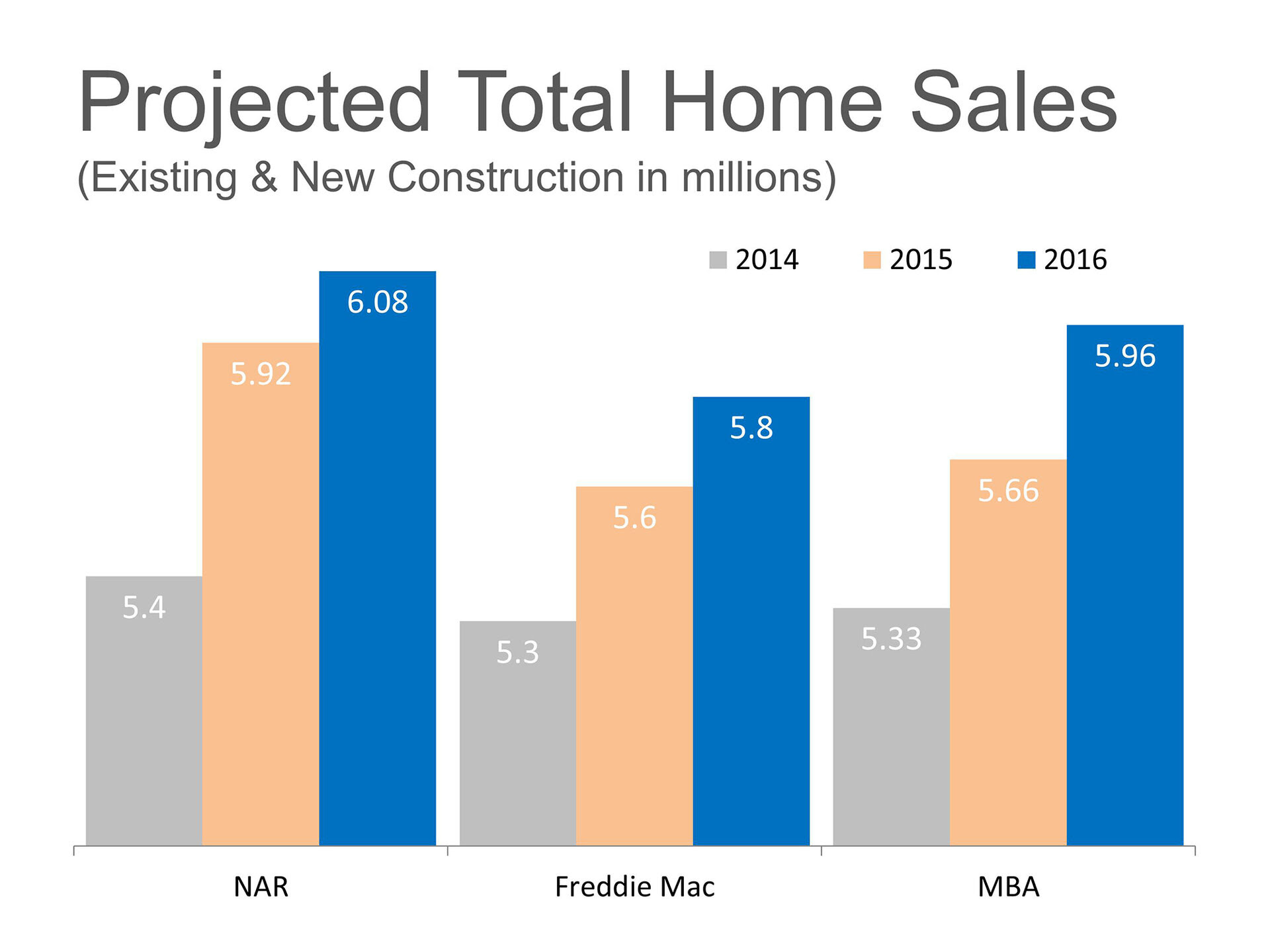

All three entities see the number of home sales increasing in both 2015 and 2016. This is further proof the housing market is back.

All three entities see the number of home sales increasing in both 2015 and 2016. This is further proof the housing market is back.

Thursday, December 4, 2014

Posted: 02 Dec 2014 04:00 AM PST

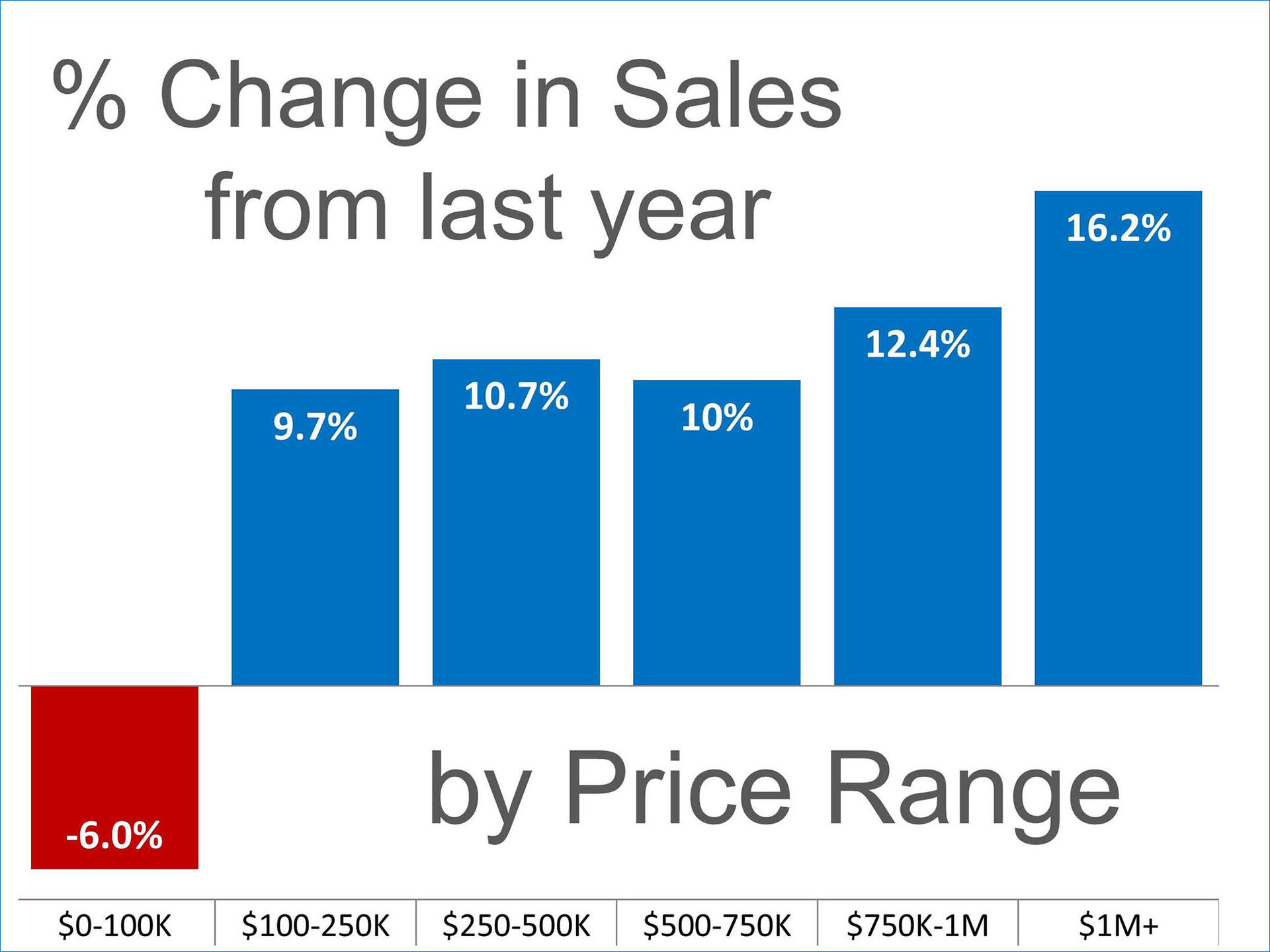

Here is the breakdown:

What does that mean to you if you are selling?

Houses are definitely selling. If your house has been on the market for any length of time and has not yet sold, perhaps it is time to sit with your agent and see if it is priced appropriately to compete in today’s market.Wednesday, December 3, 2014

Subscribe to:

Comments (Atom)

![Millennial Homebuyers & Their Preferences [INFOGRAPHIC]](https://blogger.googleusercontent.com/img/proxy/AVvXsEiONaSk5foXunqfK1AqkIsHTkN6Fy4naHDJGtwyk7JMFoLF8cugsZUFWFUqGvlXvHTCDC4O2gkjlL7HjoXHcViR1LnEK0genQO0M2EERk_mYkQXPzmmhs2mUJRgAIEsH78OKD4tmdYoyRdxxWKMiE01_EVQ27K3i7wymYiIY7DG1LwIllm5H_BTUrVLCq0x35_KVp489ROZzu8=s0-d-e1-ft)