Friday, February 28, 2014

Friday, February 21, 2014

New Retrofitting Laws for properties built prior to 1994

Conserve Water, Save Money, and Prepare for New Retrofitting LawEffective Jan. 1, 2014, property owners who obtain permits to remodel a property that was built prior to 1994 are required to retrofit with toilets that use no more than 1.6 gallons per flush, showerheads with flow rates of no more than 2.5 gallons per minute, and other interior fixtures that use less than 2.2 gallons of water per minute.

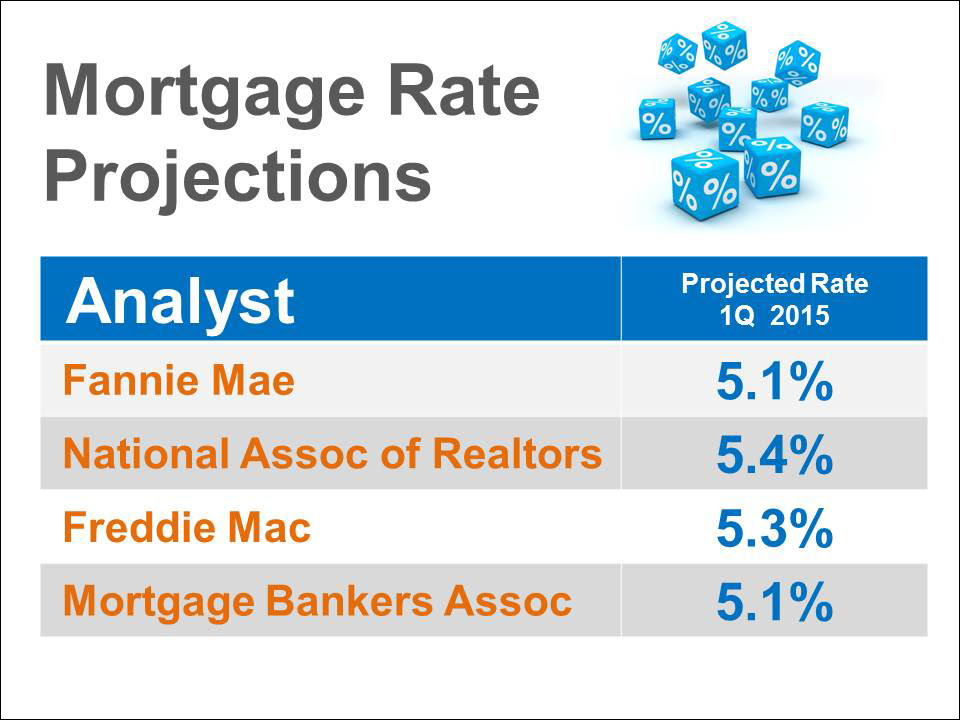

Mortgage Rates Projected to Rise as Tapering Continues

|

Posted: 18 Feb 2014 04:00 AM PST

It is projected that if the Fed continues to cut back on bond purchases that long term mortgage rates would start to climb. Many experts felt that Janet Yellen, who replaced Ben Bernanke as Fed Chair, was going to be less inclined to continue tapering bond purchases at the level established. It is projected that if the Fed continues to cut back on bond purchases that long term mortgage rates would start to climb. Many experts felt that Janet Yellen, who replaced Ben Bernanke as Fed Chair, was going to be less inclined to continue tapering bond purchases at the level established.However, in her testimony in front of the Financial Services Committee last week, Yellen made it quite clear that she will in fact continue the current pace of tapering: “In December, the Committee judged that the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions warranted a modest reduction in the pace of purchases, from $45 billion to $40 billion per month of longer-term Treasury securities and from $40 billion to $35 billion per month of agency mortgage-backed securities. At its January meeting, the Committee decided to make additional reductions of the same magnitude. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.” What does that mean to a prospective purchaser? Currently, Freddie Mac’s 30 year rate is at 4.28%. Here are the projected interest rates for this time next year:  |

Wednesday, February 12, 2014

Tuesday, February 11, 2014

10 Ways to Sabotage Your Home Sale

If you really don't want to sell your home, here are 10 things that you can do to sabotage the sale (based on my real world experience working with buyers).

1. Make it difficult to see your home. If you really want to turn off the buyer, agree to a time and then don't show up (no lockbox, obviously).

then don't show up (no lockbox, obviously).

1. Make it difficult to see your home. If you really want to turn off the buyer, agree to a time and

2. Don't clean off the front walkway and front porch. This is especially a deterrent if it has been snowy or icy.

3. Keep your Holiday decorations up all year round.

4. Don't remove the dead trees and shrubs on your property.

5. Put a key that doesn't work well in your lock in the lockbox. Using a deadbolt and then not providing a key in the lockbox works well, too.

6. Put lots of plug-in air fresheners in your house. A lot of them!

7. Don't get too caught up in vacuuming or keeping the kitchens and bathrooms clean.

8. Leave the dogs out and about…especially if they bark at the door when someone rings the bell.

9. Agree to a showing time and have people asleep in different bedrooms so that they can't be seen.

10. Keep a lot of trash around the yard; old appliances, recycling and broken bikes work really well for this.

It is a lot of work to sell your home. Many buyers try to overlook some of the things that buyers opt not to do before their home is listed, but at some point, it is very difficult to pay attention to the house when there are so many non-essential things vying for a buyer's attention.

Do the heavy lifting (literally!) prior to listing your home. Your home will look good, buyers will be impressed and, hopefully, it will go under contract quickly and for a good price. After all, isn't that your ultimate goal?

Friday, February 7, 2014

Buying a House? 10 Financial Things You Shouldn’t Do

You’ve decided to buy a house, and you need financing. Even if you have good credit, you should keep your finances shipshape until closing so that lenders won’t think twice.

Here are 10 things to avoid while you’re buying a home:

1. Don’t change your job before applying for a home loan.Also, now is not the right time to become self-employed or to quit your job. You want to show lenders stability, which means you’ll be less likely to default on the loan.

2. Don’t change banks. As with your employment, you want your banking history to show stability.

3. Don’t buy a car that you have to finance. Buying a vehicle or any other form of transportation through a loan increases your debt-to-income ratio, and loan officers don’t want to see that.

4. Don’t buy furniture on credit before buying your house. Charging big-ticket items increases your debt-to-income ratio. Save your money for the down payment.

5. Don’t be late on your credit card payments or charge excessively. You need a track record of responsibility that shows you can manage your money.

6. Don’t make large deposits into your bank accounts. Lenders like it when the money for your down payment has been sitting in your account for at least two months – what they call “seasoning” – so that the funds don’t just appear out of the ether.

7. Don’t lie on your loan application. Sounds simple, right? But don’t leave out any debts or liabilities or fudge your income. It’s fraud.

8. Don’t co-sign a loan for anyone. Even if you’re not making the payments on that loan, co-signing increases your debt-to-income ratio.

9. Don’t apply for new credit cards or prompt any other inquiries into your credit rating. Looking for new credit translates into higher risk for lenders. If your inquiries are related to your mortgage search, that usually doesn’t affect your credit score, because lenders assume that you’re rate-shopping. But opening credit accounts within a short period of time represents some risk, and your credit could take a hit. Inquiries are probably not a huge factor in calculating your ability to repay a loan, but why take a chance?

10. Don’t spend money you’ll need for closing costs. Part of the price of financing a loan is closing costs, and you’ll likely have some responsibility for paying them. Make sure you have enough for your share.

Thursday, February 6, 2014

5 Things You Probably Don’t Know About VA Loans

VA loans are the most misunderstood mortgage program in America. Industry professionals and consumers often receive incorrect data when they inquire about them. In fact, misconceptions about the government guaranteed home loan program are so prevalent that a recent VA survey found that approximately half of all military veterans do not understand it.

VA loans are the most misunderstood mortgage program in America. Industry professionals and consumers often receive incorrect data when they inquire about them. In fact, misconceptions about the government guaranteed home loan program are so prevalent that a recent VA survey found that approximately half of all military veterans do not understand it.

With this in mind, we would like to debunk the most common myths about VA Loans.

Myth 1: The VA loan benefit has a “one time” use.

Fact: Veterans and active duty military can use the VA loan many times. There is a limit to the borrower’s entitlement. The entitlement is the amount of loan the VA will guarantee. If the borrower exceeds their entitlement, they may have to make a down payment. Never the less, there are no limitations on how many times a Veteran or Active Duty Service Member can get a VA loan.

Myth 2: VA home loan benefits expire if they are not used.

Fact: For eligible participants, VA mortgage benefits never expire. This myth stems from confusion over the veteran benefit for education. Typically, the Montgomery GI Bill benefits expire 10 years after discharge.

Myth 3: A borrower can only have one VA loan at a time.

Fact: You can have two (or more) VA loans out at the same time as long as you have not exceeded your maximum entitlement and eligibility. In order to have more than one VA loan, the borrower must be able to afford both payments and sufficient entitlement is required. If the borrower exceeds their entitlement, they may be required to make a down payment.

Myth 4: If you have a VA loan, you cannot lease the home.

Fact: By law, homeowners with VA loans may rent out their home. If the home is located in a non-rental subdivision, the VA will not guarantee the loan. If the home is located in a subdivision (such as a co-op) where the other owners can deny or approve a tenant, the VA will not approve the financing. When an individual applies for a VA loan, they certify that they intend on making the home their primary residence. Borrowers cannot use their VA benefits to buy property for rental purposes except if they are using their benefits to buy a duplex, triplex or fourplex. Under these circumstances, the borrower must certify that they will occupy one of the units.

Myth 5: If a borrower has a short sale or foreclosure on a VA loan, they cannot have another VA loan.

Fact: If a borrower has a claim on their entitlement, they will still be able to get another VA loan, but the maximum amount they would otherwise qualify for may be less. For example, Mr. Smith had a home with a $100,000 VA loan that foreclosed in 2012. If Mr. Smith buys a home in a low cost area, he will have enough remaining eligibility for a $317,000 purchase with $0 money down. If he did not have the foreclosure, he would have been able to obtain another VA loan up to $417,000 with no money down payment.

Veterans and Active duty military deserve affordable home ownership. In recent years, the VA loan made up roughly 13% of all home purchase financing. This program remains underused largely because of misinformation. By separating facts from myth, more of America’s military would be able to realize their own American Dream.

Monday, February 3, 2014

An Astonishing Share Of Homebuyers Are Paying All Cash

More and more people are buying homes with pure cash. In December, all-cash purchases accounted for 42.1 percent of all U.S. residential sales, according to the latest report from RealtyTrac, a company that collects and analyzes housing data.

There are a few things driving this. Last summer, interest rates on mortgages jumped sharply. And though rates are still low by historic standards, relatively higher rates make borrowing money a less appealing option.

If you do want a mortgage, you might not be able to get one: Lending standards remain unusually tight, keeping lots of potential buyers out of the market.

Also, big, institutional investors have started buying up lots of homes and renting them out. They accounted for about 20 percent of the all-cash sales in December (and about 8 percent of home sales overall).

The high share of buyers paying with all cash is a "red flag" for the housing market, Daren Blomquist, vice president of RealtyTrac, told me. "It's like we put the fate of the housing market in the hands of the wealthy few," Blomquist said. "Hopefully we can see the number of cash buyers go down. That's what we need to see for long-term recovery."

There are a few things driving this. Last summer, interest rates on mortgages jumped sharply. And though rates are still low by historic standards, relatively higher rates make borrowing money a less appealing option.

If you do want a mortgage, you might not be able to get one: Lending standards remain unusually tight, keeping lots of potential buyers out of the market.

Also, big, institutional investors have started buying up lots of homes and renting them out. They accounted for about 20 percent of the all-cash sales in December (and about 8 percent of home sales overall).

The high share of buyers paying with all cash is a "red flag" for the housing market, Daren Blomquist, vice president of RealtyTrac, told me. "It's like we put the fate of the housing market in the hands of the wealthy few," Blomquist said. "Hopefully we can see the number of cash buyers go down. That's what we need to see for long-term recovery."

Saturday, February 1, 2014

Housing Trends News Letter

Please click on this link to view the Housing Trends JAN-2014 Newsletterhttp://wendyjimenez.housingtrendsenewsletter.com

Subscribe to:

Comments (Atom)